In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

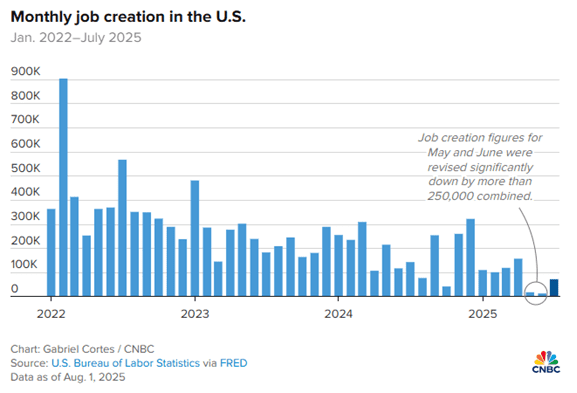

Help Wanted at Bureau of Labor Statistics

While the July jobs report surprised to the downside, with Nonfarm Payrolls reported at 73k when 104k was expected, the major shock of the report was the dramatic revision of the prior two month’s reported readings. A remarkable 258k jobs reported over the prior two months were removed from the revised data set, showing particularly weak employment growth of only 19k in May and 14k in June. The report fallout rocked the markets as it painted a particularly cautious view of companies with respect to workforce needs as they navigate trade tariff uncertainties.

The restatement of the prior reports was serious enough to cost Dr. Erika McEntarfer, Commissioner of the Bureau of Labor Statistics (BLS), her job. The Commissioner had been appointed to a 4-year term beginning in 2024 by President Biden (with bipartisan support from 86 senators, including then-Senator JD Vance.) She was fired in a particularly public manner by President Trump shortly after the data release. Many first learned of the news from social media posts by the President, accusing McEntarfer of “rigging” the data for political purposes, indicating that she would be “replaced with someone much more competent and qualified.” A decision on new leadership will be critical for the BLS, an organization dealing with Congressional budget cuts and struggling to collect sufficient survey data from households, businesses and government agencies citing resource constraints, most notably in July, with a report of nearly 20% of inflation data unable to be collected.

MARKET INDEX RETURNS | July 2025 | YTD 2025 |

S&P 500 Index | 2.2% | 8.6% |

Russell 2000 Index | 1.7% | -0.1% |

MSCI EAFE Index | -1.4% | 17.8% |

Bloomberg US Agg. Bond Index | -0.3% | 3.7% |

FTSE 3 Mo. T-Bill Index | 0.4% | 2.6% |

Finding a suitably qualified replacement for BLS Commissioner will be a tall order in a highly scrutinized role requiring political independence to maintain data integrity.

STOCK MARKET REVIEW & OUTLOOK

The New Record Stock Market Highs Continued to Quietly Roll in During July

U.S. equities continued to rise into record territory in July, advancing for a third straight month and leaving the near miss of a bear market pullback earlier in the year a distant memory in investors’ minds. Market volatility remained relatively low, without any major daily swings in either direction for the S&P 500. The widely followed index advanced by over 2% for the month, led once again by the information technology sector with some rock-solid earnings reports from mega-cap tech companies. Other growth segments of the market (Consumer Discretionary and Communication Services) followed suit, but the cyclically-oriented Industrials sector was also a strong contributor, as were Utilities stocks tied to electricity demand, as capital expenditures on AI data center expansion took center stage in the latest quarter earnings calls. International equities pulled back modestly during the month but continue to meaningfully outpace the U.S. thus far in 2025.

The Federal Open Market Committee (FOMC) held rates steady in their July meeting as was widely anticipated, although with a highly unusual dissention from two voting members of the Fed Governors (for the first time in over 30 years). The 10-Year U.S. Treasury yield ended the month at 4.37%, 0.14% higher from where it started and a 0.41% spread over the 2-Year.

S&P 500 SECTOR RETURNS | July 2025 | YTD 2025 |

Communication Services | 2.4% | 13.8% |

Consumer Discretionary | 2.6% | -1.3% |

Consumer Staples | -2.4% | 3.9% |

Energy | 2.9% | 3.7% |

Financials | 0.0% | 9.1% |

Healthcare | -3.3% | -4.3% |

Industrials | 3.0% | 16.1% |

Information Technology | 5.2% | 13.7% |

Materials | -0.4% | 5.6% |

Utilities | 4.9% | 14.8% |

Real Estate | -0.1% | 3.4% |

ECONOMIC REVIEW & OUTLOOK

Unemployment Outlook may be well Served to Keep an Umbrella Handy

In addition to the falloff in previously reported jobs from the BLS Current Employment Statistics (CES) survey (known as the “establishment” survey, collected from payroll records from companies and government agencies), the unemployment rate, as measured by an entirely different survey of households, took a tick in the wrong direction as well. Unemployment data is reported from the Current Population Survey (CPS) which is compiled through an interview process conducted with approximately 60,000 eligible households, hence its typical shorthand moniker as the “household” survey. The latest data showed that unemployment ticked up to 4.2% from the 4.1% level reported in June.

CHART OF THE MONTH

Revisions to Nonfarm Payrolls Show Job Creation Falling Below Long-term Averages

CLOSING STATEMENT

Looking Ahead

The “fluid” situation with global trade policy and tariffs are once again weighing on investor sentiment with the August 1st deadline now passed and negotiations still ongoing. Corporate profits, however, continue to exceed expectations, now standing at double the initial estimates for the second quarter at north of 10% year-on-year growth, with well over half of S&P 500 companies having reported. Economic data relating to inflation and employment, key inputs to the Fed’s monetary policy calculus, will be top of mind for investors and Fed watchers in the coming months. Should the rate cut (a can that has been kicked down the road thus far in 2025) be realized in September when the FOMC next meets, it would be an additional positive catalyst for economic growth. With the right messaging from Chairman Powell (avoiding any alarmist commentary, particularly with respect to changing views on the health of the labor market), the cut should further bolster investor optimism. Another of Bob Uecker’s famous quotes, “don’t worry, nobody’s listening anyway,” most certainly won’t apply in the post Fed meeting presser.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As always, we invite you to join the conversation on our social media pages – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com