In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Let’s Avoid Fad Diets and Investment Fads in 2024

Making New Year’s resolutions is a custom that can be traced back to the ancient Babylonians thousands of years ago. In more current times, resolutions typically involve a lifestyle modification relating to nutrition, fitness, or organization, and who among us couldn’t stand to do a little better in one or more of those categories after a delicious chocolate-filled, sugar-sprinkled, chaotic holiday season? When it comes to financially oriented resolutions, if you haven’t been in tune with your financial situation of late, by all means, a resolution to sharpen that focus may make good sense. We would caution, however, paying much (if any) attention to the plethora of “new year themes” that market gurus can’t seem to help themselves but to espouse come January. Tried and true long-term portfolio principles, such as risk diversification, prudent asset allocation, and liquidity management matched to cash flow needs should always be the foundation of portfolio management strategy. Beware of radical fads and trends that attention and click-seeking market pundits can tend to sensationalize this time of year.

MARKET INDEX RETURNS | November 2023 | YTD 2023 |

S&P 500 Index | 9.1% | 20.8% |

Russell 2000 Index | 9.0% | 4.1% |

MSCI EAFE Index | 9.3% | 12.3% |

Bloomberg US Agg. Bond Index | 4.5% | 1.6% |

FTSE 3 Mo. T-Bill Index | 0.5% | 4.8% |

Radical Fad Chatter 101: Cryptocurrency may be making a “comeback” in price, but let’s be clear, its “value” is still as baseless as ever.

STOCK MARKET REVIEW & OUTLOOK

Risk Was ON in December Like Clark W. Griswold’s Christmas Light Extravaganza

The S&P 500 finished the year just shy of all-time highs after a nine-week winning streak. Investors climbed the wall of worry in a year of political mayhem, geopolitical unrest, aggressive monetary tightening, a regional banking crisis, record deficit and a myriad of other headlines that weighed on investor sentiment. At the final trading bell of the year, those who stuck with holding risk assets found themselves sitting on a handsome profit.

Small cap stocks significantly outshined large and, at long last (in a nod to our old friend diversification) international stocks outperformed the U.S. in December. All but one sector (Energy) in the large cap S&P 500 finished in the green for the month. On a trailing one-year basis, U.S. stocks dominated, driven by a small handful of stocks in the Information Technology, Communication Services, and Consumer Discretionary sectors as highlighted in the Chart of the Month below.

The yield on the 10-Year U.S. Treasury plummeted in the final trading month, falling below 4% for the first time since July. The pullback in rates created stellar price appreciation for bond holders and ended the streak of negative total returns for bond investors at two years, when a third year seemed to be in the cards only a matter of weeks ago.

S&P 500 SECTOR RETURNS | November 2023 | YTD 2023 |

Communication Services | 7.8% | 48.7% |

Consumer Discretionary | 10.9% | 34.1% |

Consumer Staples | 4.1% | -2.1% |

Energy | -1.0% | -1.3% |

Financials | 10.9% | 6.4% |

Healthcare | 5.4% | -2.2% |

Industrials | 8.8% | 10.4% |

Information Technology | 12.9% | 52.0% |

Materials | 8.4% | 7.6% |

Utilities | 5.2% | -8.8% |

ECONOMIC REVIEW & OUTLOOK

The Federal Reserve Put the Grinch Act on Hold

The Federal Open Market Committee held rates steady in December and indicated that their next move is more likely to be a cut than another hike. The “pivot” to a looser monetary policy mindset was a welcomed change from the stay the course, “higher for longer” message the Fed Chairman did his level best to maintain in prior post-meeting statements during the year. The question-and-answer periods that followed were perhaps a different story when he seemed to regularly allow the fog of doubt to roll in on the message. Be that as it may, year-on-year inflation figures continued to pull back in a meaningful way throughout the year, the consensus call on recession ended up being much ado about nothing, and economic growth was far more resilient than most predicted. Trite plane landing analogies aside, 2023 was a year when economic outcomes far exceeded consensus expectations at the start of the year.

CHART OF THE MONTH

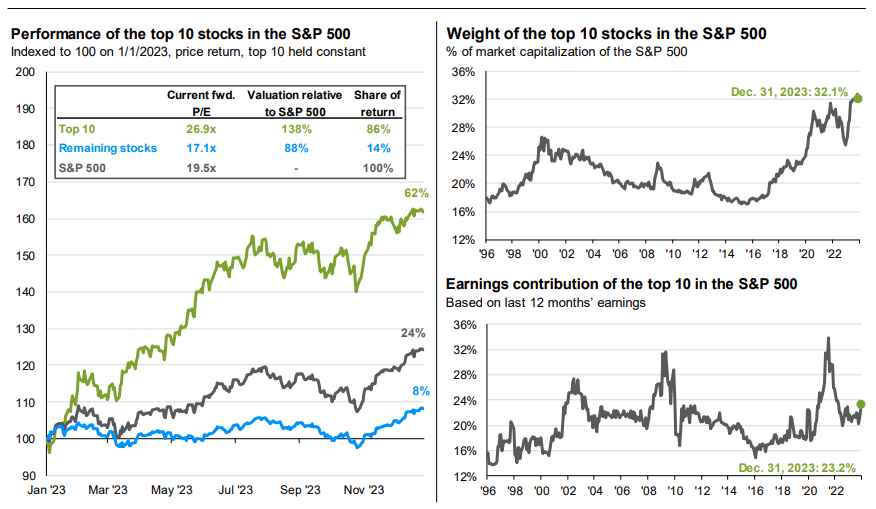

S&P 500 Index Return Concentration in 2023, Top 10 Positions

Source: J.P. Morgan Asset Management, FactSet, Standard & Poor’s

When the top 10 equities in the S&P 500 Index have a greater market cap than the entire investable stock markets of Japan, Canada and the U.K. combined, they authoritatively earn the label of “dominant.” That is exactly how they ended 2023, with a return 7.75 times more than the average of all other index constituents. The outperformance of the cap weighted S&P 500 return (with larger companies having a greater impact on the index return) had one of the largest outperformance disparities over the equal weighted index return since the 1990s.

CLOSING STATEMENT

Looking Ahead

We are keenly anticipating the start of company earnings season shortly with an eye toward gaining additional insights into who the next group of market leaders may be. We anticipate a pullback from stellar third quarter profit results but are looking for a modicum of growth on a year-on-year basis.

The Fed meeting at month’s end will be the main event for market participants. Perhaps the post meeting message will bring the Fed dot plot of forward projections and futures market closer together on the number of cuts we may expect in 2024. At the time of this writing, traders continue to be non-believers of the three cuts projected by the Fed, still pricing in five as measured by interest rate futures. Perhaps a New Year’s resolution to not “fight the Fed” is in order.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com