In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

U.S. Small Cap Dominated Equity Returns Over the Past Month

Small cap U.S. equities, as represented by the Russell 2000 Index, had a stellar month in July. The timing of the outperformance is particularly interesting as, historically, small cap stocks have typically led the way in the early stages of an economic cycle, moving into an expansion. We are clearly in the late stages of such a cycle, with concerns ebbing and flowing about when we may experience economic recession. Nearly all economists have made such a prediction at some point over the past two years. Each will eventually have the opportunity to say that they were correct…just early, as business cycles all come to an end eventually, beginning another cycle. A rotation out of highly valued mega cap technology stocks left investors looking for the next place to capture profits. As shown in the Chart of the Month in our previous letter, mega-cap technology stocks have been outgrowing (by market cap) their underlying earnings and have been poised for a correction. After lagging for the last few years and all but overlooked during the first half of this year, small cap stock valuations attracted opportunistic investors who had taken profits from the highflying largest tech stocks known as the “Magnificent Seven.” Rising expectations of interest rate cuts later in the year are seen as a positive catalyst for smaller companies, poised to benefit from lower borrowing costs to fund their growth plans.

MARKET INDEX RETURNS | July 2024 | YTD 2024 |

S&P 500 Index | 1.2% | 16.7% |

Russell 2000 Index | 10.2% | 12.1% |

MSCI EAFE Index | 2.9% | 8.4% |

Bloomberg US Agg. Bond Index | 2.3% | 1.6% |

FTSE 3 Mo. T-Bill Index | 0.5% | 3.2% |

Attractive

relative valuations and expectation for rate cuts leading to lower borrowing

costs were catalysts for recent investor interest rotating from the largest

technology companies to small cap stocks

STOCK MARKET REVIEW & OUTLOOK

There Was Plenty of Green on the Screen to go Around in July

While returns of the small cap Russell 2000 Index overshadowed other asset classes, it was a profitable month for well diversified investors. U.S. large cap and international equities, as well as fixed income investments, all provided positive rates of return. Sectors of the S&P 500 that had dominated earlier in the year (Information Technology and Communication Services) were in the red during the period, while all others were positive, led by the more rate sensitive and cyclical sectors (Real Estate, Utilities, Financials, Industrials and Materials). An allocation to international stocks added value to portfolios during the month by outperforming the S&P 500.

Yields declined during July with the yield on the bellwether 10-Year U.S. Treasury finishing the month lower by 36 basis points to 4.03%. The 2-Year dropped even more to end the month at 4.26%, adding a bit of steepening to the shape of the yield curve. On the final trading session of the month, the curve remained inverted between 2s and 10s by 23 basis points, continuing to make progress toward normalization.

S&P 500 SECTOR RETURNS | July 2024 | YTD 2024 |

Communication Services | -4.0% | 21.6% |

Consumer Discretionary | 1.7% | 7.4% |

Consumer Staples | 1.9% | 11.1% |

Energy | 2.1% | 13.3% |

Financials | 6.5% | 17.3% |

Healthcare | 2.7% | 10.7% |

Industrials | 4.9% | 13.0% |

Information Technology | -2.1% | 25.6% |

Materials | 4.4% | 8.6% |

Utilities | 6.8% | 16.9% |

Real Estate | 7.2% | 4.6% |

ECONOMIC REVIEW & OUTLOOK

Latest Employment Report Statistics Were a Long Way Off from Reaching the Medal Podium

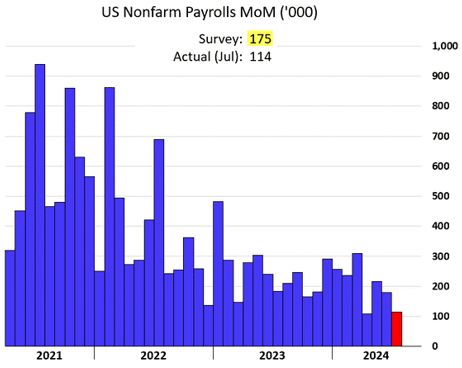

Nearly two and a half years into the Fed’s tightening cycle, the labor market is showing signs of slowing and causing economists to raise concerns that the Fed may have stayed on the sidelines for too long before acting on shifting short-term rates lower. In the latest employment report for July from the Bureau of Labor Statistics, the 114k new jobs total from the Nonfarm Payrolls Report was well below expectations and the prior two months of data were revised lower by 29k. The Unemployment rate ticked up for a fourth consecutive month to 4.3%, the highest level since November 2021. The figure factored in an additional 470k new entrants with an increase of Labor Force Participation. With a Fed continually touting a “data dependent” approach to policy decisions, the news was a catalyst for rates to pull back in anticipation of an increased likelihood for the Fed to make an initial cut at the September Federal Open Market Committee Meeting.

CHART OF THE MONTH

Monthly Job Growth Pulling Back

Source: Bureau of Labor Statistics, The Daily Shot

As shown in the chart above, the trend of new jobs growth has been declining since the Fed began monetary policy tightening in March of 2022.

CLOSING STATEMENT

Looking Ahead

The U.S. maintains a sizable lead over other countries in the Olympic medal count at the time of this writing. Despite a recent surge in volatility, the U.S. stock market remains a clear winner thus far in 2024 as well. Much like Simone Biles and her impressive Olympic teammates, the best of the best high-quality companies will rise to the top over time based on solid financial management, sustainable earnings and cash flows and the ability to hold on to a dominant market share in their respective industries. These are the types of companies we continue to research on an ongoing basis, poised to purchase or increase in client portfolios when intrinsic value appears attractive relative to market price and trim or sell when it does not.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

We also invite you to join the conversation on our social media. Be sure to follow us on Facebook and LinkedIn.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com