In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Federal Open Market Committee 101

The Federal Open Market Committee (FOMC), a branch of the Federal Reserve System, is a group consisting of twelve voting members responsible for monetary policy in the United States. The group holds eight regularly scheduled (closed-door) meetings per year to review financial conditions and set policies to achieve their dual mandate of price stability and sustained economic growth through maximum employment. Committee members are characterized as either “hawks” (favoring tight monetary policy), “doves” (favoring more accommodative policies) or centrists (somewhere in between). Members of the Committee, including the Chair and Vice Chair, are nominated by the President of the United States and confirmed by the Senate but operate independently with final say on interest rate policy.

The FOMC utilizes a limited number of tools including changing the target level of a key short-term interest rate known as the Fed Funds Rate (overnight borrowing rate that banks use to lend their balances at the Federal Reserve to each other) and open market operations, consisting of buying or selling securities in the open market utilizing the Fed’s very sizable balance sheet (currently $8.4 trillion). The broader Board of Governors of the Federal Reserve System also controls other monetary policy tools including the Discount Rate (interest rate charged to financial institutions on fully secured loans they receive from regional Federal Reserve Bank’s lending facilities), and reserve requirements (amount of capital commercial banks must keep on hand relative to deposits and lending operations). These combined limited number of policy levers have a broad effect on numerous aspects of the financial system including the cost of credit to borrowers, money supply, shape of the yield curve, foreign exchange rates and the price of goods and services.

MARKET INDEX RETURNS | FEBRUARY 2023 | YTD 2023 |

S&P 500 Index | -2.4% | 3.7% |

Russell 2000 Index | -1.7% | 7.9% |

MSCI EAFE Index | -2.1% | 5.8% |

Bloomberg US Agg. Bond Index | -2.6% | 0.4% |

FTSE 3 Mo. T-Bill Index | 0.3% | 0.7% |

Although the FOMC has 12 voting members, comments made to the financial media by other (non-voting) Reserve Bank Presidents carry enough weight to influence investor sentiment. The 7 non-voting Presidents attend committee meetings, weigh in on economic conditions, and are deemed to have unique insights into the innermost workings and thought processes of the group. Unfortunately, they typically espouse their own opinions rather than consensus views, muddying the waters of the Committee’s message and keeping traders on their toes.

STOCK MARKET REVIEW & OUTLOOK

Stock Market Tape Was Red as a Rose by Month End

Equity markets gave back some of the quick gains earned in the new calendar year with the S&P 500 lower by 2.4% in February. Sentiment shifted from FOMO (fear of missing out) early in the month to “no go” (a term unlikely to be found in any financial text) in the following weeks. Fourth quarter corporate earnings reported during the month trailed the previous quarter and significantly lagged relative to the prior year. The number of companies providing less than rosy forward guidance continued to rise from Valentine’s Day through the last of the heart-shaped candy clearance sales by month end. Information Technology stocks provided the only modest reprieve, finishing slightly in the green on the month. Unfortunately for the workers at some of the largest software and internet services companies, it came at the expense of additional job cuts. The technology-focused NASDAQ Composite suffered a more muted decline of 1.0% relative to a 3.9% pullback for the more cyclically oriented Dow Jones Industrial Average. The most defensive sectors of the market, Consumer Staples and Utilities, pulled back for a third consecutive month, the first such occurrence since 2018.

Bond prices pulled back as well in the face of rising yields which flirted for investors’ attention when short-dated Treasuries surpassed 5%. The bellwether 10-Year U.S. Treasury yield ended the final trading session of the month at 3.92%, 41 basis points higher than where it started.

S&P 500 SECTOR RETURNS | FEBRUARY 2023 | YTD 2023 |

Communication Services | -4.7% | 9.2% |

Consumer Discretionary | -2.2% | 12.5% |

Consumer Staples | -2.4% | -3.3% |

Energy | -7.1% | -4.5% |

Financials | -2.3% | 4.4% |

Healthcare | -4.6% | -6.4% |

Industrials | -0.9% | 2.8% |

Information Technology | 0.4% | 9.8% |

Materials | -3.3% | 5.4% |

Utilities | -5.9% | -7.8% |

ECONOMIC REVIEW & OUTLOOK

Rising Rates Have Weighed on Mortgage Applications

Existing Home Sales reported in February declined for a twelfth consecutive month. This is the longest downward stretch since 1999. Mortgage applications, reported by the Mortgage Bankers Association (MBA), continued to decline during the month with average 30-year fixed rate mortgages rising to 6.71%, the highest level since November 2022.

CHART OF THE MONTH

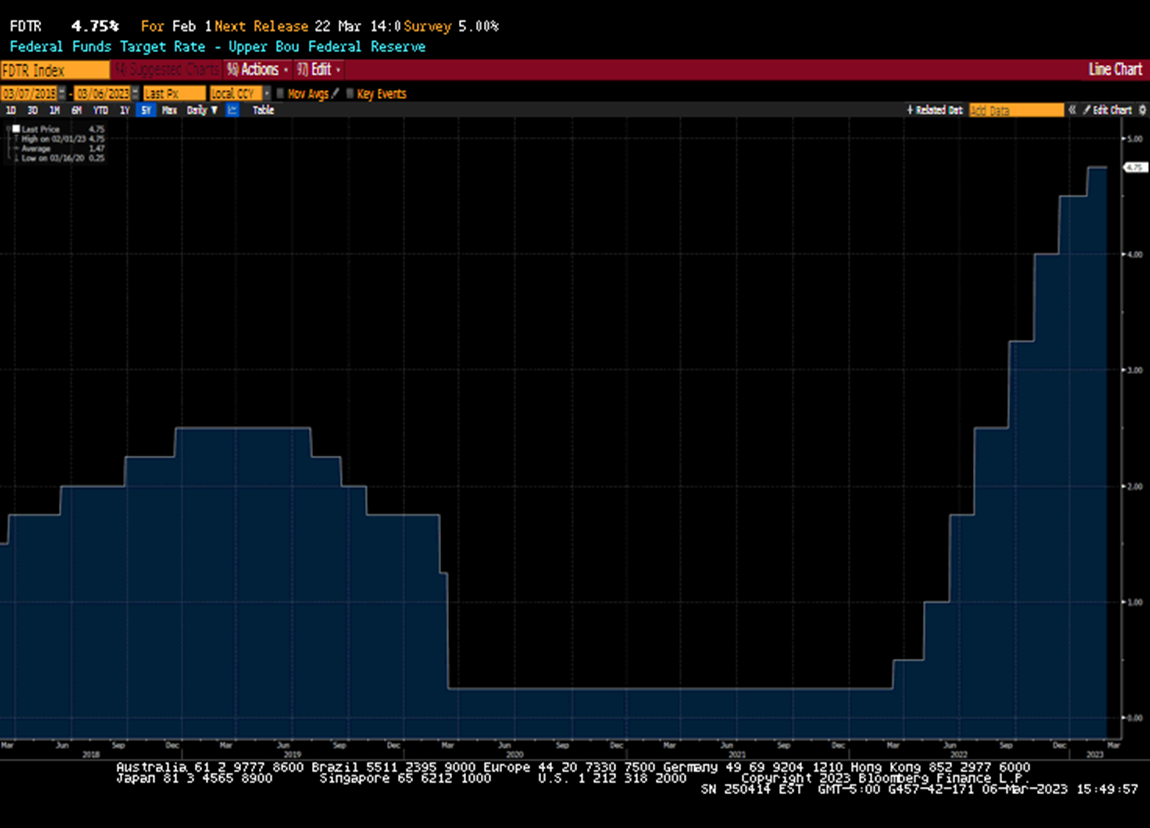

Federal Funds Target Rate

Source: Bloomberg

The chart above depicts the aggressive rate hikes the Fed has instituted over the past year in its shift toward significantly tighter monetary policy.

CLOSING STATEMENT

Looking Ahead

Equity markets shifted from hot to not only two months into the new trading year. The recurring struggle between market bulls and bears should be expected to continue in a love story older than time. With fourth quarter earnings season now wrapped up, we will be monitoring financial results carefully, in search of those companies able to outperform cautious forward guidance provided by many company management teams.

Because exceptional customer service is very important to us, please be advised that we are mailing a survey to you in the coming weeks. We invite you to assess your satisfaction with us by completing the questionnaire and returning it to us in the prepaid postage envelope provided by May 26, 2023. The survey should only take a few minutes to complete, and your participation would be greatly appreciated.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com