In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Upcoming Fed Rate Announcement in September has the Potential to Outshine Engagement Announcement of one of America’s Favorite Pop Stars

When the next FOMC meeting concludes on September 17th, the announcement on rates, and subsequent press conference, could rival the “internet breaking” Swift-Kelce engagement announcement that recently garnered a record-breaking 30 million likes on Instagram within the first 24 hours of posting. While perhaps the frenzy won’t reach that extreme, it will be a highly important announcement in the minds of financial markets participants. A 0.25% cut to short-term rates is nearly fully priced in by futures markets at the time of this writing and it seems the Fed is highly likely to get off their hands and continue with the easing cycle started one year ago, before hitting the pause button thus far in calendar year 2025.

While the idea of “getting on the bus” is front of mind, please also take note of the colorful blue bus in the graphic of this newsletter. This bus is just one way in which BayCoast Bank (parent company of Plimoth Investment Advisors) supports the community through the support of youth education and fosters financial literacy with the mindset that education is the primary economic driver that transforms lives and communities for the better. The latest school supply campaign (Stuff the Bus!) in partnership with the R.I. State Police, Cardi’s Furniture, Ocean State Job Lot and WJAR Channel 10 was a huge success, allowing a strong and confident start to the new school year for many local students.

MARKET INDEX RETURNS | August 2025 | YTD 2025 |

S&P 500 Index | 2.0% | 10.8% |

Russell 2000 Index | 7.1% | 7.0% |

MSCI EAFE Index | 4.3% | 22.8% |

Bloomberg US Agg. Bond Index | 1.2% | 5.0% |

FTSE 3 Mo. T-Bill Index | 0.4% | 3.0% |

The 2025 Stuff the Bus! campaign led to over 2,000 supply-filled backpacks being distributed at 25 locations.

STOCK MARKET REVIEW & OUTLOOK

Investors Remain Confident Riding the Stock Market Bus

The S&P 500 continued its steady rise, breaching five new record highs in the month of August, driven by rock solid year-over-year corporate earnings growth and expectations that a Fed rate cut will be a boost to the economy. Other than a handful of days of rattling windows or sputtering exhaust during August, the market bus gave investors a comfortable ride, picking up momentum following dovish (rate cut friendly) comments made by Fed Chair Jerome Powell at the Jackson Hole Economic Symposium.

High-flying Information Technology stocks took a breather in the month, and (in a sharp reversal of leadership) Healthcare stocks provided the strongest returns. The revival of Healthcare and Consumer Discretionary shares shifted both sectors back into the green on a year-to-date basis, leaving all sectors of the large cap U.S. index in positive territory through August. Portfolio diversification into small cap U.S. equities and international stocks also added value during the month. U.S. Treasury yields pared back modestly in the month, with the bellwether 10-Year U.S. Treasury ending the period at 4.23%, 0.60% above the 2-Year.

S&P 500 SECTOR RETURNS | August 2025 | YTD 2025 |

Communication Services | 3.6% | 17.9% |

Consumer Discretionary | 3.4% | 2.0% |

Consumer Staples | 1.6% | 5.5% |

Energy | 3.6% | 7.5% |

Financials | 3.1% | 12.5% |

Healthcare | 5.4% | 0.8% |

Industrials | 0.0% | 16.1% |

Information Technology | 0.3% | 14.0% |

Materials | 5.8% | 11.6% |

Utilities | -1.6% | 13.0% |

Real Estate | 2.2% | 5.7% |

ECONOMIC REVIEW & OUTLOOK

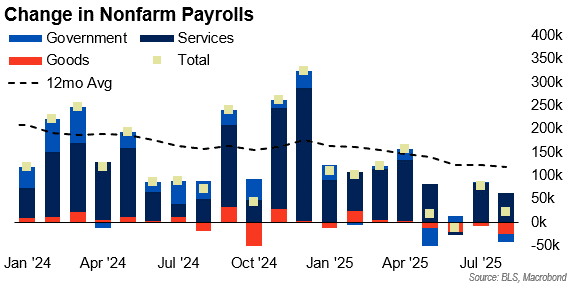

Employment Picture Got Another Flat Tire

The latest employment figures from the Bureau of Labor Statistics (BLS) were as gloomy as the last. 22k newly created jobs were reported for the month of August, well below expectations. Further revisions to the prior months led June’s report even lower to a now -13k and July only modestly higher to 79k. The June data point is now the first negative monthly jobs print since the December 2020 pandemic period. Beyond the halt of job creation during the pandemic, you would need to go back to the 2009 financial crisis period for a weaker comparison of job creation in a calendar year through August. The unemployment rate (measured from the separate household survey… see the August 2025 newsletter for a refresher on this survey distinction) was up a tick as well to 4.3%, the highest level since October 2021.

CHART OF THE MONTH

August Employment Report

Source: Bureau of Labor Statistics, Macrobond

CLOSING STATEMENT

Looking Ahead

The latest weakness in employment data supports our (squarely in the consensus camp) view that the Fed shouldn’t be able to justify sitting on their hands any longer and is likely to provide the rate cut anticipated for much of this year at their upcoming September 17th policy meeting. While U.S. equity market valuations continue to get stretched further beyond historical norms, investors may very well get an added dose of octane in their fuel tanks from the boost such monetary accommodation will afford the overall economy. The stock market bus may be overflowing with speculative bulls for the time being, but as history has shown us, expected bumps in the road experienced time and again will lead to a few speculator exits along the way, leaving the steadfast long-term prudent investor with room to keep their feet firmly planted on the floor on the ride to achieving their financial goals.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way. As always, we invite you to join the discussion on our social media pages – Facebook and LinkedIn.

And be sure to keep an eye out for the big blue BayCoast bus in your community as the mission of supporting local education and improving financial literacy rolls on.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com