In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The Fed Could Not Rain on the Market’s Parade in July

Perhaps the fear-induced flash floods of volatility in the previous months were sufficient to price in the aggressive stance taken by the Fed this summer. The Federal Open Market Committee (FOMC) raised short term rates by 75 basis points in the final week of July, for a second consecutive meeting. This magnitude of tightening (the largest since the Paul Volker era in the 1980s and not even a consideration earlier in the year) has apparently been accepted by investors as markets rallied following the announcement and didn’t look back.

For now, interest rate futures contracts are pricing in a subsequent 50 basis point hike at the next FOMC meeting in September. As we now know full well, those expectations can turn on a dime, giving new meaning to the phrase “data-dependent.”

MARKET INDEX RETURNS | July 2022 | YTD 2022 |

S&P 500 Index | 9.2% | -12.6% |

Russell 2000 Index | 10.4% | -15.5% |

MSCI EAFE Index | 5.0% | -15.6% |

Barclays US Agg. Bond Index | 2.4% | -8.2% |

FTSE 3 Mo. T-Bill Index | 0.1% | 0.3% |

Welcome to your newfound fame, MIT professor and President of the NBER, James Poterba. He is now a sought-after guest on major financial news outlets as the foremost expert on defining a recession.

STOCK MARKET REVIEW & OUTLOOK

Green on the Screen Again – Finally

It was hard to find much of any green in suburban neighborhood lawns in July, but a return to green on the screen was a welcomed change for investors. The S&P 500 closed the month higher by 9.2%, while the technology-focused NASDAQ Composite rose by a stellar 12%. The best monthly returns for equity markets since November 2020 were led by the “growthier” segments of the market that normally lead in fast-paced recoveries (and declines). The Consumer Discretionary and Information Technology sectors were stand out winners during a month in which all segments of the S&P 500 Index were positive. Equity volatility, measured by the VIX Index, peaked at 34 in July, before declining to 26 at month-end and continuing on a downward trajectory from there. This is another unusual turn of events in a recessionary environment, typically accompanied by a rapid rise in market volatility.

In another untraditional move, bond yields took a precipitous slide, sending bond and equity prices higher in lockstep. The core tenet of Modern Portfolio Theory (benefit of diversification) that revolutionized portfolio construction in the 1950s may be due for a fresh look to keep up with its pioneering name, with all due respect to Nobel Prize-winning economist Harry Markowitz. The yield on the bellwether 10-Year U.S. Treasury declined by 36 basis points in July to 2.65%. The 2-Year eased by 8 basis points to 2.88%. The spread between the 2-Year and 10-Year Treasury was inverted throughout the entire month of July, a signal historically supportive of an economic downturn and another key driver of the recession labeling debate (under the proverbial hood).

S&P 500 SECTOR RETURNS | JULY 2022 | YTD 2022 |

Communication Services | 3.7% | -27.6% |

Consumer Discretionary | 18.9% | -20.1% |

Consumer Staples | 3.3% | -2.5% |

Energy | 9.7% | 44.4% |

Financials | 7.2% | -12.9% |

Healthcare | 3.3% | -5.3% |

Industrials | 9.5% | -8.9% |

Information Technology | 13.5% | -17.0% |

Materials | 6.1% | -12.9% |

Utilities | 5.5% | 4.9% |

ECONOMIC REVIEW & OUTLOOK

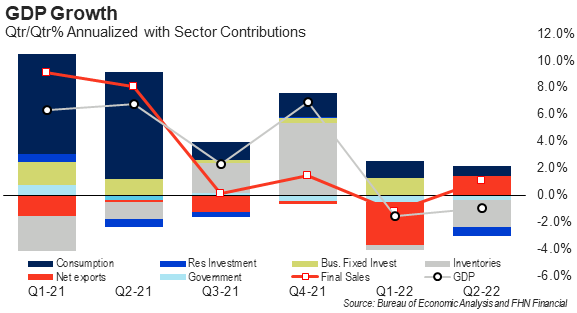

Economic Contraction in the Second Quarter Was Led by Inventory Declines

The initial estimate of the amount of goods and services produced in the United States in the second quarter contracted by 0.9%. If the estimate stands, it will mark the second consecutive quarter of negative real economic growth. Much of the decline was driven by decreased inventory levels. The phenomenon of businesses overordering to account for supply chain disruptions came to a halt in the second quarter. Retailers faced with excess supply have been cutting prices, creating a reticence to refill shelves and storerooms until the situation is in hand. Rising mortgage rates and elevated home prices also dampened residential investment, which weighed on the reading. Although consumer spending was less robust in the second quarter, it still rose by 1%. The balance of trade also improved meaningfully from the prior quarter with exports expanding and imports contracting.

CHART OF THE MONTH

Drivers of Economic Contraction

Source: Bureau of Economic Analysis, FHN Financial

As shown in the chart above, a reversal of inventory builds in the second half of last year was a key driver of economic contraction in the second quarter of 2022.

CLOSING STATEMENT

Looking Ahead

The state of the economy will, of course, have a meaningful bearing on the ability of companies to sustain profits, regardless of the exact label assigned for where we are in the business cycle. Data from a robust employment environment may very well continue in a tug of war with inflation pressures and a slowing housing market. Investors are highly likely to continue to be distracted by geopolitical events and world news headlines. At the end of the day, corporate earnings are what will matter to the bottom line of corporate income statements, stock prices, and ultimately to the ability for investors to compound capital by holding risk assets.

We are hopeful you are enjoying some treasured time with family and friends this summer. We will be doing some recharging as well, while continuing to focus on portfolio positioning, attractive investment opportunities, and ensuring members of our team remain available to you for any questions that may arise. Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com