In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Take Stock

Although you want to regularly consider if your long-term allocation to stocks is where it should be, in this case, “take stock” is being recommended in a much broader context. It’s not the setup for a twist on a joke first made by comedian Henny Youngman in the mid-1930s, such as… “Take my stock portfolio, please,”; although investors would be forgiven for that dry quip when looking at account statements last year.

The suggestion to “take stock” in this instance is similar to the idea of spring cleaning; taking a fresh look at your overall financial picture for any areas that may benefit from some added attention or “clean up.” Your account officers at Plimoth Investment Advisors would be delighted to connect with you to assess and review your overall financial plan. While certain life changes such as marriage, divorce, birth of a child or grandchild, college education costs, new job, or retirement regularly indicate that it is time to consider a financial review, it is also a good idea to spend some time at least once per year thinking about less commonly considered aspects of an overall financial equation. Perhaps it’s time to consider if your credit cards provide the most attractive perks and benefits for your current lifestyle or if the yield on your cash and CD accounts is keeping up with market rates. In a higher rate environment considering if any floating debt consolidation might make sense, reviewing estate documents to ensure wills and beneficiaries are up to date, or looking more closely at insurance levels on appreciated property. While we may not be experts in each and every one of these areas, rest assured that we have long-standing high-quality partners to connect you with if these or any other areas of your finances would benefit from a spring tune-up.

MARKET INDEX RETURNS | APRIL 2023 | YTD 2023 |

S&P 500 Index | 1.6% | 9.2% |

Russell 2000 Index | -1.8% | 0.9% |

MSCI EAFE Index | 2.8% | 11.5% |

Bloomberg US Agg. Bond Index | 0.6% | 3.6% |

FTSE 3 Mo. T-Bill Index | 0.4% | 1.5% |

While taking stock, why not take a moment to consider some other often-overlooked practical items like that inspection sticker on your car windshield, the state of the furnace filter that worked hard all winter, assessing the value of all those streaming services and pay cell phone apps as well as important financial matters, like reviewing retirement plan contribution amounts and beneficiaries.

STOCK MARKET REVIEW & OUTLOOK

While Not Exactly Pretty, Financial Markets Were Profitable in April

Equity markets in the U.S. squeaked out an incremental gain in April to add to the strong turnaround in returns thus far in 2023 after a dismal result in 2022. The large cap companies of the S&P 500 made up lost ground experienced earlier in the month and closed 1.6% higher, while smaller cap companies had a third consecutive monthly pullback. The Russell 2000 Index was led lower by meaningful exposure to regional bank stocks which have continued to fall in price as well as smaller technology companies. The majority of sectors in the S&P were in the green for the month, with Communication Services continuing to lead the pack, based primarily on the eye-popping (and head-scratching) returns of a single stock (Meta). On a year-to-date basis, Financials, Energy, Healthcare and Utilities remain the laggards. With roughly half the companies in the S&P 500 now having reported through the period ended March 31, we are still anticipating an overall earnings decline for the quarter, despite an above average level of earnings beats thus far. Developed economy international stocks were positive as well, edging out U.S. stock returns for the month and year-to-date.

While there was no official policy meeting of the Federal Open Market Committee in April, Fed speak unsurprisingly persisted throughout the month with a focus on remaining vigilant in maintaining tighter monetary policy to quell stubborn inflation. The bellwether 10-Year U.S. Treasury yield finished the month lower by 5 basis points at 3.42%. The spread between the 2-Year and 10-Year Treasury yields remained decidedly negative. This inverted state of the yield curve served as a recurring reminder of the fragility of the U.S. economy tiptoeing around recession, while being supported by a robust labor market.

S&P 500 SECTOR RETURNS | APRIL 2023 | YTD 2023 |

Communication Services | 3.8% | 25.1% |

Consumer Discretionary | -0.9% | 15.0% |

Consumer Staples | 3.6% | 4.5% |

Energy | 3.3% | -1.6% |

Financials | 3.2% | -2.6% |

Healthcare | 3.1% | -1.4% |

Industrials | -1.2% | 2.2% |

Information Technology | 0.5% | 22.4% |

Materials | -0.1% | 4.1% |

Utilities | 1.9% | -1.4% |

ECONOMIC REVIEW & OUTLOOK

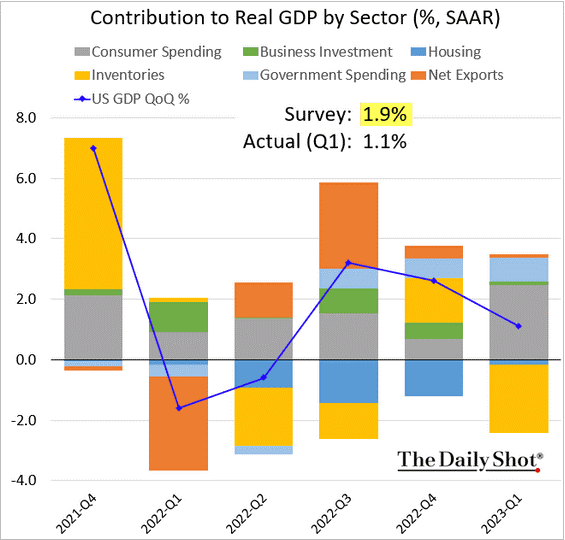

First Quarter GDP Was More Muted Than Anticipated

The initial estimate of Gross Domestic Product (GDP) in the U.S. was reported last month at 1.1%. The reading trailed consensus expectations as well as the final reading from the previous quarter (2.6%). Inventory reductions were a key factor in the sub-par report, while consumer spending held up at the strongest level in two years, driven by a surge in the purchases of motor vehicles. Some key areas of business fixed investment expanded as well, including structures and intellectual property, while capital equipment fell for a second consecutive quarter. Housing remained a headwind but was less of a factor than in the previous three quarters. Growth would have been fairly close to expectations if not for the pullback in inventories, which had healthy expansion in the prior quarter

CHART OF THE MONTH

First Quarter 2023 GDP Sector Contribution

Source: The Daily Shot

As the chart above displays, consumer spending (responsible for more than two thirds of the measure of economic growth in the U.S.) held the first quarter GDP reading in positive territory. The key detractor was a reduction in the inventory of products available for sale.

CLOSING STATEMENT

Looking Ahead

“Taking stock” can mean numerous things in our day-to-day lives, including simply keeping eyes open to experience that which is going on around us. Take care not to miss all the enjoyable signs of spring taking place, including the recent return of migratory hummingbirds, one of our favorites! The financial press and political pundits will continue to find ways to turn up the noise to fill daily news quotas. Rest assured that our team will be sifting through and focusing on the most critical facts to incorporate into our portfolio management decisions on behalf of you, our clients. Feel comfortable hitting the “silence” or even “off” button on your devices on occasion to enjoy the fruits of your labor. Rest assured that we will always have members of our team tuning in and sharing news items and economic measures we find important and relevant to your financial future.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com