In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The Fed Cut Rates but Not Without Pulling Away the Punchbowl

The Federal Open Market Committee (FOMC) made an additional cut of 0.25% at their December 18th meeting, bringing the upper bound of the Fed Funds Rate to 4.5%. The move was widely expected, but the tone of the Fed Chairman’s statement and comments made during the subsequent press conference were decidedly more hawkish than perhaps anticipated. Chairman Powell spoke of a more measured and deliberate pace of cuts going forward, noting that the final push to get to 2% inflation may be the most difficult, much like those last couple of pounds indulgent partygoers try to trim back in the new year.

The newly released Summary of Economic Projections drew ample attention after the meeting, with the dot plot projecting just two additional cuts in calendar year 2025, down from the four projected following the last update in September. Policymakers also revised year-end growth estimates up modestly, with a more substantive increase in inflation expectations than was anticipated, along with a modestly lower level of unemployment. Fed watchers felt the Chairman’s articulation of heightened inflation concerns like a “punch,” and not the kind found in a bowl.

MARKET INDEX RETURNS | December 2024 | YTD 2024 |

S&P 500 Index | -2.4% | 25.0% |

Russell 2000 Index | -8.3% | 11.5% |

MSCI EAFE Index | -2.3% | 3.8% |

Bloomberg US Agg. Bond Index | -1.6% | 1.3% |

FTSE 3 Mo. T-Bill Index | 0.4% | 5.4% |

Santa Claus Rally – the S&P 500 has historically had gains in the final trading days of a calendar year into the initial trading days of a new year (over 75% of the time since 1950)

STOCK MARKET REVIEW & OUTLOOK

Growth Stocks Were THE Hot Gift Investors Wanted This Year

Investor focus shifted back to the prevailing playbook for most of 2024 with the Communication Services, Information Technology and Consumer Discretionary sectors outperforming all others. All other sectors were in the red for the month, meaningfully paring back gains across the more cyclical, interest rate sensitive and defensive segments of the market achieved earlier in the year. For the calendar year, the S&P 500 Index closed with a stellar return of 25%, with all segments in the green, with the exception of a flat return for Materials. The previously mentioned growth sectors (Communication Services, Information Technology and Consumer Discretionary) were key to the exceptional gains. Financials were also strong performers with the shape of the yield curve beginning to normalize and expectations of a less onerous regulatory environment to come. Healthcare, Real Estate and Energy were among the laggards. Small Cap stocks (represented by the Russell 2000 Index) provided a lower, albeit respectable, return and allocations to international stocks detracted value in 2024.

The yield on the 10-Year U.S. Treasury rose meaningfully by 0.40% to 4.57% in December. The bellwether Treasury closed the year with a healthy positive spread of 0.32% over the 2-Year. As sentiment continued to shift away from fears of recession and attention increased on the potential inflationary impact of government policies (such as heightened trade tariffs), bond traders were sellers during the month, driving rates on intermediate maturities higher.

S&P 500 SECTOR RETURNS | December 2024 | YTD 2024 |

Communication Services | 3.6% | 40.2% |

Consumer Discretionary | 2.4% | 30.1% |

Consumer Staples | -5.0% | 14.9% |

Energy | -9.5% | 5.7% |

Financials | -5.5% | 30.5% |

Healthcare | -6.2% | 2.6% |

Industrials | -8.0% | 17.3% |

Information Technology | 1.2% | 36.6% |

Materials | -10.7% | 0.0% |

Utilities | -7.9% | 23.4% |

Real Estate | -8.6% | 5.2% |

ECONOMIC REVIEW & OUTLOOK

Personal Consumption Continued at a Reveler’s Pace

The final estimate for the third quarter of Gross Domestic Product (GDP) from the Bureau of Economic Analysis was revised upward in December to 3.1% from a previous reading of 2.8%. Personal consumption expenditures were a key driver of the uptick, increasing by 3.7% with durable goods (long-lasting manufactured goods (3 years or more) such as machinery, equipment, computers and appliances) a key area of strength. Retail shoppers did their part by spending on non-durable goods (essentials like food and clothing) as well, along with continued support of services industries.

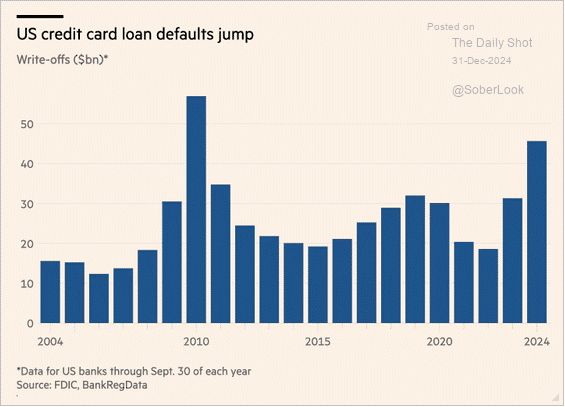

History has shown us that the economy is cyclical and will eventually slow and pull back from expansion to recession. The consumer will be key to how far down the road that scenario comes into focus. We are closely monitoring the overall increasing levels of credit card debt as a leading indicator of a decreasing supply of dry powder to sustain current levels of spending. As the chart below indicates, there are cracks forming in the proverbial ice with a sudden rise in defaults.

CHART OF THE MONTH

But… Credit Card Defaults Surged in 2024

Source: The Daily Shot, FDIC, BankRegData

Consumers are continuing to shift from spending down savings to increasingly taking on incremental credit card debt which has risen to a record high, exceeding $1.1 trillion in the U.S. As shown above, repayment delinquencies jumped meaningfully in 2024.

CLOSING STATEMENT

Looking Ahead

We expect corporate earnings, the foundation of equity valuations over time, to remain solid in the coming quarters. While this is supportive of a case for continued equity strength into 2025, we are also quite cognizant of how far and fast U.S. equities have run over the past two years, highly predicated on exuberant investor sentiment. Experienced investors are aware of the fact that sentiment, much like interest in the hottest, must-have, toy of the season, can be fickle. With that in mind, markets are overdue for a normal pullback (-5%) or correction (-10%), something we would be unsurprised to see in the months ahead.

The basis of a sound long-term investment strategy is to remain invested in risk assets through periods of volatility, rebalancing portfolios based upon strategic targets and ranges. Allocation adjustments should be based on changes in important factors such as time horizon or risk tolerance, and positioning adjustments based on tried-and-true fundamental research and analysis. At Plimoth, we pride ourselves on understanding each of our clients’ unique circumstances to actively manage portfolio exposures and liquidity to meet their dynamic needs and objectives.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As a reminder, we invite you to join the conversation on our social media pages – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com