In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Meet the Santa Claus Rally and Welcome the January Effect

The term “Santa Claus Rally” refers to a phenomenon in which stock prices tend to rise into the year-end holiday season, which, having happened 78% of the time since 1950, has earned it the right to be considered a “trend”. Since the occurrence typically happens in the last week of December into the first couple days of January, the term was coined when compared to the excitement of Santa arriving at Christmastime with gifts for good boys and girls. Clearly, stock investors viewed themselves with some degree of correlation to those on Santa’s “nice” list. Some theorize the occurrence is driven by (typically more bullish) retail investors, while institutional investors enjoy a bit of time off around the holidays.

The Santa Claus Rally concept is based on the belief that investors position portfolios with a higher degree of equities in advance of what is known as the “January Effect.” The latter is based on the premise that tax loss selling (realizing losses in a calendar year to offset taxable gains) typically done toward year end, will create subsequent (re)buying in the first month of the new year. By Internal Revenue Service rule, the positions sold may not be bought back for at least 30 days, leading to a higher degree of purchasing volume in the month of January.

MARKET INDEX RETURNS | November 2023 | YTD 2023 |

S&P 500 Index | 9.1% | 20.8% |

Russell 2000 Index | 9.0% | 4.1% |

MSCI EAFE Index | 9.3% | 12.3% |

Bloomberg US Agg. Bond Index | 4.5% | 1.6% |

FTSE 3 Mo. T-Bill Index | 0.5% | 4.8% |

The first known reference to “Santa Claus Rally” was in 1972 in a book titled “The Stock Trader’s Almanac” by author Yale Hirsh.

STOCK MARKET REVIEW & OUTLOOK

The S&P 500 Index Spiked to the Highest Level of the Year in November

U.S. equities reversed course after three consecutive months of decline. The 9.1% monthly gain on the S&P 500 is the largest since July of 2022 and the seventh strongest monthly return for the index in the last 30 years. Financial market history buffs would only need two hands to count the number of times the index had such a stellar return in the month of November since 1928. Investor optimism pushed the VIX Index (measure of stock market volatility) down to pre-pandemic levels.

Technology stocks were back in favor, leading the NASDAQ Composite to an impressive 10.8% return. Consumer Discretionary and Financial stocks were other key contributors to the star-studded index gains. Diversifying equity exposures in small cap and international stocks had an equally solid month. Stocks in the energy sector, stand-alone leaders not long ago, have faltered like the New England Patriots this year.

The yield on the 10-Year U.S. Treasury pulled back meaningfully during the month from 4.88% to 4.37%, predicated on the view that the Federal Reserve may be wrapping up efforts on monetary tightening, just in time for the holidays. A decline in a key inflation gauge, Personal Consumption Expenditures (PCE), increased confidence in the view.

S&P 500 SECTOR RETURNS | November 2023 | YTD 2023 |

Communication Services | 7.8% | 48.7% |

Consumer Discretionary | 10.9% | 34.1% |

Consumer Staples | 4.1% | -2.1% |

Energy | -1.0% | -1.3% |

Financials | 10.9% | 6.4% |

Healthcare | 5.4% | -2.2% |

Industrials | 8.8% | 10.4% |

Information Technology | 12.9% | 52.0% |

Materials | 8.4% | 7.6% |

Utilities | 5.2% | -8.8% |

ECONOMIC REVIEW & OUTLOOK

The Fed’s Preferred Measure of Inflation is Moving in the Right Direction

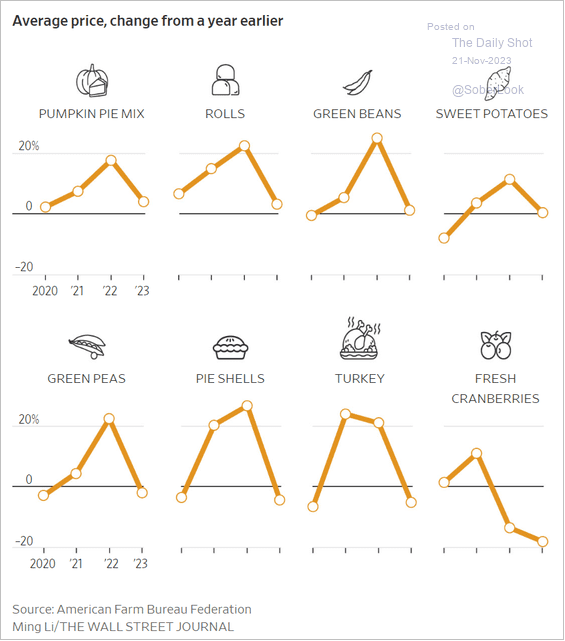

Personal Consumption Expenditures (PCE), a key measure of inflation regularly referenced by Federal Reserve officials, has continued to decline. The latest figures through October reported headline inflation at 3.0% on a year-on-year basis, down from 3.4% and the lowest level since March 2021. The reading was driven lower by a 5.3% decline in gasoline prices, much to the enjoyment of holiday travelers and daily commuters. The Core PCE reading (excluding food and energy) came in at 3.5%, also lower than the prior month and the lowest level since April 2021. A headline reading lower than core means the most volatile (and most easily noticeable to consumers) segments of the index, specifically food and energy, have been declining more than other areas. This is also to the delight of those shopping for Thanksgiving turkeys last month as shown in the exhibit below.

CHART OF THE MONTH

Families Got a Welcomed Reprieve on the Price of Turkeys this Thanksgiving

Source: American Farm Bureau Federation

The cost of key inputs for a traditional Thanksgiving feast declined considerably from a year earlier as detailed in the exhibit above. A decrease in costs associated with this meal, as well as a recent downtick in regularly repeated purchases, such as food and gasoline, have given a near-term boost to consumer optimism… just in time for holiday shopping.

CLOSING STATEMENT

Looking Ahead

With “Santa Claus Rally” and “January Effect” now front of mind and ready to dazzle friends and family during holiday party conversations, we wish you and your families a wonderful safe and healthy holiday season. We remain continually grateful for you, our clients, who have entrusted us to partner with you in the management of your financial affairs.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com