In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Congress Decked the Halls with SECURE Act 2.0

The House and Senate approved a major piece of retirement reform legislation shortly before stockings were hung by the chimney with care. The bill was then signed into law as part of an omnibus spending package two nights before the ball dropped at Times Square in New York City to ring in the New Year. The Setting Every Community Up for Retirement Enhancement (SECURE) Act was originally passed in 2019 to increase the retirement savings potential of working Americans and was modified in a meaningful way in the final days of last year.

Some of the key highlights from the 2022 revisions include an immediate increase of the required minimum distribution age from 72 to 73 and increased tax credits for small businesses that start new retirement plans for their employees. The modifications also call for automatically enrolling new employees into company retirement plans, increased catch-up contribution limits and incorporating student loan repayments into employer retirement matching programs.

MARKET INDEX RETURNS | DECEMBER 2022 | YTD 2022 |

S&P 500 Index | -5.8% | -18.1% |

Russell 2000 Index | -6.5% | -20.5% |

MSCI EAFE Index | 0.1% | -14.5% |

Barclays US Agg. Bond Index | -0.5% | -13.0% |

FTSE 3 Mo. T-Bill Index | 0.3% | 1.5% |

Our Retirement Plan Specialists would be pleased to discuss how the nearly 400 pages of festive year-end legislative modifications made to the SECURE Act may benefit your retirement saving goals.

STOCK MARKET REVIEW & OUTLOOK

Returns for U.S. Equities and Bonds Ended the Year with a Thud

The S&P 500 closed a grinding trading year 18% lower than where it started. The NASDAQ Composite ended a challenging year for technology stocks lower by a much more painful 33%. The more cyclically oriented Dow Jones Industrial Average experienced the least drawdown, ending the calendar year off by 9%. All sectors of the S&P 500 were in the red during the final trading month of the year. Energy stocks held onto most of the significant gains from earlier in the year and Utilities were the only segments of the index (modestly) in the green for the year. Communication Services and Consumer Discretionary sectors were the hands down biggest losers during the period at -40% and -37% respectively.

The 10-Year U.S. Treasury yield finished the final trading session at 3.88%, off the peak of 4.25% experienced in October and well ahead of the start of the year at 1.50%. The 2-Year U.S. Treasury closed the year at 4.41%, leaving the yield curve inverted (short rates higher than intermediate and long rates), where it spent much of the year. Calendar year 2022 now has the distinction of being one of only five years in the past 100 in which both U.S. Treasuries and the S&P 500 provided negative returns to investors.

S&P 500 SECTOR RETURNS | DECEMBER 2022 | YTD 2022 |

Communication Services | -7.8% | -39.9% |

Consumer Discretionary | -11.3% | -37.0% |

Consumer Staples | -2.8% | -0.6% |

Energy | -3.0% | 65.4% |

Financials | -5.3% | -10.6% |

Healthcare | -1.9% | -2.0% |

Industrials | -3.0% | -5.5% |

Information Technology | -8.4% | -28.2% |

Materials | -5.6% | -12.3% |

Utilities | -0.5% | 1.6% |

ECONOMIC REVIEW & OUTLOOK

Monetary Policy Dominated the Macroeconomic Environment in 2022

The Federal Reserve raised the short-term Fed Funds Rate seven times in calendar year 2022 from a pandemic-level target of 0-0.25% to 4.25-4.50% at their final meeting in December. The moves, which included four outsized 0.75% increases, were the fastest paced rate hikes since the early 1980s. The rapid shift in policy, enacted while the purchase of billions of dollars of bonds in the open market (to stimulate the economy out of the COVID lockdowns recession) continued, led to the highest level of interest rate volatility since 2009.

Far from precise tools, the use of rate changes and open market operations are employed to attempt to satisfy the dual mandate the Fed is charged with: maintaining price stability (i.e., inflation) and maximizing employment. Consumer price inflation peaked in June 2022 and has since started to subside but remains well above the Federal Open Market Committee’s (FOMC) target. How the Fed proceeds with combatting stubborn inflation will be top of mind for investors and traders while trying to get a read on market sentiment and economic implications going into the new year

CHART OF THE MONTH

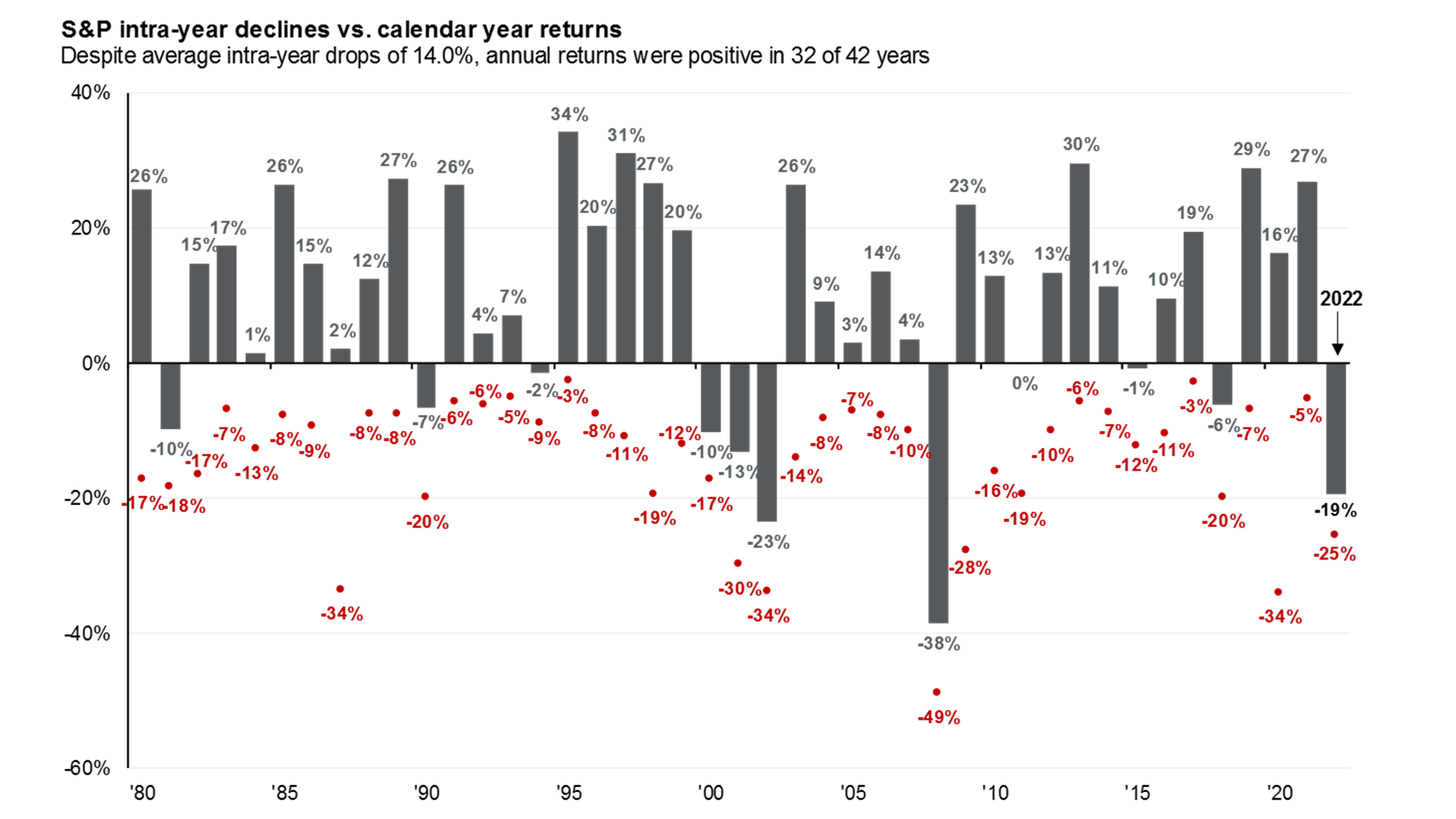

S&P 500 Annual Returns and Intra-year Declines

Source: J.P. Morgan 1Q 2023 Guide to the Markets

The chart above shows just how challenging equity markets were in calendar year 2022 relative to history. While positive years significantly outnumber negative, investors in risk assets have needed to be willing to tolerate drawdowns of this nature numerous times throughout history, en route to positive long-term compounded rates of return.

CLOSING STATEMENT

Looking Ahead

As we look ahead to a new trading year, we remain diligently focused on the widely anticipated monetary policy moves by the Federal Reserve. Continued policy tightening and higher short-term interest rates to follow the next FOMC meeting in February are fully priced into fixed income futures markets. Market participants will be closely tuned into any and all comments by the Fed, ready for a collective sigh of relief when the expected pause in quantitative tightening becomes a reality.

In the meantime, we will continue to take advantage of attractive yields being offered on high quality bonds across the short to intermediate part of the yield curve. With another corporate earnings season just around the corner, we will continue to seek opportunities in the equity market to add to high conviction positions should short-term price movements misalign with our long-term view of intrinsic value.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com