In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

“A Smooth Sea Never Made for a Skilled Sailor” Franklin D. Roosevelt

In his much-anticipated keynote speech at the Jackson Hole Economic Symposium, Jerome Powell sent the clearest, and most directly worded, message yet that the “time has come” for a policy shift. He indicated that the “direction of travel” is clear, referring to key data points associated with the Fed’s dual mandate of maximum employment and price stability. Powell also took a stab at some self-deprecating economic humor in his remarks, stating that “the good ship Transitory was a crowded one.” This was in reference to the Fed’s recurring refrain on why spiking inflation was not initially viewed as a worry in the post-pandemic economy before they ultimately enacted a series of rapid rate increases to control it. He drew some chuckles from the crowd when he quipped “I think I see some former shipmates out there today.” We must give credit to the Chairman, as we know full well how difficult it is to elicit a smile from an audience, let alone a chuckle, when presenting an economic update.

Key inflation measures have continued to cool toward the Fed’s long-term target of 2%, in conjunction with an employment environment that is “no longer overheated” (according to Powell.) These factors set the stage for a cut in short-term interest rates, something economists and investors have been anticipating since the Fed put a pause on their rapid rate tightening cycle nearly one year ago.

|

MARKET INDEX RETURNS |

August 2024 |

YTD 2024 |

|

S&P 500 Index |

2.4% |

19.5% |

|

Russell 2000 Index |

-1.5% |

10.4% |

|

MSCI EAFE Index |

3.3% |

12.0% |

|

Bloomberg US Agg. Bond Index |

1.4% |

3.1% |

|

FTSE 3 Mo. T-Bill Index |

0.5% |

3.7% |

“The good ship transitory was a crowded one.” Chairman Jerome Powell

STOCK MARKET REVIEW & OUTLOOK

Blink and You Missed the Extreme Spike in Volatility in August

The S&P 500 rewarded investors with another month of positive returns in August. In an anticipated (admittedly for quite a while, but finally gaining some traction) shift in market leadership, the positive returns were driven primarily by defensive sectors of the index (Consumer Staples, Healthcare and Utilities), along with more rate sensitive cyclicals (Real Estate and Financials.) We view the more reasonable monthly return in August in a more favorable light than some of the high-flying monthly returns earned earlier in the year that were narrowly driven by the largest mega-cap technology stocks. The fact that the equal weighted S&P 500 return outperformed the “Magnificent Seven” technology stocks during the month is a positive sign. This increased breadth of returns makes for a more sustainable positive trajectory for the stock market over time.

Also noteworthy from the period is that the positive return in the S&P masks a volatile month in which the VIX Volatility Index briefly spiked to 65, the third highest level on record, after comfortably leveling below the long-term average of 20 all year. A global panic relating to an unwinding of the Yen carry trade sparked the short-lived stock sell off early in the month. (Please visit our website to read the August 9th Weekly Market Commentary or access August 12th audio clips on LinkedIn or Facebook for more on the carry trade unwind.)

The yield on the 10-Year U.S. Treasury decreased by 12 basis points during the month, closing at 3.90%. The 2-Year yield declined further by 34 basis points to 3.92%. Cheers to a “bull steepening” shift in the yield curve (a positive sign for the economy) with the pumpkin spiced beverage of your choice.

|

S&P 500 SECTOR RETURNS |

August 2024 |

YTD 2024 |

|

Communication Services |

1.2% |

23.1% |

|

Consumer Discretionary |

-1.0% |

6.4% |

|

Consumer Staples |

5.9% |

17.7% |

|

Energy |

-1.7% |

11.3% |

|

Financials |

4.5% |

22.6% |

|

Healthcare |

5.1% |

16.3% |

|

Industrials |

2.9% |

16.3% |

|

Information Technology |

1.3% |

27.1% |

|

Materials |

2.4% |

11.2% |

|

Utilities |

4.9% |

22.5% |

|

Real Estate |

5.8% |

10.6% |

ECONOMIC REVIEW & OUTLOOK

“Conversation About the Weather is the Last Refuge of the Unimaginative”

-Oscar Wilde

Inflation “cooling”… employment “no longer overheating”… perhaps Oscar Wilde was on to something in this epigram about how unimaginative economic analogies can be. Be that as it may, there are clear signs that inflation has retreated and the employment picture is not as strong as it was when an Unemployment reading with a 3 handle became the norm once again in the first quarter of 2022, as it had been before the pandemic. The Unemployment rate has trended up to 4.2% in the latest reading. Similarly, the latest Job Openings and Labor Turnover Survey (JOLTS) showed that the number of job openings declined to their lowest level since December 2021. The number of new jobs, as measured by the monthly Nonfarm Payrolls Report, has been coming in weaker than forecasted and there have been a series of negative revisions to the data, while the most recent ADP private employment report showed the lowest monthly gain since August 2021. Weekly Initial Jobless Claims have been slowly trending upward as well. With inflation seemingly off the hot seat, the Fed’s view on (insert your favorite weather-related metaphor) employment is now front and center for rate forecasters.

CHART OF THE MONTH

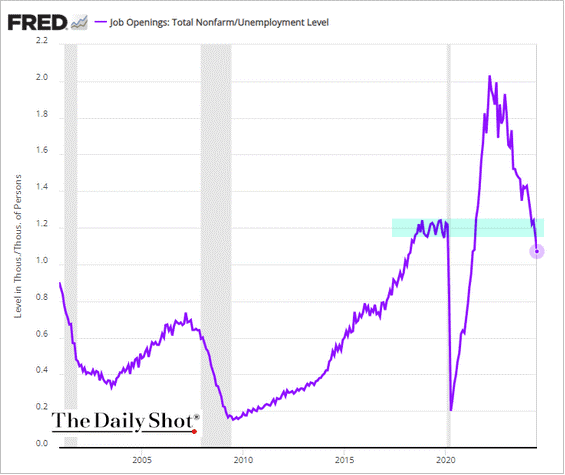

Job Openings Per Unemployed Worker Have Been on the Decline

Source: Federal Reserve Economic Data, St. Louis Fed; The Daily Shot

Supporting Chairman Powell’s comment on a “no longer overheated” employment environment, the number of available positions per job seeker has fallen below the pre-pandemic level, as shown in the chart above.

CLOSING STATEMENT

Looking Ahead

We support the consensus view that the time has, in fact, come for the Fed to start a rate easing cycle, something they likely should have started already. We fully anticipate a rate cut at their upcoming meeting on September 18th. We expect the Fed to ease into things with a 0.25% cut, but there are plenty of others leaning toward a more aggressive cut of 0.50%.

Let’s all be mindful of those school buses and backpack toting students while getting to and from our favorite coffee shops in the coming weeks. Readers of this newsletter are welcomed and encouraged to please share the strangest pumpkin-spiced product you encounter this fall.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way. Be sure to join the conversation and give us a follow on our socials – Facebook and LinkedIn!

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com