In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Near-Term Interest Rate Cut Expectations Have Stalled

Traders have become more aligned with the official Federal Reserve dot plot of forward interest rate expectations. The number of rate cuts priced into the futures market for 2024 has declined from six to three since the start of the year. There seems to be a solid consensus that the Federal Open Market Committee will further analyze recent data at their March 19th meeting without making any rate policy changes. The hawkish tone has been set and seems to have finally been heard (for now) in the financial markets.

MARKET INDEX RETURNS | November 2023 | YTD 2023 |

S&P 500 Index | 9.1% | 20.8% |

Russell 2000 Index | 9.0% | 4.1% |

MSCI EAFE Index | 9.3% | 12.3% |

Bloomberg US Agg. Bond Index | 4.5% | 1.6% |

FTSE 3 Mo. T-Bill Index | 0.5% | 4.8% |

Wealth Effect (noun): a behavioral economic theory based on the premise that consumers tend to feel more financially secure and spend more when broadly held assets like stocks and real estate are rising in value

Mickey Mouse (verb): slang term used colloquially to describe something done too easily to be taken seriously

STOCK MARKET REVIEW & OUTLOOK

The Most Widely Watched Superbowl in History Paled in Comparison to the Performance of U.S. Stock Indices in February

U.S. equities capped a four-month winning streak with the best February return since 2015. The S&P 500 and Nasdaq Composite ended the month at new all-time closing highs. Although the growth of large cap company earnings meaningfully surpassed those of small cap, investors bid them up marginally higher in the month with an impressive 5.7% gain for the Russell 2000 Index. All sectors of the S&P 500 finished in the green for the month with the strongest returns coming from a diverse group including Consumer Discretionary, Industrials and Materials outperforming the recently dominant Technology and Communication Services sectors.

Yields on the benchmark 10-Year U.S. Treasury rose marginally during the month following the replay of the “higher for longer” message delivered by Fed officials following their January meeting. The 10-Year ended the month at 4.25%, 37 basis points below the 2-Year Treasury, with the yield curve inversion having persisted for 17 months, the longest stretch since before CNN made their first news report. (1980)

S&P 500 SECTOR RETURNS | November 2023 | YTD 2023 |

Communication Services | 7.8% | 48.7% |

Consumer Discretionary | 10.9% | 34.1% |

Consumer Staples | 4.1% | -2.1% |

Energy | -1.0% | -1.3% |

Financials | 10.9% | 6.4% |

Healthcare | 5.4% | -2.2% |

Industrials | 8.8% | 10.4% |

Information Technology | 12.9% | 52.0% |

Materials | 8.4% | 7.6% |

Utilities | 5.2% | -8.8% |

ECONOMIC REVIEW & OUTLOOK

Progress on Reigning in Inflation Has Reached the Pace of Traffic on the Washington Bridge in Providence

For those familiar with the rerouting of traffic for the past few months on Interstate 195 to pass through the state capital of the “biggest little state in the union”, the headline above says it all. Tighter monetary policy has certainly dampened the pace of rising inflation over the past year, but progress has stalled much like a trip through scenic Providence, Rhode Island this year. The latest January reading of the Core (excluding volatile food and energy prices) Consumer Price Index (CPI) was 3.90% on a year-on-year basis. The annual rate of change has continued to decline since its peak in September 2022, but at a slowing pace. The Core Producer Price Index (PPI) was reported at 2.00% and has ticked up modestly over the past two months. The Fed’s preferred gauge of inflation, Core Personal Consumption Expenditures (PCE) followed a similar trajectory as the CPI, cooling to 2.85% in the January report, relative to the Fed’s steadfast target of 2.00%.

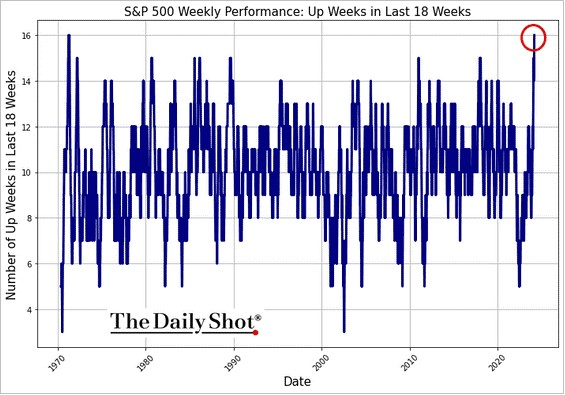

CHART OF THE MONTH

The S&P 500 Continues to Rally at a Pace Not Seen in Decades

CLOSING STATEMENT

Looking Ahead

With the fourth quarter earnings season nearly fully wrapped up, companies in the S&P 500 reported earnings growth of 4.0% for the second consecutive quarter of year-on-year growth. Over 250 companies mentioned the word “inflation” at least once during their quarterly conference calls, which highlights a key consideration across sectors and industries. Be that as it may, 73% of companies reported actual earnings per share ahead of estimates. While impressive, that figure is marginally below the 77% five-year average. Company managements have been known to “Mickey Mouse” their guidance to set expectations at levels that are more likely to be beaten than not. Looking through the noise and focusing on the key data points, our assessment of the fundamental strength of our core holdings continues to be positive. S&P 500 earnings growth is expected to continue into the current quarter at a healthy 3.5% level and potentially reward investors with earnings per share growth in the calendar year that squeaks its way into the double digits, with no mousing around.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com