In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The State of Financial Markets was Nothing if not Extremely “Interesting” in April

The idea of importing anything from China right now is as unpopular as newly imposed checked bag fees on Southwest Airlines (beginning this month), but the appropriateness of this quote is perhaps worth the potential tax levy. Following the ebbs and flows of financial markets is never boring, but there are times, such as the past month, that are simply more “interesting” than others.

Uncertainty creates volatility, and that, in a proverbial nutshell, sums up the state of financial markets in April. For well experienced investors, it is understandable to think that over the past several decades we have seen it all. Cue the past month to turn that thought on in its head. Even the most experienced of us have been taken aback by the magnitude of recent market swings, driven by single social media posts, sound bites, rumor and speculation. In addition to overall market movements, individual stocks have been regularly whipsawed with extraordinary changes in market capitalization that are wildly disconnected from the enterprise value of the underlying companies the flashing red and green prices on our screens are designed to represent. Companies that seemed to meet expectations in their earnings reports were punished or rewarded (based on the parsing of a word or two in guidance statements) with double-digit percentage stock price movements in single trading sessions with a regularity that surpassed even the most volatile periods over the past decades.

MARKET INDEX RETURNS | April 2025 | YTD 2025 |

S&P 500 Index | -0.7% | -4.9% |

Russell 2000 Index | -2.3% | -11.6% |

MSCI EAFE Index | 4.6% | 11.8% |

Bloomberg US Agg. Bond Index | 0.4% | 3.2% |

FTSE 3 Mo. T-Bill Index | 0.4% | 1.5% |

“May you live in interesting times” was widely popularized after being used in a speech by Robert F. Kennedy in 1966

STOCK MARKET REVIEW & OUTLOOK

The Power of Diversification Paid Dividends in April

U.S. equities clawed their way back from steep losses during the month to close April with a modest decline of less than one percent. The market volatility index (VIX) spiked to north of 50 during the period, well beyond the long-term historical average of 20 Energy stocks reversed course, giving up sizable outperformance from the prior month and erasing year-to-date gains (and then some) as the worst performing sector in April. Energy is one of only two sectors (along with Materials) reporting negative sales growth from just over 50% of companies that have reported thus far in the first quarter earnings season. Oil prices plummeted during the month based on Organization of the Petroleum Exporting Countries (OPEC) production increases and exacerbated by heated China trade relations which proved to be major headwinds. Traditionally defensive segments of the market (Consumer Staples, Utilities and Healthcare) have provided U.S. investors with the most favorable returns thus far this year.

Equities outside of the U.S. provided needed diversification, generating welcomed positive returns in April. International stocks have outperformed their U.S. counterparts in every month thus far in 2025. Higher risk small cap U.S. stocks have lagged the large cap index. The yield on the bellwether 10-Year U.S. Treasury closed higher by a modest 8 basis points in the month to 4.29% after trading in a range of 4.01-4.49%.

S&P 500 SECTOR RETURNS | April 2025 | YTD 2025 |

Communication Services | 0.7% | -5.5% |

Consumer Discretionary | -0.3% | -14.1% |

Consumer Staples | 1.2% | 6.5% |

Energy | -13.6% | -4.8% |

Financials | -2.1% | 1.3% |

Healthcare | -3.7% | 2.6% |

Industrials | 0.2% | 0.0% |

Information Technology | 1.6% | -11.2% |

Materials | -2.2% | 0.6% |

Utilities | 0.1% | 5.0% |

Real Estate | -1.2% | 2.3% |

ECONOMIC REVIEW & OUTLOOK

Get Your Pre-tariff Imports While They’re Hot

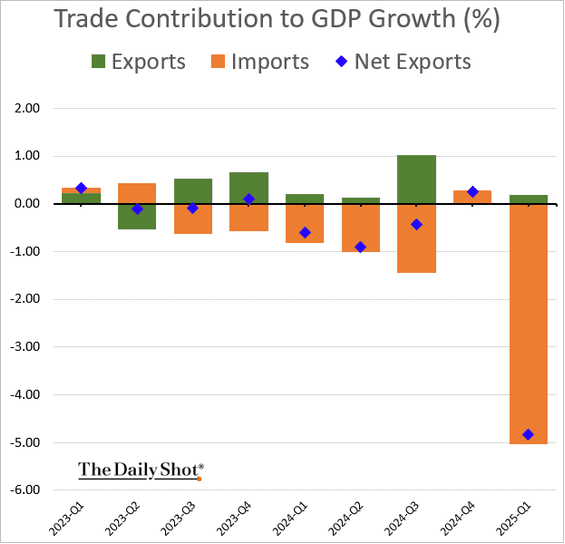

The -0.3% report of Gross Domestic Product (GDP) for the first quarter of the year was pulled down by a steep decline in net exports. The number of imports (a negative contributor to GDP) advanced by over 40%, the largest in five years, and is estimated to have detracted a remarkably large 5.0% from the latest reading. The rapid pick up in imports comes from companies desperately trying to front run subsequent tariff levies. Without this impact, growth would have remained on track at a pace above its long-term average.

Growth in business investment (the strongest since the second quarter of 2023), consumer spending (despite reports of low levels of consumer confidence and sentiment) and inventories were all positive contributors to the report. Spending accelerated in advance of steeper anticipated price impacts from tariffs expected to return to an oversized sandwich board at a rose garden press conference in Washington soon. Government spending was a modest detractor as it posted the first pullback since the second quarter of 2022 at the hand of the DOGE chainsaw.

CHART OF THE MONTH

Contribution of Net Imports to GDP

Source: The Daily Shot

The impact of tariff-front-running imports had a much higher than usual impact on the latest result of the Bureau of Economic Analysis GDP report.

CLOSING STATEMENT

Looking Ahead

The global trade situation continues to be extremely fluid with China starting to show some willingness to budge while the rest of the world enjoys a short-term reprieve from the bombshell tariffs announced by President Trump on April 2nd with a “Liberation Day” tag aimed to rival the ubiquitous “Made in China” tags prevalent in the U.S. The word “tariffs” was mentioned nearly 1,000 times (thank you AI-powered transcript review programs) on the S&P 500 companies’ first quarter earnings calls thus far on a markedly higher pace than the previous quarter.

We will be keeping a close eye on these developments along with Fed commentary following their May 7th meeting, including from Jerome Powell. The Fed Chairman spent a good amount of time in the President’s crosshairs last month before getting a modest reprieve of his own, with some more sanguine comments about the debate over who controls his near-term job security.

We expect no boring days in the weeks ahead, which are rare in the financial world even in the best of times. We are expecting the trend of particularly “interesting” days to be prevalent for quite some time. Our team welcomes any and all discussions that you, our trusted clients, would find helpful along the way. As always, please feel free to join the conversation on our socials – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com