In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The Fed Continued to Hold the Line on Rates

The Federal Open Market Committee (FOMC) voted unanimously to keep short-term interest rates as-is at their May meeting, as was widely anticipated. There was, however, a notable policy change with some backtracking on the unwinding of the Fed’s whopping $7.3 trillion in bond holdings. The cap for monthly Treasury roll offs from the Fed balance sheet was cut by more than half to $25 billion from $60 billion, while the cap for mortgage-backed securities was left unchanged at $35 billion. By slowing the pace of the balance sheet unwind, the Fed may be indirectly leaning in a bit to easier monetary policy that market participants have been looking for without committing to the first rate cut since March of 2020 just yet. Chairman Powell towed the line between dovish and hawkish commentary, noting progress made toward getting inflation closer to target, but that it may take longer than anticipated to reach the desired mark. At the time of this writing, market participants are anticipating the next FOMC move (as priced in through U.S. Treasury futures markets) to be a cut, with a 57% probability of a 25 basis point decrease of the Fed Funds Rate in September.

MARKET INDEX RETURNS | May 2024 | YTD 2024 |

S&P 500 Index | 5.0% | 11.3% |

Russell 2000 Index | 5.0% | 2.7% |

MSCI EAFE Index | 3.9% | 7.1% |

Bloomberg US Agg. Bond Index | 1.7% | -1.6% |

FTSE 3 Mo. T-Bill Index | 0.5% | 2.3% |

Perhaps “Hold in May, assess and rebalance risks, and call it a day” would be a more appropriate investor adage.

STOCK MARKET REVIEW & OUTLOOK

A Tech-Fueled Rally Drove Stocks Higher in May

Equity markets finished the month of May comfortably in the green, despite some stumbles along the way with investors punishing companies with any sign of weakness in earnings reports, particularly within the software and cloud segments of Information Technology. The 5% gain of the S&P 500 Index was the best logged for the month of May since 2003 and erased the pullback in major industry averages experienced in April.

Outperformance relative to the overall S&P 500 return came from a combination of disparate sectors. High-flying growthy IT stocks were the hands down leader in the month (including another whopping 27% gain for market darling semiconductor stock Nvidia in the month alone), with an honorable mention to Communication Services, which includes similar high growth media companies along with sleepy high dividend-paying telecommunications stocks. Interestingly, two of the most interest rate sensitive sectors, Utilities and Real Estate, were key contributors during the period as well. Energy was the lone sector to record modest losses, in conjunction with crude prices pulling back from April highs.

The yield on the bellwether 10-Year U.S. Treasury pulled back slightly by 18 basis points to 4.50% at month’s end. The spread relative to the 2-Year (-38 basis points) extended the inversion of the Treasury yield curve to an historic 22 months.

S&P 500 SECTOR RETURNS | May 2024 | YTD 2024 |

Communication Services | 6.6% | 20.9% |

Consumer Discretionary | 0.3% | 0.7% |

Consumer Staples | 2.5% | 9.2% |

Energy | -0.4% | 12.4% |

Financials | 3.2% | 11.1% |

Healthcare | 2.4% | 5.8% |

Industrials | 1.7% | 8.8% |

Information Technology | 10.1% | 17.3% |

Materials | 3.2% | 7.3% |

Utilities | 9.0% | 15.8% |

Real Estate | 5.1% | -4.4% |

ECONOMIC REVIEW & OUTLOOK

Inflation Data Had Been Surprising to the Upside, Much Like the Celtics Sweep of the Indiana Pacers in the NBA Eastern Conference Finals

After monthly inflation measures consistently came in hotter than expected earlier in the year, the latest reports calmed investors by simply offering no upside surprises. The Consumer Price Index (CPI) cooled for the first time in six months. Headline and Core CPI (excluding food and energy) were 3.4% and 3.6% respectively on a year-on-year basis through April, both lower than prior readings and hitting economists’ targets. Prices of vehicle insurance rose once again and apparel, energy and gasoline remained sticky, while new and used car and truck prices pulled back further. The Fed’s preferred measure of inflation, Personal Consumption Expenditures (PCE), data release was also well behaved at 2.7% year-on-year, in line with consensus estimates and the prior month.

CHART OF THE MONTH

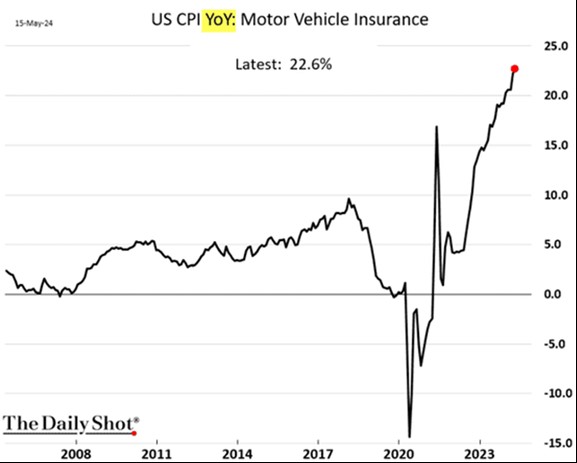

Motor Vehicle Insurance Costs Have Put the “AYE!” in Inflation

Source: Fidelity Investments

Motor vehicle insurance premiums continue to rise at an exceptionally fast pace. If you would like to assess how your policy rates compare to competitors, please reach out and we would be delighted to connect you with a colleague from our partner company BayCoast Insurance for a comparative quote.

CLOSING STATEMENT

Looking Ahead

With earnings season coming to a close for the first quarter, companies continue to impress with solid profits. A 6% increase for bottom line year-on-year growth was the highest since Q1 2022 and exceeded expectations. Amid the strength of the overall S&P 500 were some interesting dynamics, most notably just how quickly the bloom fell off the rose for major software and cloud computing companies relative to red hot semiconductor and media players. The Communication Services sector was a standout leader with 34% year-on-year earnings growth. Companies have been quick to point to artificial intelligence as part of their growth plans (“AI” mentioned at least once during 199 management earnings calls from March to May), but investors have shown that they can be equally quick to penalize companies whose runway to enhanced productivity from AI may be longer than anticipated, as was the case with Salesforce this quarter.

To our long-term investment partners, perhaps we should coin our own phrase to put the antiquated “sell in May” adage out to pasture. Consider… “hold in May, assess and rebalance risk, and call it a day.” Have another catchy rhyme in mind? Let us know!

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com