In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Financial Markets Had Some Fireworks of Their Own

Investors hardly missed a beat in June despite the extreme levels of geopolitical angst following the U.S. strike on Iranian nuclear sites. Tensions were quelled by a ceasefire announcement only days later, mitigating concerns of an escalation in the Israel-Iran conflict. Investors subsequently drove financial market indices to new highs to end the month with solid green across the screen. The back-to-back returns from May to June have been the strongest two months for stocks since November and December of 2023, showing that positive investor sentiment is back in force.

MARKET INDEX RETURNS | June 2025 | YTD 2025 |

S&P 500 Index | 5.1% | 6.2% |

Russell 2000 Index | 5.4% | -1.8% |

MSCI EAFE Index | 2.2% | 19.4% |

Bloomberg US Agg. Bond Index | 1.5% | 4.0% |

FTSE 3 Mo. T-Bill Index | 0.4% | 2.2% |

Two-time Grammy Award-winning singer LeAnn Rimes headlined the 2025 Fireworks Spectacular, and the Boston Pops closed the performance with a crowd favorite, Tchaikovsky’s 1812 Overture

STOCK MARKET REVIEW & OUTLOOK

Stocks Closed Out the First Half of the Year with a Bang

U.S. equities staged a strong rally in June, remarkably driving the S&P 500 Index into new record-high territory. Technology stocks were the strongest contributors to the gains, propelling the Nasdaq Composite Index back through the 20,000 level to fresh new highs of its own. The Communication Services sector also outperformed the bellwether S&P Index, while Consumer Staples were the only sector in the red. Small cap stocks, beaten down earlier in the year, staged an impressive comeback in June, falling only modestly short of getting back into positive territory on a year-to-date basis. International stocks lagged during the month but continue to be standout winners midway through 2025.

The 10-Year U.S. Treasury closed the month at 4.22%, 0.18% lower than where it started, creating a positive 0.50% spread over the 2-Year.

S&P 500 SECTOR RETURNS | June 2025 | YTD 2025 |

Communication Services | 7.3% | 11.1% |

Consumer Discretionary | 2.2% | -3.9% |

Consumer Staples | -1.9% | 6.4% |

Energy | 4.8% | 0.8% |

Financials | 3.2% | 9.2% |

Healthcare | 2.1% | -1.1% |

Industrials | 3.6% | 12.7% |

Information Technology | 9.8% | 8.1% |

Materials | 2.3% | 6.0% |

Utilities | 0.3% | 9.4% |

Real Estate | 0.2% | 3.5% |

ECONOMIC REVIEW & OUTLOOK

Latest Employment Report Sparked Economic Optimism

The Bureau of Labor Statistics reported that 147,000 new jobs were added in June, well ahead of economists’ expectations. Healthcare and state and local government hirings (with a surprising increase in public education hirings) led on the upside, while federal government and private sector hirings slowed. Manufacturing hiring was particularly weak, as uncertainty over the upcoming tariff policy changes persists, along with leisure and hospitality hirings that fizzled. Prior months’ revisions were also positive, showing an incremental 16,000 jobs in April and May than originally reported. Seasonal adjustment factors may have been more of a contributing factor than usual in the stronger-than-expected report, but at a high level, the latest payrolls report stoked optimism.

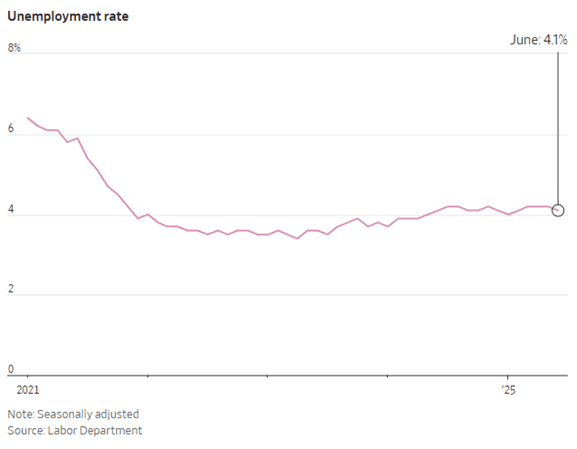

The unemployment rate (reported from the household survey) declined as well, from 4.2% to 4.1% with a pullback in the number of active job seekers. The labor-force participation rate dropped a tick to the lowest level since 2022, with some citing increased immigration enforcement as a factor, as the subset of foreign-born people actively seeking employment declined for a third consecutive month.

CHART OF THE MONTH

Unemployment Ticked Lower in June

CLOSING STATEMENT

Looking Ahead

We fully expect Chairman Powell and his cast of Fed Governors to stay the course on rates at their upcoming meeting on July 29-30, likely followed by a dud of a presser afterwards. Fireworks in the coming weeks are more likely to come from tariff negotiations, with the conclusion of the 90-day pause on reciprocal tariffs put in place in April. Expectations for second quarter earnings growth are expected to sparkle a bit less at 5% after skyrocketing in the first quarter. Our research team will be ready to digest these results and what is sure to be a jam-packed summer of important headlines reminiscent of traffic diverted from Storrow Drive in Boston on the Fourth.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As always, please feel free to join the conversation on our socials – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com