In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

When Good News is Bad News

The well-known saying “Don’t fight the Fed” is taking center stage once again. For quite some time this was considered a bullish axiom, but with a reversal in policy course comes a new interpretation. While the Fed was enacting loose monetary policy, flooding markets with liquidity and showing seemingly insatiable demand for purchasing Treasury and mortgage-backed securities, market participants enjoyed gale-force tailwinds which drove equity markets to new heights. Swimming against the tide of risk assets (i.e., fighting the Fed) in that environment proved to be a losing proposition. With the Fed now transitioned to quantitative tightening, the adage is creating a cautionary connotation, one in which good news has become bad news.

The oxymoron simply means that investors have become leery of strong economic data (such as robust employment readings or expansionary manufacturing data) as it gives more weighting to hawkish Fed speak from members seeking a faster pace of interest rates hikes and increasingly tighter conditions. While few have set out on the perilous journey of trying to capitalize on directly betting against the direction of Fed policy, most have learned from experience that it is wise to pay attention to their reaction function following unexpected changes in economic data.

MARKET INDEX RETURNS | MAY 2022 | YTD 2022 |

S&P 500 Index | 0.2% | -12.8% |

Russell 2000 Index | 0.1% | -16.6% |

MSCI EAFE Index | 0.7% | -11.3% |

Barclays US Agg. Bond Index | 0.6% | -8.9% |

FTSE 3 Mo. T-Bill Index | 0.0% | 0.1% |

The S&P 500 Index declined by more than 20% from a recent high during intraday trading on May 20th, but never officially closed in “bear market” territory.

STOCK MARKET REVIEW & OUTLOOK

Ending Where They Started, Markets Did Much More Than Run in Place

Equity markets in the U.S. zigged and zagged, burning a lot of calories in May, to finish roughly where they started. The S&P 500 advanced a modest 0.2% for the month. The NASDAQ Composite traded lower by -1.9%. Investors continued to project higher commodity prices (perhaps to infinity and beyond) and once again bid up prices of Energy stocks by a whopping 16%. The once beleaguered Energy sector continues to dominate all other S&P 500 segments in 2022, with the defensive, higher dividend-paying Utilities sector the only other in the green this year. Stocks outside the U.S. modestly outperformed but made little headway on recouping formidable losses incurred earlier in the year.

Fixed income investors enjoyed their first (modestly) positive monthly return of the calendar year. The yield on the 10-Year U.S. Treasury took an overdue pause on its rapid climb, finishing the final trading session of May (8 basis points below where it started) at 2.85%.

S&P 500 SECTOR RETURNS | MAY 2022 | YTD 2022 |

Communication Services | 1.8% | -24.3% |

Consumer Discretionary | -4.9% | -24.7% |

Consumer Staples | -4.6% | -3.2% |

Energy | 15.8% | 58.4% |

Financials | 2.7% | -8.8% |

Healthcare | 1.4% | -5.8% |

Industrials | -0.5% | -10.1% |

Information Technology | -0.9% | -19.4% |

Materials | 1.1% | -4.7% |

Utilities | 4.3% | 4.7% |

ECONOMIC REVIEW & OUTLOOK

Do Consumers Really Say What They Mean and Mean What They Say?

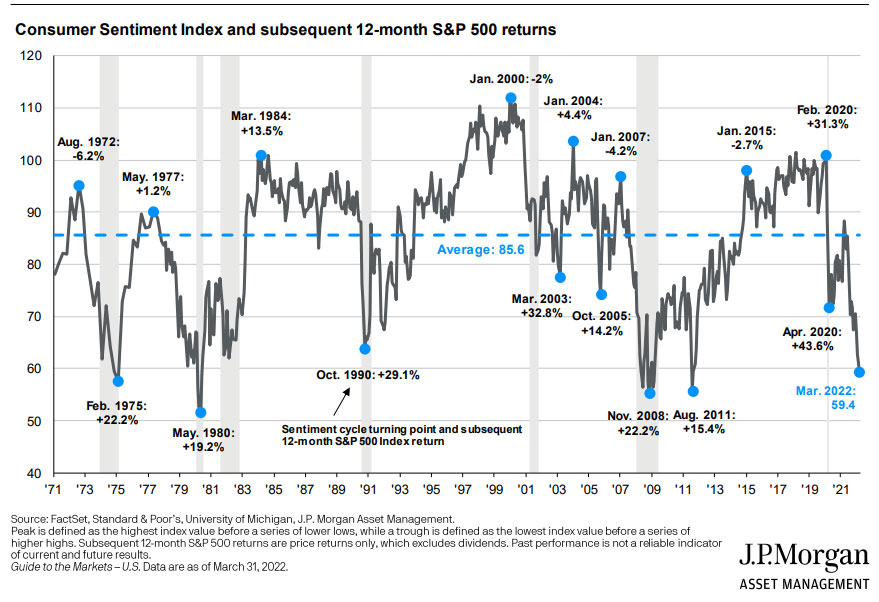

Consumer confidence, both in terms of assessing current conditions and future expectations, has declined in a meaningful way this year. The chart below provides some historical context of just how far and fast dour sentiment has taken hold. Recent data reported on consumer spending, however, has not pulled back with sentiment. Undaunted by rising inflation, consumer spending rose 0.9% in April, higher than expected as personal incomes only increased by 0.4%. Consumers continue to dip into their savings, certainly to some degree for higher priced necessities like food and gasoline. A transition in consumption dollars from discretionary items to staples was noted on a number of Q1 earnings calls of retail companies.

It is perhaps also possible that consumers are attempting to front run further price increases on big ticket items, or maybe they simply aren’t quite as worried about tightening their household budgets as the surveys imply. Regardless of the reason, personal savings rates as a percentage of disposable income in the U.S. dipped to the lowest levels since 2008. Consumers’ use of credit cards rose considerably and is back on pace with pre-COVID levels.

CHART OF THE MONTH

A Fall in Consumer Sentiment – Historically Positive for Stocks

Source: Redfin

Source: JP Morgan Q2 2022 Guide to the Markets

As shown in the (perhaps busier than necessary) chart above, meaningful declines in consumer sentiment have historically been followed by particularly strong stock market returns. For the eight “peak” sentiment periods identified above, the S&P 500 rose by an average 4.1% in the subsequent year. For the eight “trough” sentiment periods, the index rose by a significantly higher 24.9%. The contrarian nature of the historical data would indicate a tailwind for equities given the considerable declines in confidence measures thus far in 2022.

CLOSING STATEMENT

Looking Ahead

If you have a child who has studied Shakespeare in Literature class (or have an above average memory and recall doing so yourself), the opening soliloquy may have perhaps resonated. If nay, fear not, for I too received a recent teenager-directed literary refresher on the subject matter.

No matter how artfully crafted a description of the current market environment may be, it has been neither appealing nor elegant for long-term investors slogging through thus far in 2022. Although the textbook definition of a bear market (closing 20% lower than a recent high) has not been met for the S&P 500, to say that the running of the bulls has been to the sell side of the trade blotter would be a perfectly appropriate statement. Tried and true investment musings such as being “greedy when others are fearful” (a Warren Buffet favorite), “with turmoil comes opportunity” and “emotions are best ignored while investing, unless capitalizing on those of others” are never more valiant than when they feel the least comfortable.

Attractively valued opportunities are dominating the airtime in our team meetings. Our models continue to steer our interests and guide our Analysts’ fundamental research. The overlay of our Portfolio Managers’ experienced judgment will guide us through challenging markets, as it has in decades past.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or anything else we can be helpful with.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com