Time in the Market, Not Timing the Market

Want to gain valuable insights on investing for the future? Hoping to learn more about estate planning and trusts? The experts at Plimoth Investment Advisors are here to help you. Let’s watch as Plimoth’s trusted team members offer key information during the 2024 Economic Breakfast Event, held on June 18th.

“The Darkest Hour is Just Before Dawn” English Theologian, Thomas Fuller

Investing in risk assets, like common stock, has historically been a profitable, albeit bumpy, pursuit. There are numerous memorable days in every investor’s lifetime ranging from the good (sometimes great), to the bad (occasionally ugly.) Interestingly, such extremes have tended to happen within close proximity of each other, in our indelible memories and confirmed by the calendar. The best 10 days of stock market returns over the past 20 years have happened in the gloomiest of periods following big declines, specifically the 2008 financial crisis and 2020 pandemic lockdowns. In fact, 78% of the stock market’s best days have occurred during a bear market, or first two months of a new bull market, times when investor confidence can be up against the proverbial ropes.

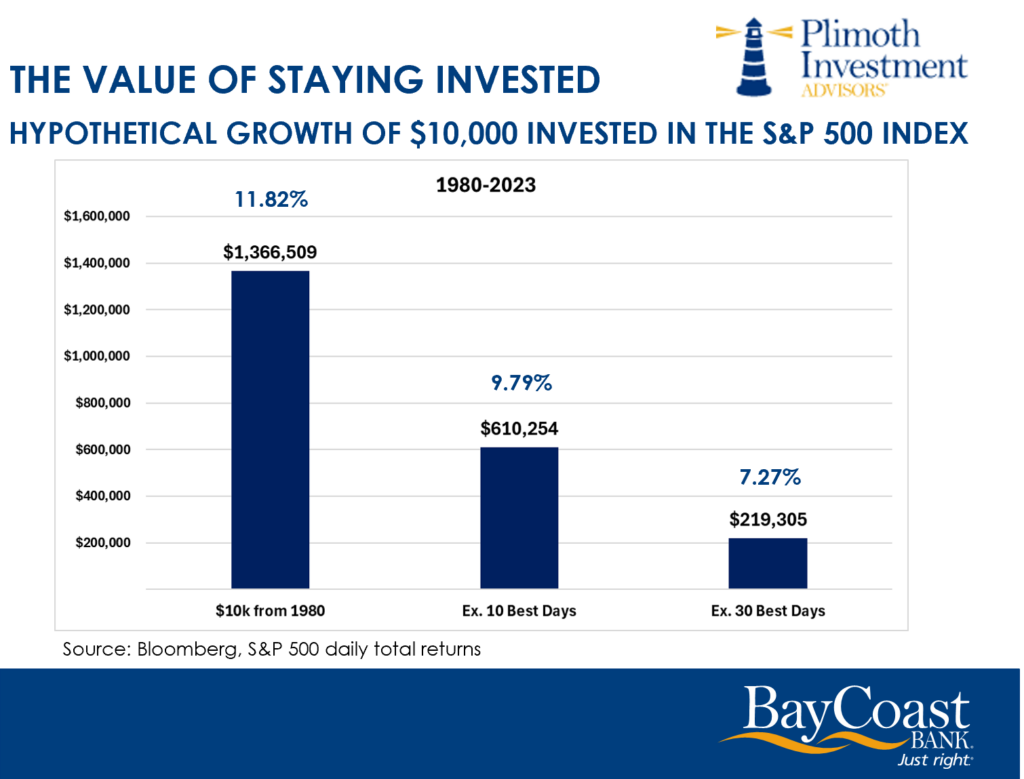

Remaining invested to capture the stellar returns of those shining star days is critical to the historical compounding of capital at an attractive rate of return. Without them, portfolio results are mediocre at best. Patient investors willing to invest through full market cycles have historically been rewarded with favorable outcomes.

“The two most powerful warriors are patience and time.” Leo Tolstoy, War and Peace

Over the past 40 years, remaining steadfastly invested in the market has rewarded investors with an attractive double digit annualized rate of return. Missing only the best 10 days (during the entire four-decade period) cuts that result more than in half. As the number of stellar days missed increases, the further those annualized returns plunge into mediocrity. A prudent long-term investment strategy employs healthy doses of both patience and time.