In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

“In the Short Run, the Market is a Voting Machine but in the Long Run it is a Weighing Machine.” – Benjamin Graham

One of the most popular questions we have received over the past few weeks relates to positioning investment portfolios to capitalize on changes in Washington in the New Year. There are certainly factors to consider with respect to global trade, tariffs, fiscal spending and deficits, inflation and deregulation, among numerous others. Potential policy changes with a Republican-controlled White House and both chambers of Congress are reasonable considerations when forming a multi-year view on asset allocation and portfolio positioning. The key to forming a long-term view, however, is to think strategically, rather than tactically.

Any policy changes (when actually implemented versus merely being considered) will take significant time to be impactful on industries and companies. It is logical to consider, for example, that an aggressive stance on tariffs may weigh on the profits of companies outside the U.S., a decreased regulatory environment may benefit certain companies (e.g., Financials), an inclination to increase domestic oil production may benefit the Energy sector in the short-term, with additional supply likely to weigh on price. These and a myriad of other factors are all worthwhile to keep in mind. What is equally important is resisting the urge to overreact to uncertain changes as a near-term trading strategy.

Speculators have been quick to bid up areas of the market expected to benefit from what has become known as the “Trump trade.” With history as our guide, these types of reactionary swings are typically short-lived when based on a mindset of short-term “voting” versus long-term “weighing” of company prospects, as eloquently stated by the renowned investor and author Ben Graham. Look no further than the unexpected underperformance of big oil stocks under the previous Trump administration and clean energy stocks under Biden’s tenure. While government policy is a part of a long list of considerations for investors, it is far less influential than other key factors such as monetary policy and interest rate changes, economic cycles and inflation levels. The confluence of these dynamics creates a useful backdrop in which to frame the type of deep dive fundamental research long-term investors must undertake for each company considered for investment, with a focus on identifying those with the highest quality sustainable earnings.

MARKET INDEX RETURNS | November 2024 | YTD 2024 |

S&P 500 Index | 5.9% | 28.1% |

Russell 2000 Index | 11.0% | 21.6% |

MSCI EAFE Index | -0.6% | 6.2% |

Bloomberg US Agg. Bond Index | 1.1% | 2.9% |

FTSE 3 Mo. T-Bill Index | 0.4% | 5.0% |

For more details on how the stock market has fared during various presidential administrations, please refer back to the April 2024 newsletter on our website.

STOCK MARKET REVIEW & OUTLOOK

Even Wall Street Grinches had to Admire all the Green on the Screen Last Month

U.S. equities posted their biggest monthly gain of the year in November, driving valuations further outside of historical norms. The S&P 500 and Dow Jones Industrial Average closed out the final trading session of the month at record highs. The measure of equity volatility (VIX Index) started November at a level close to long-term historical averages but diminished meaningfully throughout the month. All sectors of the S&P were in the green for the month, led by impressive double-digit returns for Consumer Discretionary and Financials. The breadth of returns was wide, coming from companies of all shapes and sizes. Small cap stocks (represented by the Russell 2000 Index) were stellar, posting an 11% return. International stocks were a laggard during the period.

The yield on the 10-Year U.S. Treasury pulled back modestly during the month, closing at 4.18%. The spread over the 2-Year remained positive but tightened to a meager 0.02% leaving the positive slope of the yield curve (achieved only a few short months ago) dangling by a thread like a Christmas tree ornament dangerously within a feisty pet’s reach.

S&P 500 SECTOR RETURNS | November 2024 | YTD 2024 |

Communication Services | 3.1% | 35.4% |

Consumer Discretionary | 13.3% | 27.1% |

Consumer Staples | 4.7% | 20.9% |

Energy | 6.9% | 16.8% |

Financials | 10.3% | 38.0% |

Healthcare | 0.3% | 9.4% |

Industrials | 7.5% | 27.5% |

Information Technology | 4.7% | 35.0% |

Materials | 1.6% | 12.0% |

Utilities | 3.7% | 34.1% |

Real Estate | 4.1% | 15.1% |

ECONOMIC REVIEW & OUTLOOK

Investors Were Thankful for the Fed Last Month

The Federal Open Market Committee (FOMC) voted unanimously to cut short-term interest rates by 25 basis points last month as was highly expected. It was the second cut in the current monetary easing cycle, following a (larger than anticipated) decrease of 50 basis points in September. Interest rate watchers seemed to appreciate the lack of surprise in November, bidding up risk assets following the announcement. The FOMC watered down its statement on the pace of inflation moving toward its 2% target by removing the words “greater confidence” in the view. Be that as it may, Traders are currently betting that the Fed is likely to deliver a similar cut at its meeting in December. Anything less would be as unpopular as a lump of coal from Santa or coming up Shin (add one of your game pieces to the pot) on a dreidel spin.

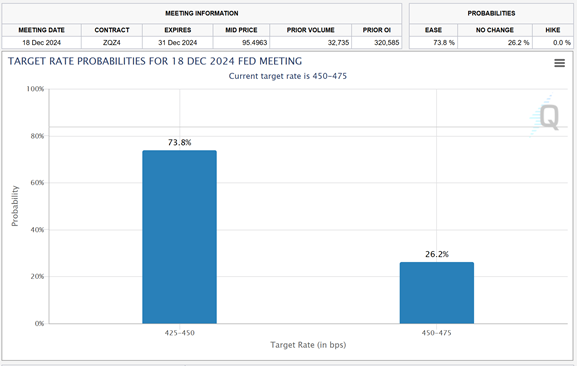

CHART OF THE MONTH

Futures are Shiny and Bright for Another Fed Rate Cut This Month

Source: CME Group Fed Watch

Based upon trading activity in the Fed Funds futures market, traders are pricing in an approximately 74% probability of a subsequent short-term rate cut of 25 basis points to a target rate of 4.25-4.50% at the next FOMC meeting on December 18th.

CLOSING STATEMENT

Looking Ahead

The Fed has cautiously hedged its language in recent statements to reign in expectations of optimistic market participants anticipating a steady series of rate cuts in the coming quarters. A pre-holiday cut seems all but baked into the mix at this point, with less certainty into the new year. Fed officials are backtracking on their latest dot plot projection of 100 basis points of cuts in 2025. Traders have the prerogative to be skeptical of the message change, but the “don’t fight the Fed” adage is as “wicked” relevant today as when it was first used in 1970 by the late great investor, professor, and renowned author of the industry classic Winning on Wall Street, Dr. Martin Zweig.

In the coming weeks, we will be paying close attention to Fed policy and final company reports in a fifth consecutive quarter of positive earnings growth (with the fewest number of companies reporting negative forward guidance in the last 11 quarters) along with initial estimates of holiday spending, forecast to be a double-digit percentage increase from last year. All of these factors will be considered in our forward view and process of weighing the prospects of each holding in our managed portfolios.

We wish you and yours a joyous holiday season and Happy New Year. Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As a reminder, we invite you to join the conversation on our social media pages – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com