In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

What is a Tariff and Why do they Matter?

It is hard to pick up (click on) any publication lately without a major headline on tariffs. We know that a tariff is a tax on imported goods, but there are nuances and implications for trade and commerce that are causing some concern for investors. In its simplest form, a tariff is a tax levied on goods imported from other countries that is paid by companies receiving those goods to the U.S. government. For those with a penchant for the details of how tariffs may impact the economy and consumers, please refer to the special addendum at the conclusion of this newsletter.

MARKET INDEX RETURNS | January 2025 | YTD 2025 |

S&P 500 Index | 2.8% | 2.8% |

Russell 2000 Index | 2.6% | 2.6% |

MSCI EAFE Index | 5.3% | 5.3% |

Bloomberg US Agg. Bond Index | 0.5% | 0.5% |

FTSE 3 Mo. T-Bill Index | 0.4% | 0.4% |

To delve more into the topic of the impact of trade tariffs on various industries, companies and your investment portfolio, contact one of your Plimoth account officers and join the conversation.

STOCK MARKET REVIEW & OUTLOOK

Markets had a Change in Leadership but Continued to March Forward

Financial markets climbed in the first month of the year, but the results were about as far away from the “same old same old” as they could get. The previously high-flying technology sector was the only one in the red during the period. Chinese startup company DeepSeek sent shock waves through the Artificial Intelligence (AI) stratosphere by become the number one downloaded app in the U.S. The shift had U.S. investors on their heels for fear of China catching up in the AI adoption race. The company’s claim to have found a cheaper and more efficient path toward generating generic language and reasoning models (novel advancements in open-source AI) sent mega cap industry darling Nvidia (with concerns about a potential shift in demand away from their highly expensive graphic processing units or GPUs) and other associated semiconductor supply chain companies plummeting on the report. Nvidia stock tumbled 17% in a single trading session, losing nearly $600 billion in market cap, the largest for an individual company at any time in U.S. stock market history. While the tumult was short-lived, the sector was still in negative territory at month’s end.

While the AI concerns weighed heavily on the Information Technology sector, its usual close running mate, the Communication Services sector, bucked the trend and was far and away the best performer during the month, up over 9%. An interesting dichotomy of other sectors was particularly strong in January, including (typically defensive) Healthcare, (interest rate sensitive) Financials and (cyclicals) Materials and Industrials. In another meaningful change in leadership, the sleepy international equity markets meaningfully outperformed their U.S. counterparts.

The yield on the 10-Year U.S. Treasury pulled back modestly in the month, closing at 4.54%, with a spread over the 2-Year of 30 basis points. In the tried-and-true analogy of bond prices and yields enjoying a sunny day seesaw ride with each other (“inversely correlated” for the more technically oriented) a decrease in yields led to a rise in bond prices generating a positive total return to start off the new year.

S&P 500 SECTOR RETURNS | January 2025 | YTD 2025 |

Communication Services | 9.1% | 9.1% |

Consumer Discretionary | 4.4% | 4.4% |

Consumer Staples | 2.0% | 2.0% |

Energy | 2.1% | 2.1% |

Financials | 6.5% | 6.5% |

Healthcare | 6.8% | 6.8% |

Industrials | 5.0% | 5.0% |

Information Technology | -2.9% | -2.9% |

Materials | 5.6% | 5.6% |

Utilities | 2.9% | 2.9% |

Real Estate | 1.8% | 1.8% |

ECONOMIC REVIEW & OUTLOOK

The Superbowl of all Economic Data – Calendar Year End GDP

Real Gross Domestic Product (GDP) grew by 2.3% on an annualized basis in the fourth quarter, led by robust personal consumption. The 4.2% rise in consumer spending included a 12% increase in the purchase of durable goods, the highest since the first quarter of 2023. The overall reading was modestly below expectations with headwinds coming from trade and inventories. Inventory levels are historically volatile and the drawdown in the latest quarter is likely to be reversed in the coming quarters as businesses recalibrate to consumer demand. The report estimates full calendar year growth for 2024 at a very respectable 2.8% and indicates an economy entering the new year on solid footing.

CHART OF THE MONTH

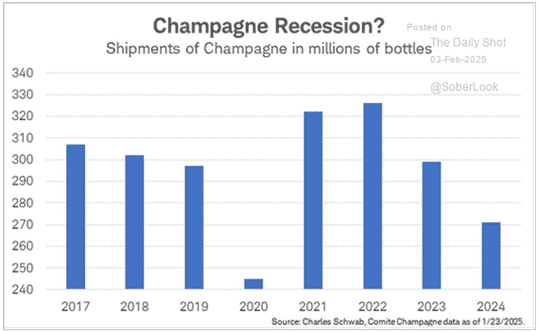

A Consumption Shift from Discretionary Items to Staples is Playing Out

Source: The Daily Shot

Despite a blowout report of personal consumption expenditures growth in the latest GDP estimate, it appears champagne consumption has meaningfully pulled back. While investors had lots of good news to celebrate last year, a shift in consumption from discretionary items to more staples items is an underlying story in the data. Hence the remarkable results at Wal Mart last year, driving the stock a whopping 74% higher in 2024, a name perhaps overlooked by some in a market dominated by high flying technology and internet stocks.

CLOSING STATEMENT

Looking Ahead

There is certainly no shortage of information to sort through and digest in the coming months to hold investors’ attention. Fourth quarter corporate earnings season is in full swing with companies continuing to report impressive profits. Fed watchers will be looking for clues about what to expect at the next FOMC meeting in March. Chairman Powell has all but ruled out a rate decision by stating that a cut in March is not their base case assumption but expect the usual litany of Fed Governors making headline catching comments in the meantime. The current tariff dance between the U.S. with Canada, Mexico and China will be sure to have plenty of headlines and copy space as well.

As a final thought, much like the June 2007 finale of the wildly successful television show The Sopranos, which closed out with this Journey smash hit, Don’t Stop Believing in the journey of the stock market over time. An investment in the S&P 500 made on the trading day following that airing (despite being made shortly before the great financial crisis) would have compounded at 10.3% annually, a 465% cumulative return on investment.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As a reminder, we invite you to join the conversation on our social media pages – Facebook and LinkedIn!

Addendum: Tariffs and the Economy

For those who like to trample a little further into the weeds like us.

In its simplest form, a tariff is a tax levied on goods imported from other countries that is paid by companies receiving those goods to the U.S. government. While the tax becomes a source of revenue for the government, (all or some of) the costs are subsequently passed on to the consumer making purchases from those companies. Higher prices (inflation) are the near-term downside with tariffs, which is what all the media buzz is about.

The President is using executive powers to enact (or merely threaten) trade tariffs, allowing a bypass of the usual Congressional process, based on the flow of illicit drugs into the country. Employing tariffs is a form of protectionism, with the idea of protecting U.S. manufacturing and jobs, which comes at a cost as the taxes are paid by those within the country. For tariffs to have their intended effect, consumption patterns need to change and demand needs to shift away from these (now) higher priced goods. A drawback of this plan, however, is that profit-hungry companies providing substitutes for these products become incentivized to raise prices as well, figuring as long as the alternative is modestly cheaper than the “tariffed” option, companies (and ultimately consumers) will pony up for their now higher priced goods. It is only when prices reach a level that consumers are no longer willing to pay that the inflationary pressures subside.

The threat of heightened tariffs against countries that have them in place on U.S. exported products has proven to be an effective negotiating tool, but the practice comes with economic risk. The most serious downside of trade tariffs is when retaliatory measures between countries lead to a trade war. In that case, there are no winners as consumers and companies on both sides of the equation struggle with higher prices.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com