In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Investors Profited by Sticking Around in May

Investors elected to look through the global trade talk malaise in May, not letting on-again, off-again tariff threats against major trading partners (China) and individual companies (read Apple) cloud their long-term investment outlook for U.S. stocks. Any speculators that followed the catchy rhyming market adage, “sell in May and go away”, were left with a high degree of seller’s remorse by month’s end. The S&P 500 just posted the best return in the month of May since 1990 (back when Jessica Tandy won for Best Actress in Driving Miss Daisy) and best monthly return since November 2023.

MARKET INDEX RETURNS | May 2025 | YTD 2025 |

S&P 500 Index | 6.3% | 1.1% |

Russell 2000 Index | 5.3% | -6.9% |

MSCI EAFE Index | 4.6% | 16.9% |

Bloomberg US Agg. Bond Index | -0.7% | 2.4% |

FTSE 3 Mo. T-Bill Index | 0.4% | 1.8% |

Holding through May is the long-term prudent investor’s way (perhaps a more appropriate stock market expression that will one day catch on)

STOCK MARKET REVIEW & OUTLOOK

And the Award for Best Performance in the Month of May goes to… U.S. Growth Stocks

U.S. equities roared back after three consecutive months of declines to nudge the S&P 500 Index back into the green in 2025. Growth stocks led the gains with Information Technology, Communication Services and Consumer Discretionary sectors posting stellar returns. A return of exuberance for all things artificial intelligence related led to a formidable 9.6% surge in the technology-focused Nasdaq Composite. Healthcare stocks were the sole declining sector in the month as headlines involving a tighter regulatory environment and the possibility of government-imposed drug price ceilings gave investors pause. International stocks provided another strong month of returns, trailing U.S. markets in May, but maintaining substantial gains over the U.S. nearly halfway through the calendar year.

Moody’s was the third (and final) rating agency, after Standard & Poor’s and Fitch, to pull the triple-A rating from U.S. debt, causing a decrease in existing debt demand and rise in yields. The 10-Year U.S. Treasury closed the month at 4.40%, 0.24% higher than where it started. As expected, the Federal Open Market Committee held short-term rates steady at its May meeting.

S&P 500 SECTOR RETURNS | May 2025 | YTD 2025 |

Communication Services | 9.6% | 3.6% |

Consumer Discretionary | 9.4% | -6.0% |

Consumer Staples | 1.8% | 8.5% |

Energy | 1.0% | -3.9% |

Financials | 4.4% | 5.8% |

Healthcare | -5.5% | -3.1% |

Industrials | 8.8% | 8.8% |

Information Technology | 10.9% | -1.6% |

Materials | 3.0% | 3.6% |

Utilities | 3.8% | 9.1% |

Real Estate | 1.0% | 3.4% |

ECONOMIC REVIEW & OUTLOOK

Inflation Stayed Out of the Spotlight Last Month

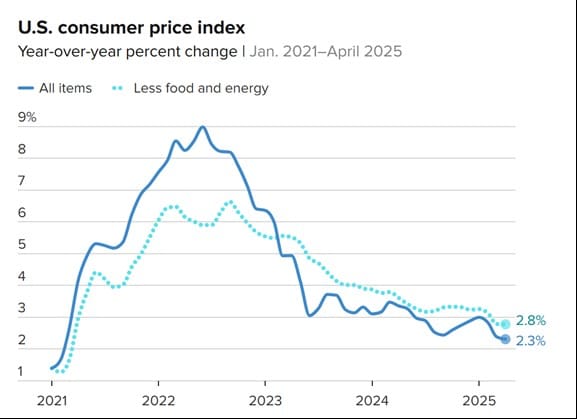

Inflation kept calm and carried on in May. The latest reading of the Consumer Price Index (CPI) was lower than anticipated at 2.3% on a year-on-year basis. This is the lowest annualized reading in over four years. The Core reading (excluding volatile food and energy) held steady at 2.8%. The usual suspects (shelter, medical costs and auto insurance) went stubbornly higher, but a welcomed reprieve came from a pullback in gasoline and (much bandied about) egg prices. Producer Prices (PPI) and the Fed’s preferred inflation gauge, Personal Consumption Expenditures (PCE), were equally benign. While Federal Reserve officials may find the data palatable, they may also view it as merely a calm before a potential tariff-induced storm that is on hold for the time being.

CHART OF THE MONTH

U.S. Consumer Price Index

January 2021 – April 2025

Source: U.S. Bureau of Labor Statistics, CNBC

CLOSING STATEMENT

Looking Ahead

Quite remarkably, the S&P 500 Index is now back within striking distance of the all-time high achieved in February. Nearly all companies in the S&P 500 have reported first quarter earnings with year-over-year growth exceeding 13%, led by the mega-cap technology behemoths. Analysts were caught somewhat off guard by the earnings surge as the “Magnificent Seven” stocks exceeded analysts’ estimates by 15% (with actual earnings growth of an eye-popping 28%). The upside surprise of the remaining 493 stocks in the index was roughly half that level, showing that analysts have been premature in curbing their enthusiasm for tech earnings.

Federal Reserve Chairman Powell was recently summoned to his first ever meeting with President Trump, one of his most vocal critics. Despite the equivalent of being called into the principal’s office, we expect him to continue to express Federal Open Market Committee (FOMC) independence as they continue to watch and wait for additional clarity on the state of the economy. How eventual global trade policies will factor into inflation and employment remain critical factors to be better understood. We are fully anticipating another hold on rate policy in the upcoming June meeting.

Theatrics regarding the latest tax and spending bill in Washington will continue to capture headlines and garner clicks. Now former Washington Department of Government Efficiency (DOGE) insider, Elon Musk, has entered the fray in stark opposition to the President’s budget bill with some mighty strong words of disagreement. Added spending runs contrary to DOGE efforts along with policies with the potential to be a headwind to profit margins of the companies he will return his focus to. When multi-billionaires publicly rain on each other’s parades, more sensational headlines are sure to follow.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As always, please feel free to join the conversation on our socials – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com