In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

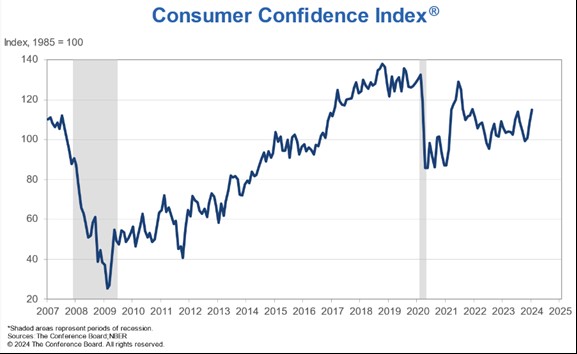

How Do We Know How Confident the Consumer is Anyway? Thank You Conference Board

The Conference Board in the U.S. has been around since before Prohibition or the Jazz Age of the Roaring Twenties, a period when the U.S. economy grew at an eye-popping pace of over 40%. The Board dates back to 1916, originally formed in Boston as The National Industrial Conference Board by a group of industrious CEOs focused on how workplace issues impact business. They later incorporated as a private, nonprofit, organization after a move to New York in 1920. While the Board has performed numerous studies and created various committees to focus on key economic matters, working closely with a number of U.S. Presidential administrations over many decades, it is now primarily known as a preeminent source of economic survey and data distribution. This includes consumer confidence data, based on a key index created in 1967, and Leading Economic Indicators, a data series created in 1996.

MARKET INDEX RETURNS | November 2023 | YTD 2023 |

S&P 500 Index | 9.1% | 20.8% |

Russell 2000 Index | 9.0% | 4.1% |

MSCI EAFE Index | 9.3% | 12.3% |

Bloomberg US Agg. Bond Index | 4.5% | 1.6% |

FTSE 3 Mo. T-Bill Index | 0.5% | 4.8% |

The 18th Amendment, ratified in 1919, prohibited the manufacturing, sale or transportation of intoxicating liquors in the U.S. Liquor companies profiting from a sales spike from football (and Taylor Swift) fans on Super Bowl Sunday have the 21st Amendment to thank for its repeal in 1933 that allows them to continue to operate today.

STOCK MARKET REVIEW & OUTLOOK

To Infinity and Beyond

The S&P 500 continued its positive trend with a third consecutive month of gains. The broad-based benchmark of U.S. large cap stocks, as well as the Dow Jones Industrial Average, continued their climbs into all-time record high territory. Large cap stocks outperformed small, and international equities in the first trading month of the year. Results were mixed across market segments with the growthier Communications Services and Information Technology sectors once again providing the most outsized returns. Half of the index sectors ended the month in the red with a diverse group of laggards pulled down primarily by Materials, Consumer Discretionary, and Utilities.

The Federal Open Market Committee remained on hold with rate policy during January and did their best to reign in traders’ interest rate cut expectations with their statement following their latest two-day meeting. The projection of forward rates (dot plot) continues to show an estimated three cuts to the Fed Funds Rate in 2024. U.S. Treasury yields advanced modestly during the month, with the bellwether 10-Year teetering over and under the 4% level throughout January, closing the final trading session at 3.99%. The yield curve inversion between the 2 and 10-Year Treasuries narrowed modestly to 28 basis points.

S&P 500 SECTOR RETURNS | November 2023 | YTD 2023 |

Communication Services | 7.8% | 48.7% |

Consumer Discretionary | 10.9% | 34.1% |

Consumer Staples | 4.1% | -2.1% |

Energy | -1.0% | -1.3% |

Financials | 10.9% | 6.4% |

Healthcare | 5.4% | -2.2% |

Industrials | 8.8% | 10.4% |

Information Technology | 12.9% | 52.0% |

Materials | 8.4% | 7.6% |

Utilities | 5.2% | -8.8% |

ECONOMIC REVIEW & OUTLOOK

Nothing to See Here Recession Watchers

The U.S. economy has continued to grow at an impressive pace. Gross Domestic Product (GDP) was reported for the fourth quarter of 2023 at a 3.3% annualized pace, well ahead of expectations. Unemployment remains at an historically low 3.7% and jobs remain plentiful with over 9 million open positions. Both factors have buoyed consumer confidence. The latest report of the Conference Board Index hit a two-year high with a stellar view of current conditions and declining pessimism about the future. The University of Michigan reported the highest level of consumer confidence since July 2021.

The Fed’s preferred gauge of inflation, Personal Consumption Expenditures (PCE), slowed to a sub-3% annualized pace for the first time since March 2021. The latest reading of the Core Consumer Price Index (CPI) came in below 4% on an annualized basis for the first time in two years and Core Producer Prices (PPI) continued to cool as well. Monetary policy is known to work with a lag and the effects of rapid tightening over the last two years are certainly showing up in the latest data.

CHART OF THE MONTH

Consumer Sentiment is Working its Way Back to Pre-Pandemic Peak Level

CLOSING STATEMENT

Looking Ahead

Considering ongoing consumer exuberance, we remain cautious on exactly how much longer it can last with government stimulus checks long ago spent and forgotten, savings rates decreasing and the level of credit card debt and delinquencies continuing to rise.

Corporate earnings season is in full swing. With more than half the companies in the S&P 500 now reported, 72% have reported an earnings surprise and expectations have shifted from a negative quarter to modestly positive earnings growth of 1.6%. If the trend holds, this will be the second consecutive quarter of positive earnings growth. In a welcomed shift to more rational behavior, companies missing consensus expectations or reporting lower forward guidance have (for the most part) been bid down and those exceeding expectations have been rewarded by investors. Fortunately, we will all have an extra day in February this leap year to digest and interpret the slew of data.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com