In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

When Can We Expect the Release of a “Fed Chair” Barbie?

Not to be outshined by Barbie mania, the Federal Open Market Committee (FOMC) and Chairman Jay Powell were back on center stage in July, announcing a hike in short-term interest rates for an eleventh time in the current monetary tightening cycle. The Fed Funds Rate target range was increased by 0.25% to 5.25-5.50%, the highest level in 22 years, going back to when “Presidential Candidate Barbie” was a top seller. This was just one of over 250 of the beloved (Barbara Millicent Roberts – Barbie’s full name) toy’s featured careers throughout decades of redesigns. We, along with a growing consensus, are of the camp that the latest increase in rates may be “(k)enough” (if you’ve seen Barbie– you know, if not – we won’t spoil the fun) to continue to mitigate pricings pressures in the economy. Key inflation measures have continued to expand at a decelerating pace, with the primary focal point of the Fed, Personal Consumption Expenditures (PCE), reported at a meaningfully lower headline level of 3.0% on a year-on-year basis.

With its newfound popularity, retailers seem to be unsure of how to price Barbie merchandise in the current environment. The new “Barbie the Movie” collectible doll is currently listed for sale at an incredibly wide range of prices online from $25 at a prominent (sixth largest in the U.S.) retailer (with no delivery option and a sold-out status at every location) to $99 at the nation’s largest retailer, to the mid-$50 range from a variety of retailers suppling the largest online shopping platform. There seems to be a wonderful lesson here on supply and demand dynamics and breakdown of pricing arbitrage for even the youngest of consumers. Even more amazing, according to our research on the Barbie Media website, is the fact that a “Barbie Dreamhouse” (originally created back in 1962) is sold every two minutes from a franchise with over 99% brand awareness globally. This phenomenon may very well be a business school case study waiting to happen.

MARKET INDEX RETURNS | July 2023 | YTD 2023 |

S&P 500 Index | 3.2% | 20.6% |

Russell 2000 Index | 6.1% | 14.7% |

MSCI EAFE Index | 3.2% | 15.3% |

Bloomberg US Agg. Bond Index | -0.1% | 2.0% |

FTSE 3 Mo. T-Bill Index | 0.5% | 2.9% |

The first Barbie doll sold for $3.00 in 1959 with a cleverly placed commercial aired during the Mickey Mouse Club show.

STOCK MARKET REVIEW & OUTLOOK

Despite a Massive Surge in the Popularity of All Things Pink, it was Green on the Screen for Every Sector of the S&P 500 in July

U.S. equities advanced for another month, with a definitive shift in market sector strength. An increase in the breadth of returns across various stocks was a welcomed change after a period of extremely narrow leadership by only the largest of the large technology and communications companies. Energy stocks were the top performing sector in July. Following Communication Services, Financials and Materials staged a solid comeback during the period as well. The change led to modest outperformance of some more value-oriented companies relative to growth and a resurgence of small cap shares. Underlying company earnings have not kept pace with overall rising stock prices, indicating that recent strength is predicated on investors’ willingness to pay more for a dollar of earnings (i.e., multiple expansion.)

The yield on the bellwether 10-Year U.S. Treasury continued to rise during July, closing the month higher by 11 basis points at 3.95%. 2-Year U.S. Treasury yields however, pulled back a bit on the view that the Fed may be nearing an end of its tightening efforts, closing at 4.85%. Despite a modest narrowing of the yield curve inversion, the 90-basis point negative spread between the two has a long way to go to approach a more normalized curve shape.

S&P 500 SECTOR RETURNS | July 2023 | YTD 2023 |

Communication Services | 6.9% | 45.7% |

Consumer Discretionary | 2.4% | 36.2% |

Consumer Staples | 2.1% | 3.5% |

Energy | 7.4% | 1.4% |

Financials | 4.8% | 4.3% |

Healthcare | 1.0% | -0.5% |

Industrials | 2.9% | 13.4% |

Information Technology | 2.7% | 46.6% |

Materials | 3.4% | 11.4% |

Utilities | 2.5% | -3.4% |

ECONOMIC REVIEW & OUTLOOK

The Fed Upgraded U.S. Growth View and the Data Did Not Disappoint

The FOMC made a key wording change in their most recent statement, upgrading U.S. economic growth from “modest” to “moderate”. The report was released just a day ahead of a higher than anticipated jump in second quarter Gross Domestic Product (GDP.) Fed members were not breaking out any neon-colored party hats with the “good” news though as their work to bring inflation to their target level in a period of robust consumption continues.

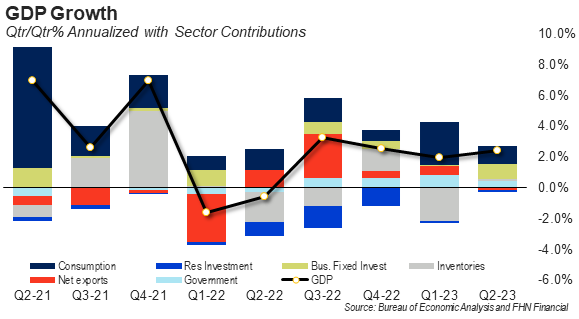

The key level of goods and services produced in the United States accelerated by a 2.4% annualized rate, ahead of consensus estimates. Personal Consumption held up and a rise in Business Fixed Investment was a key contributor to the solid results. The Services component of Consumption was a strong catalyst, measured before the release of blockbuster summer movie ticket sales. Both equipment and structures investment were the strongest in over a year. Although Net Exports were a modest detractor, a significant decline in imports offset much of the pullback in product exports.

CHART OF THE MONTH

Gross Domestic Product Q2 2023

Source: Bureau of Economic Analysis and FHN Financial

As shown in the exhibit above, Personal Consumption continues to serve as a key component of economic growth. Business Fixed Investment increased meaningfully in the second quarter of the year relative to the first.

CLOSING STATEMENT

Looking Ahead

We will be keeping a close eye on inflation data points being released in the coming days and other key economic metrics later in the month. With the majority of companies in the S&P 500 having reported second quarter earnings at the time of this writing, it is shaping up to be another negative period of year-on-year bottom line earnings growth comparisons, but (similar to first quarter results) not quite as weak as was originally anticipated.

We hope you are taking some time to enjoy the summer months and beautiful weather with family and friends or perhaps some time out to watch a newly released blockbuster movie in a well air-conditioned theater. Members of our team are doing some recharging of our own, but rest assured that under our service model, with two dedicated officers per client, and with careful backup personnel planning, we remain fully available to connect with you at any time.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com