In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

War in Ukraine Took Center Stage in February

The heaviest sanctions ever imposed on any country were taken against Russia, which will have devastating financial consequences to their economy and are expected to reverberate across others. Preliminary estimates are calling for at least a 10% drop in Russian GDP, a spike in inflation and significantly diminished living standards for their people. The Russian Ruble dropped to $0.01 versus the U.S. dollar by month end, then the lowest level in history, while continuing to find lower ground since. The price of crude oil skyrocketed 30% this year through February and is continuing to rise rapidly driving average prices at the pump to the highest level in history at the time of this writing. Brent closed at over $100 per barrel on the final trading day of the month. Russia controls roughly 10% of the world’s oil supply and the disruption created by crippling sanctions will be felt globally. The supply-demand dynamic for crude is continuing to destabilize with global oil inventories reaching their lowest level since 2014.

Incremental costs to U.S. companies and potentially prolonged supply chain disruptions are likely. Russia and Ukraine are large exporters of grains and a number of different metals in addition to oil and natural gas. The specific impacts in the U.S., as well as our important trading partners in Europe, will be difficult to quantify with any precision while the crisis is ongoing.

MARKET INDEX RETURNS | FEBRUARY 2022 | YTD 2022 |

S&P 500 Index | -3.0% | -8.0% |

Russell 2000 Index | 1.1% | -8.7% |

MSCI EAFE Index | -1.8% | -6.5% |

Barclays US Agg. Bond Index | -1.1% | -3.2% |

FTSE 3 Mo. T-Bill Index | 0.0% | 0.0% |

Markets experienced a roller coaster ride last month, not unlike what we have experienced with past shocking geopolitical events, acts of war and terrorism.

STOCK MARKET REVIEW & OUTLOOK

The S&P 500 extended its year-to-date decline to -8%, with an incremental fall of -3% during the month. Both the bellwether stock index and the more narrowly focused Dow Jones Industrial Average fell into correction territory (decline of more than 10%) and the NASDAQ dipped briefly into a bear market (decline of more than 20%) during intraday trading during the month. Energy stocks, once again, were the only sector to provide a positive return, based on soaring commodity prices. Financial markets around the world were shaken by the news of Russia’s invasion. The key benchmark tracking Russian equities dropped a whopping 35% in a single day.

Investors seeking safe haven were buyers of U.S. Treasuries, sending the yield on the 10-Year U.S. Treasury on a rocky ride in a wide trading range of 1.78% to 2.04% before closing the month modestly higher at 1.82%. The Federal Open Market Committee gave the clearest statement yet on its plan to make a measured 25 basis point hike in the Fed Funds Rate at its next meeting later this month.

S&P 500 SECTOR RETURNS | FEBRUARY 2022 | YTD 2022 |

Communication Services | -7.0% | -12.8% |

Consumer Discretionary | -4.0% | -13.3% |

Consumer Staples | -1.4% | -2.8% |

Energy | 7.1% | 27.6% |

Financials | -1.4% | -1.3% |

Healthcare | -1.0% | -7.7% |

Industrials | -0.9% | -5.6% |

Information Technology | -4.9% | -11.4% |

Materials | -1.2% | -8.0% |

Utilities | -1.9% | -5.1% |

ECONOMIC REVIEW & OUTLOOK

Consumers Did Not Hesitate to Swipe, Scan and Enter Credit Card Information Online Last Month

Before war broke out in Eastern Europe, Producer Prices (paid by manufacturers to suppliers) spiked in January following a larger than expected rise in the Consumer Price Index (CPI). The largest monthly increase since May 2021 was driven by strong demand and ongoing supply disruptions. Retailers’ pricing power was clearly visible in February to anyone in the market for a Valentine’s Day gift, experience or gesture. Whether true love or an earnest attempt at staying out of the “dog house”, Economics 101 on the power of inelastic demand moved from textbooks to consumers’ wallets on the days leading up to the Hallmark holiday.

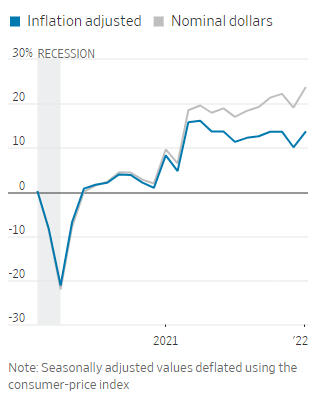

Higher prices and a global pandemic did not stop consumers from getting out to spend in January. Retail Sales jumped by 3.8% from the previous month. Online sales soared and purchases of vehicles and building materials were strong contributors to the rise. As shown on the chart below, this was the highest month-over-month gain since last March when massive pandemic relief distribution drove consumption higher.

The spending increases surprised economists on the heels of weaker than expected reports from closely followed consumer sentiment indices. We prefer to follow the age-old advice of watching what consumers do versus what they say.

CHART OF THE MONTH

Retail Sales Change from February 2020

Source: St. Louis Fed, The Wall Street Journal

Even adjusting for rising prices, the (inflation-adjusted) blue line above shows a strong revival of consumer spending from the lows of the pandemic shock.

CLOSING STATEMENT

Looking Ahead

Our hearts are heavy for the destruction and suffering currently taking place in the Ukraine. Focusing on financial markets and using history as a guide, equity markets typically fare quite well within a relatively short period of time following market corrections. Past experience has shown us that it does not usually take long for investors to regroup after a major world event to regain footing on the “wall of worry” and look for attractive buying opportunities. Invariably, investors swiftly overreact to troubling news that has limited impact on asset prices over time.

We have taken the pullback as an opportunity to sharpen our pencils and look for opportunities to upgrade portfolios with a focus on high quality stocks that have declined along with the overall market in a manner that may not be indicative of future business prospects. Market volatility should be expected to remain higher than usual in the near -term and investors should be expected to continue to be reactive to headlines. Any mention of the word “nuclear” will understandably heighten anxiety and weigh on investor sentiment. How the myriad of economic sanctions in play, as well as the isolation of Russia by a growing number of individual companies, will impact the global economy will take some time to be sorted out and understood.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or anything else we can be helpful with.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com