In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Fed Chair Guides for Gradual Policy Tightening

The Federal Open Market Committee (FOMC) kept interest rates unchanged at their latest meeting. However, Chairman Jerome Powell stressed the need for rate hikes in the future to combat rising inflation. Investors have now fully priced in a 0.25% hike to the Fed Funds Rate for the March meeting. From there, three to four more interest rate hikes are expected, although the Fed says they will be “data-dependent” and could possibly change course.

Expect the Fed’s balance sheet to begin decreasing in size later this year, as they let their holdings of U.S. government bonds and mortgage-backed securities expire without replacement. This is another form of policy tightening, as it means the Fed will be taking less action to hold down interest rates at accommodative levels for businesses and consumers.

MARKET INDEX RETURNS | JANUARY 2022 | YTD 2022 |

S&P 500 Index | -5.2% | -5.2% |

Russell 2000 Index | -9.6% | -9.6% |

MSCI EAFE Index | -4.8% | -4.8% |

Barclays US Agg. Bond Index | -2.2% | -2.2% |

FTSE 3 Mo. T-Bill Index | 0.0% | 0.0% |

Stocks suffered in January, but economic data remained resilient.

STOCK MARKET REVIEW & OUTLOOK

Equities Suffer Rate Shock to Begin New Year

While the S&P 500 fell -5.2%, the decline in the NASDAQ was the big story of the month. Higher interest rates pushed the technology-heavy index down -9.0%. Meanwhile, the Dow Jones Industrial Average, which is tilted towards the largest, blue-chip companies, fell -3.2%, holding up slightly better. Shares of Energy stocks were by far the strongest in the S&P, climbing 19.1%. Nearly every other sector of the market was down, although Financials rose a modest 0.1%. While technology had a tough month, falling -6.9%, Consumer Discretionary was the month’s worst-performing sector, off by -9.7%. The first batch of corporate earnings released reflecting Q4 2021 were mostly positive with 77% of companies beating revenue estimates.

The yield on the bellwether 10-Year U.S. Treasury rose by a startling 0.27%, winding up at 1.78%. The 2-Year U.S. Treasury, often seen as a proxy for short-term interest rates, vaulted to 1.16%, after finishing 2021 at 0.73%. Although the curve is not close to inverting (meaning short-term yields are higher than long-term yields), the shrinking difference between the 2 and 10-year Treasury yields should be a consideration for the Fed as inverted yield curves have preceded every recent U.S. economic recession.

S&P 500 SECTOR RETURNS | JANUARY 2022 | YTD 2022 |

Communication Services | -6.2% | -6.2% |

Consumer Discretionary | -9.7% | -9.7% |

Consumer Staples | -1.4% | -1.4% |

Energy | 19.1% | 19.1% |

Financials | 0.1% | 0.1% |

Healthcare | -6.8% | -6.8% |

Industrials | -4.7% | -4.7% |

Information Technology | -6.9% | -6.9% |

Materials | -6.8% | -6.8% |

Utilities | -3.3% | -3.3% |

ECONOMIC REVIEW & OUTLOOK

Will Consumer Spending Hold Up Against Record Inflation?

Consumer spending remained strong in January, yet consumer sentiment remains downbeat according to the closely watched University of Michigan survey. Inflation is the top concern on the minds of consumers, showing that higher inflation has the potential to create demand destruction. Housing is a key culprit driving prices higher. New home construction is robust, with builders taking advantage of the strong pricing environment. Supply chain difficulties continue to weigh on this sector, however, with delays in building permit approval and difficulties securing skilled labor and materials such as lumber and copper. Rent has ticked up as well, reflecting a move back to the cities by younger people and lower apartment construction.

Auto prices have soared as the semiconductor shortage continues. Chip manufacturers are ramping up production but are having trouble sourcing raw materials. Judging by recent corporate press releases and conference calls during earnings reports, the situation will not fully resolve itself this year, though it may improve. New car prices have risen 20% annually, while used car prices are up 35% as consumers look for cheaper alternatives.

The biggest inflation wild card will be the price of oil. U.S. drillers and members of OPEC are enjoying high oil prices after several disappointing years (remember when gas was below $2 per gallon in 2016?). These parties are aiming to keep production low and prices high, with U.S. firms focused on returning cash to shareholders. In addition, the policy environment is very uncertain; new oil projects often pay out over multiple decades, and due to the shift towards renewable energy, the returns are not enticing enough for these companies to spend billions to increase drilling opportunities. Look for another release from the U.S. Strategic Petroleum Reserve if oil prices continue to be a political headwind for the Biden Administration.

CHART OF THE MONTH

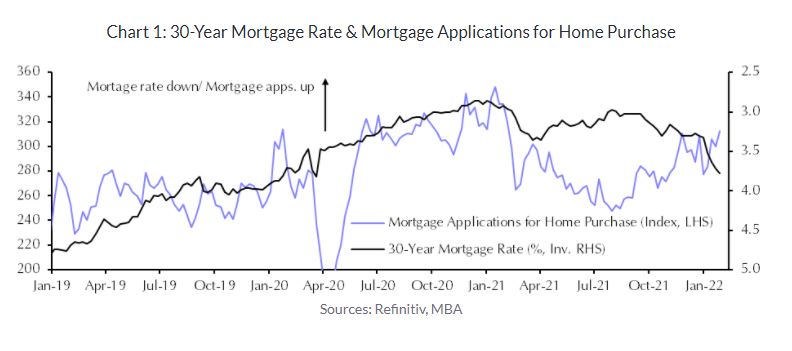

How Higher Mortgage Rates Could Harm the Hot Housing Market

Source: Capital Economics

The chart above shows the relationship between the 30-year mortgage rate and the amount of new mortgage applications. Applications have remained high lately, thanks to strong household formation and high demand for housing in the suburbs during the pandemic. However, mortgage rates are trending in the wrong direction due to higher inflation and the beginning of the Fed’s interest rate hiking cycle. With the median sales price of a home up nearly 20% on the year, housing affordability is becoming more stretched.

CLOSING STATEMENT

Looking Ahead

There are several catalysts on the horizon that can support a continued economic recovery. Consumers, especially those who are wealthier, built up a strong reserve of savings during the pandemic. With the virus mutating to somewhat weaker strains, and higher levels of vaccination and prior immunity, consumer mobility should increase throughout 2022. The pent-up demand for travel, entertainment, and dining should act as a major support to the economy this year. Consumers will have to contend with inflation as well as stricter monetary policy, and continued supply chain bottlenecks. The expectation is that inflation will remain high relative to historical levels but subside later in the year due to higher production of commodities, more available workers, and more favorable year-over-year comparisons. The Fed’s March decision and announcements on future balance sheet policy will be closely scrutinized, especially given recent speculation of the possibility for a 0.50% rate hike, which we are not expecting.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or anything else we can be helpful with.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com