In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The Fed Went Big in September with an Aggressive Rate Cut

The first cut is the deepest, according to both Rod Stewart and Sheryl Crow (in their respective remakes of the 1967 song by that name written by Cat Stevens.) Fed Chairman Jerome Powell announced an aggressive 50 basis point cut in interest rates at the conclusion of the Federal Open Market Committee (FOMC) meeting on September 18th, signifying the start of a new monetary easing cycle. The Committee voted 11-1 on the policy change, moving forward with the first dissent from a Governor since 2005. Fed Governor Michelle Bowman expressed a more cautious view on the state of inflation indicating that she favored a more modest cut. The magnitude of the policy decision shows a general consensus that the FOMC has confidence that inflation is moving sustainably toward its 2% target and shifts more focus to the full employment side of their dual mandate. Chairman Powell indicated that the risks to achieve each are now “roughly in balance.”

|

MARKET INDEX RETURNS |

September 2024 |

YTD 2024 |

|

S&P 500 Index |

2.1% |

22.1% |

|

Russell 2000 Index |

0.7% |

11.2% |

|

MSCI EAFE Index |

0.9% |

13.0% |

|

Bloomberg US Agg. Bond Index |

1.3% |

4.4% |

|

FTSE 3 Mo. T-Bill Index |

0.4% |

4.2% |

According to Chairman Powell, the risks of a reacceleration in inflation and weakening labor conditions are “roughly in balance.”

STOCK MARKET REVIEW & OUTLOOK

The S&P 500 Had 42 New Closing Records in 2024, as Impressive as Watching #42 Jackie Robinson Steal Home Plate, then… a 43rd

The S&P 500 hit a 43rd record new high for the year to close out a stellar third quarter and month of September. Having recently spent part of a flight watching the powerful movie 42, depicting the life story of Major League Baseball (MLB) great Jackie Robinson, this writer was selfishly hoping to end the quarter with one less closing high, anticipating a neat tie in for a financial newsletter and Mr. Robinson’s historic 1947 signing with the Brooklyn Dodgers. Much like many of the trading days this year, markets would simply not be held back in the final session. Be that as it may, where there is a will there is often a way, thus the hats off mention of the legendary number 42. All MLB players wear the number on their jerseys in games played annually on Jackie Robinson Day, celebrated each April 15th.

The stellar performance in the month was generated with solid breadth, indicative of returns coming from a varied group of contributors. The cyclical-growth oriented Consumer Discretionary sector led with the strongest return, followed closely by a rock-solid return from the uniquely different Utilities sector, historically a defensive, interest rate sensitive segment of the market. While investors continue to look for any mention of AI as an investment theme, the story behind ongoing strength in Utilities has, in our opinion, more to do with the turn in the rate cycle than a power grid sourcing thesis. Incorporating the September gains, Utilities took the lead as the strongest sector of the index on a year-to-date basis, edging out Information Technology, the high-flying growthiest segment of the market. The ongoing robust breadth of returns across sectors is a positive catalyst to sustain positive equity gains.

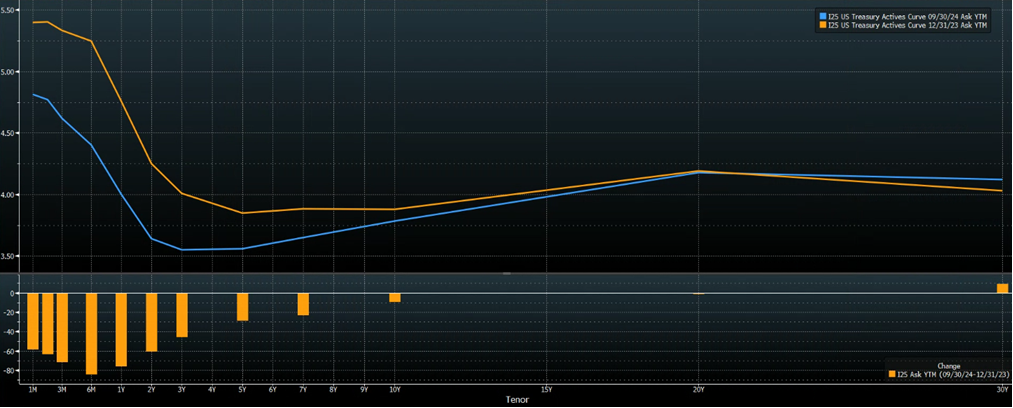

The yield on the bellwether 10-Year U.S. Treasury was lower by 12 basis points in September, closing at 3.78%. The 2-Year pulled back by 27 basis points (further bull steeping) leading to a positive spread of 0.14%. While the shortest end of the yield curve still remains markedly inverted, it is encouraging to see further normalization in the intermediate part of the curve as shown in the chart below.

|

S&P 500 SECTOR RETURNS |

September 2024 |

YTD 2024 |

|

Communication Services |

4.6% |

28.8% |

|

Consumer Discretionary |

7.1% |

13.9% |

|

Consumer Staples |

0.9% |

18.7% |

|

Energy |

-2.7% |

8.4% |

|

Financials |

-0.5% |

21.9% |

|

Healthcare |

1.7% |

14.4% |

|

Industrials |

3.4% |

20.2% |

|

Information Technology |

2.5% |

30.3% |

|

Materials |

2.6% |

14.1% |

|

Utilities |

6.6% |

30.6% |

|

Real Estate |

3.3% |

14.3% |

ECONOMIC REVIEW & OUTLOOK

Latest Inflation Reports Remain in Line with the Fed’s Narrative

The release last month of the latest reading of the Fed’s preferred inflation measure, Personal Consumption Expenditures (PCE) came in at 2.2%, its lowest year-on-year level since February of 2021. Consumers are still experiencing modest price increases in the services sector, while seeing some relief in the goods sector, lower by 0.2%. Core PCE, excluding the volatile food and energy segments, came in a little hotter at 2.7%. Gasoline prices, at a welcomed sub $3.00 per gallon at the pump, were a key factor in the deviation. Readings of the latest Consumer and Producer Price Indices were equally benign.

CHART OF THE MONTH

The U.S. Treasury Yield Curve is Shape Shifting to Something More “Normal”

Source: Bloomberg

Just in time for the upcoming Halloween holiday, the yield curve has done some shape shifting to a more normalized slope in the intermediate part of the curve (blue line 9/30/24, yellow line 12/31/23.) The shortest end of the curve remains notably inverted.

CLOSING STATEMENT

Looking Ahead

The next meeting of the Federal Open Market Committee is November 6-7. At the time of this writing, the policy makers have one more trip to the data well for employment and inflation to factor into their next decision. The latest dot plot of forward projections released by the Fed now implies another 50 basis points in cuts by year end and an additional 100 in 2025. In a recent interview with the National Association for Business Economics, Jerome Powell stated that the FOMC “is not a committee that feels like it’s in a hurry to cut rates quickly,” but rather one that “wants to be guided…by the incoming data.” We factor these views into an expectation that the Fed may take a more measured approach with the next cut, while also acknowledging we were admittedly on the more conservative end of expectations prior to the aggressive rate decrease last month.

The latest corporate earnings season wrapped up with more treats than tricks, posting stellar year-on-year bottom line growth of 13%. Positive estimates for the third quarter (currently 4.6%) anticipate a fifth consecutive quarter of year-on-year growth. As we prepare for another Halloween night of filling the bags of enthusiastic costumed youngsters, average candy prices are a much more reasonable 2.5% higher than this time last year, when a near double digit price increase put a damper on the spooky festivities.

Looking ahead, we will be managing the portfolios of our trusted clients with an eye toward a continued balance of risk and return. Heightened geopolitical risks have rightfully moved higher on the ever present “wall of worry” investors face when allocating capital to risk assets, an area we will be paying close attention to. Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As a reminder, we invite you to join the conversation on our social media pages – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com