In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

From Sunglasses to Reading Glasses

Some key considerations regarding the expiration of the Tax Cuts and Jobs Act in 2026 (assuming no new tax legislation to extend or change current provisions) include income tax increases along with a decrease in the estate tax exemption. Perhaps most significant is a reversion of individual tax rates to their 2017 levels (indexed for inflation.) This means that tax rates will increase across the income spectrum. Standard deductions will also be reduced to less than half of current levels, creating a return to more taxpayers itemizing deductions. A dramatic reduction in the size of estates exempt from taxation, currently $13.6 million at the Federal level (indexed annually for inflation), is another critically important factor. In 2026, this will revert to an expected inflation-adjusted level of $7.2 million. The changes associated with the potential expiration of this legislation include a myriad of other items we would be pleased to discuss with you and your tax advisor to ensure the most appropriate steps are taken relative to your unique situation.

MARKET INDEX RETURNS | June 2024 | YTD 2024 |

S&P 500 Index | 3.6% | 15.3% |

Russell 2000 Index | -0.9% | 1.7% |

MSCI EAFE Index | -1.6% | 5.3% |

Bloomberg US Agg. Bond Index | 0.9% | -0.7% |

FTSE 3 Mo. T-Bill Index | 0.5% | 2.8% |

Please reach out to a member of the Plimoth Investment Advisors team if you would like to discuss gifting and estate strategies relating to your personal financial plan.

STOCK MARKET REVIEW & OUTLOOK

U.S. Equities in the First Half of 2024 Were More Spectacular Than the Boston Pops July 4th Fireworks Production

Large cap U.S. equities, led by a continued surge in technology stocks, drove returns for U.S. equity investors over the past month, while international and small cap equities pulled back modestly. The S&P 500 hit seven new closing highs during the period, capping a remarkable 31 booming new records in the first half of the year. The dominance of the largest technology stocks on the large cap index return has been more pervasive than ever. Performance of the stocks known as the “Magnificent Seven” (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) have accounted for over 60% of the skyrocketing return of the index through the first half of the year. Without them, the benchmark would be positive by only 5%. As the largest companies got larger, the weighting of the top 10 stocks in the S&P 500 Index reached 37%, the highest in the history of the bellwether index.

A modest (sparkler like relative to explosive stocks) gain in fixed income investments in June trimmed losses incurred earlier in the year. Bond yields (inversely correlated to prices) pulled back during the month, with the yield on the 10-Year U.S. Treasury closing lower by 10 basis points to 4.40%, 36 basis points below the 2-Year yield. The historically long inversion of the yield curve is soon to reach two full years.

S&P 500 SECTOR RETURNS | May 2024 | YTD 2024 |

Communication Services | 6.6% | 20.9% |

Consumer Discretionary | 0.3% | 0.7% |

Consumer Staples | 2.5% | 9.2% |

Energy | -0.4% | 12.4% |

Financials | 3.2% | 11.1% |

Healthcare | 2.4% | 5.8% |

Industrials | 1.7% | 8.8% |

Information Technology | 10.1% | 17.3% |

Materials | 3.2% | 7.3% |

Utilities | 9.0% | 15.8% |

Real Estate | 5.1% | -4.4% |

ECONOMIC REVIEW & OUTLOOK

The U.S. Consumer is Showing Signs of Cooling Their Jets

The latest report on May Retail Sales came in below expectations at a modest 0.1%, along with downward revisions to the prior two months of data previously reported. Discretionary spending pulled back notably at bars and restaurants as consumer credit reports showed a tick down in revolving (credit card) debt.

The third and final estimate of first quarter Gross Domestic Product (GDP) was released last month. Although the final revision showed an uptick in growth from 1.3% to 1.4% on an annualized basis, the changes showed a similar pullback in previously reported personal consumption data (which accounts for more than two thirds of GDP.) Consumer spending components were revised lower for durable and nondurable goods as well as services. Spending by government entities, residential and nonresidential fixed investment offset the lower personal consumption data, leading to the modest uptick in the final report.

CHART OF THE MONTH

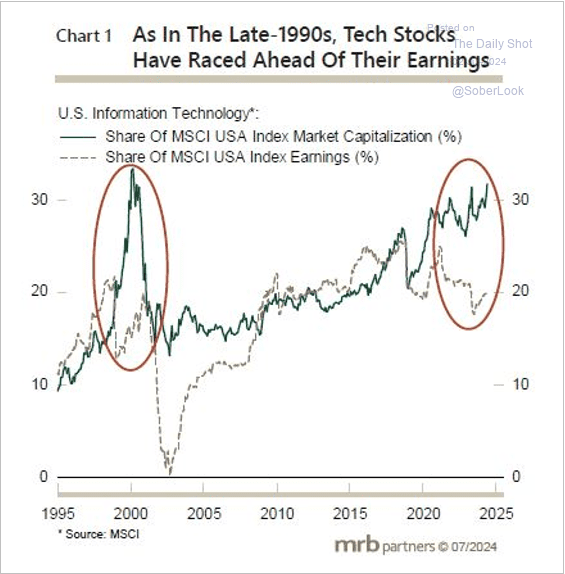

Mega-Cap Technology Companies Have Accounted for the Majority of S&P 500 Index Gains So Far This Year

Source: Morgan Stanley Capital International

As shown in the chart above, the market capitalization of U.S. Information Technology stocks is diverging from underlying company earnings, making valuations look pricey.

CLOSING STATEMENT

Looking Ahead

The U.S. economy continues to keep its head above water. Inflation has continued to cool at the consumer and producer levels, along with a particularly encouraging recent report of the Fed’s preferred inflation gauge, Personal Consumption Expenditures (PCE.) Traders are still attempting to fight the Fed, pricing in two short-term interest rate cuts this year while the Fed dot plot has been revised to one. We expect a consensus to develop as the year progresses, likely into the single cut camp (in September) with additional cuts coming next year if inflation and employment data stay on their current trajectory. We will be paying close attention to the Fed’s policy statements following their late July meeting, with no fireworks expected and a “steady as you go” hold on the Fed Funds Rate.

As you consider the shadow cast by the potential sunset of the TCJA provisions, we would be pleased to discuss your unique situation, estate planning and gifting strategies that may be employed in a tax-advantaged manner.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com