In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Prudent Investors Run in Market Marathons

A sixth consecutive month of gains in the S&P 500 Index were derailed by a selloff in the final trading session of the month on October 31st. The fright was short-lived, but sufficient to temporarily break the stellar bull run of five consecutive months of gains and push the bellwether U.S. equity proxy modestly into the red for the month. Much like the beautiful deciduous trees in New England that change their colors and drop their leaves over time, markets move through cycles and “fall back” periodically, certainly not just during daylight savings time. Despite its recent sprint, markets will continually be more akin to a marathon in which bulls and bears regularly battle it out, with bulls having far more medals stored in their collections.

MARKET INDEX RETURNS | October 2024 | YTD 2024 |

S&P 500 Index | -0.9% | 21.0% |

Russell 2000 Index | -1.4% | 9.6% |

MSCI EAFE Index | -5.4% | 6.8% |

Bloomberg US Agg. Bond Index | -2.5% | 1.9% |

FTSE 3 Mo. T-Bill Index | 0.4% | 4.6% |

“Life is a marathon, not a sprint” is a well-known quote credited to Phillip C. McGraw (Dr. Phil) in addition to one of his lesser-known “Phil-isms,” “No matter how flat you make a pancake, it’s still got two sides.”

STOCK MARKET REVIEW & OUTLOOK

Investors Have Had Ample Market Treats

Throughout the Year to Absorb a Day of Tricks

The S&P 500 declined by a modest 0.9% in October, a brief reprieve in a strong run of five consecutive calendar months of gains. The index still stands more than 20% higher than at the start of the year despite the pause. Most sectors shared in the pullback with Healthcare the weakest. Financials, Communication Services, and Energy were spared in the short-lived pullback and finished in the green. Non-U.S. stocks fared worse during the month and small cap stocks underperformed large for a third straight month.

The yield on the 10-Year U.S. Treasury rose substantially by 50 basis points in October to 4.29%. The 2-Year was equally strong, ending the final trading session at 4.19%, maintaining some positive slope in that important segment of the yield curve. Bond market volatility increased as the fall in U.S. Treasury prices (inversely correlated to yields) was the largest since September 2022.

S&P 500 SECTOR RETURNS | October 2024 | YTD 2024 |

Communication Services | 1.9% | 31.3% |

Consumer Discretionary | -1.5% | 12.1% |

Consumer Staples | -2.8% | 15.4% |

Energy | 0.8% | 9.2% |

Financials | 2.7% | 25.2% |

Healthcare | -4.6% | 9.1% |

Industrials | -1.3% | 18.6% |

Information Technology | -1.0% | 29.0% |

Materials | -3.5% | 10.2% |

Utilities | -1.0% | 29.3% |

Real Estate | -3.3% | 10.6% |

ECONOMIC REVIEW & OUTLOOK

Consumer Spending was Robust in the Latest Report, Even Before Factoring in Eye Popping Estimates of Purchases of Halloween Candy

The first estimate of Gross Domestic Product (GDP) in the U.S. was a healthy annualized gain of 2.8% in the third quarter. This follows a strong second-quarter reading of 3.0% and remains ahead of the Fed’s long-term forecast of 1.8%. Consumer spending continued to be a key driver, increasing 3.7%, the strongest reading since the first quarter of 2023. Consumption of durable goods was a key element, outpacing services spending for the first time in over a year. Government expenditures were the second largest contributor and sufficiently offset slower growth in residential investment in housing. The whopping estimated $3.5 billion spent on Halloween candy by U.S. consumers won’t be part of the data mix until next quarter.

CHART OF THE MONTH

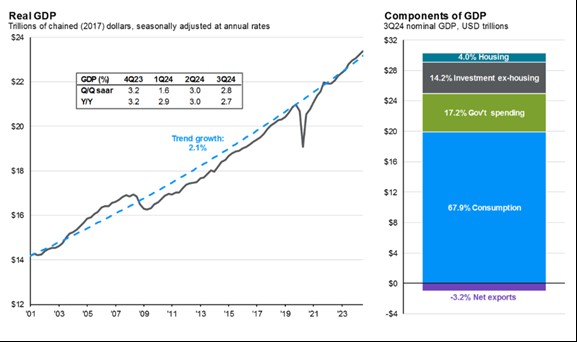

Economic Growth and the Composition of GDP

Source: J.P. Morgan Guide to the Markets

The amount of goods and services produced in the United States (GDP) continues to grow at a healthy pace, in line with long-term historical averages.

CLOSING STATEMENT

Looking Ahead

At the time of this writing, election uncertainty is now in the rearview mirror as Donald Trump became only the second U.S. President in history to be reelected in a non-consecutive term. The Federal Open Market Committee has followed through on its commitment to ease economic conditions by cutting short-term interest rates by an incremental 25 basis points. Corporate earnings have continued to be robust with over 70% of companies having now reported third quarter results, the index is on its way to posting a fifth consecutive quarter of year-over-year growth. Despite ongoing geopolitical risks as prevalent as ever, market volatility continues to hold at levels below long-term historical averages.

These are among the many considerations we will have in mind as we continue to make investment decisions on behalf of our clients. As always, we’ll be looking at every possible angle of each data point used to assess a company’s intrinsic value, not limiting our view to the number of sides of a pancake as Dr. Phil would say. Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

As a reminder, we invite you to join the conversation on our social media pages – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com