In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

“The Darkest Hour is Just Before Dawn” English Theologian, Thomas Fuller

Investing in risk assets, like common stock, has historically been a profitable, albeit bumpy, pursuit. There are numerous memorable days in every investor’s lifetime ranging from the good (sometimes great), to the bad (occasionally ugly.) Interestingly, such extremes have tended to happen within close proximity of each other, in our indelible memories and confirmed by the calendar. The best 10 days of stock market returns over the past 20 years have happened in the gloomiest of periods following big declines, specifically the 2008 financial crisis and 2020 pandemic lockdowns. In fact, 78% of the stock market’s best days have occurred during a bear market, or first two months of a new bull market, times when investor confidence can be up against the proverbial ropes.

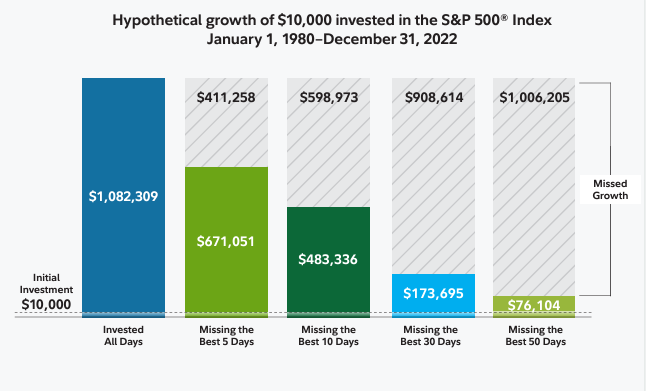

As highlighted in the Chart of the Month below, remaining invested to capture the stellar returns of those shining star days is critical to the historical compounding of capital at an attractive rate of return. Without them, portfolio results are mediocre at best. Patient investors willing to invest through full market cycles have historically been rewarded with favorable outcomes.

MARKET INDEX RETURNS | November 2023 | YTD 2023 |

S&P 500 Index | 9.1% | 20.8% |

Russell 2000 Index | 9.0% | 4.1% |

MSCI EAFE Index | 9.3% | 12.3% |

Bloomberg US Agg. Bond Index | 4.5% | 1.6% |

FTSE 3 Mo. T-Bill Index | 0.5% | 4.8% |

“The two most powerful warriors are patience and time.” Leo Tolstoy, War and Peace

STOCK MARKET REVIEW & OUTLOOK

April Showers Put a Damper on the U.S. Equity Rally

April showers may bring May flowers, but they also rained on the long and winding stock market parade celebrating the strongest first quarter return for the index since 2019. Fortunately, prudent long-term investors have come to expect periodic downpours from risk assets and set their portfolios (and expectations) to weather such storms.

U.S. equities took a pause after a torrid pace of gains over the past five months. Rising geopolitical tensions, college campus protests and questions about when the Federal Reserve may follow through on talk of easier monetary policy were pervasive headlines during the month. A pullback in previously high-flying technology stocks weighed heavily on the index repricing. All but one of the 10 index sectors finished in the red, with high dividend paying Utilities stocks the sole gainer. International stocks pulled back less than U.S. large cap stocks. The small cap Russell 2000 Index was particularly weak, wiping away all of the gains from earlier in the year, and then some.

The yield on the bellwether 10-Year U.S. Treasury climbed higher during the month by 48 basis points to 4.67%, near the high for the year. The Federal Open Market Committee stood pat on rates as anticipated, patiently awaiting friendlier inflation data to plan their first cut in the current monetary cycle.

S&P 500 SECTOR RETURNS | November 2023 | YTD 2023 |

Communication Services | 7.8% | 48.7% |

Consumer Discretionary | 10.9% | 34.1% |

Consumer Staples | 4.1% | -2.1% |

Energy | -1.0% | -1.3% |

Financials | 10.9% | 6.4% |

Healthcare | 5.4% | -2.2% |

Industrials | 8.8% | 10.4% |

Information Technology | 12.9% | 52.0% |

Materials | 8.4% | 7.6% |

Utilities | 5.2% | -8.8% |

ECONOMIC REVIEW & OUTLOOK

Latest Inflation Data Appears to be as Ornery and Stubborn as Bill Belichick is Portrayed in the Apple TV Documentary “The Dynasty – New England Patriots”

The latest reports through March on consumer and producer prices came in far warmer than anticipated and higher than the prior month’s readings. The Consumer Price Index (CPI) came in at 3.5% on a year-on-year basis. Excluding the volatile food and energy segments, Core CPI was 3.8%. The Fed’s preferred gauge of price inflation, Personal Consumption Expenditures (PCE) followed a similar trend but was a bit more Brady than Belichick (read “friendlier.”) The data did nothing to advance the narrative of a Fed willing to cut rates in the near-term.

CHART OF THE MONTH

The Cost of Missing the Best Days in the Market

Source: Fidelity Investments

As shown in the exhibit above (over the 42-year period highlighted), remaining steadfastly invested in the market has rewarded investors with an attractive double digit annualized rate of return. Missing only the best 10 days (during the entire four plus decade period) cuts that result more than in half. As the number of stellar days missed increases, the further those annualized returns plunge into mediocrity.

CLOSING STATEMENT

Looking Ahead

Earnings reported thus far for the first quarter of 2024 have been solid, despite the equity index price pullbacks into the second quarter. With just over half the companies in the S&P 500 having reported, the latest estimate from FactSet is that Q1 earnings will be 3.9% higher than the same quarter last year. There has been a meaningful dichotomy of price reaction between winners and losers thus far. A number of stocks have been rewarded or punished with double digit percentage price changes in a single day following earnings announcements.

The forecast continues to look sunny for corporate profits, with double digit growth anticipated in calendar year 2024. Much like New England weather, there is always a chance of a volatile shift, albeit nothing that can’t be handled by a long-term investment strategy employing healthy doses of…patience and time.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com