In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Investors Were on the Run but Not Hiding

The equity market continued to pull back in October for a third straight month. This is the longest streak of consecutive monthly declines for the S&P 500 since March 2020. During that particular time period, the Fear & Greed Index of investor sentiment was squarely redlined in the “Extreme Fear” camp due to the uncertainty associated with worldwide pandemic lockdowns. Fortunately, that measure is not nearly as extreme at this time. Investors have been understandably rattled by the devastation and insecurity associated with the Israel-Hamas war in addition to the Russia-Ukraine war, remarkably only a few months away from reaching the two-year mark. A divided U.S. government that was forced to sit on its hands most of the month while debating the appointment of a new Speaker of the House was also a source of angst. While there have been some wild swings of individual company stocks this earnings season, the overall market has, interestingly, retreated without the striking levels of high volatility experienced in 2020. The VIX Index (key measure of volatility of the S&P 500) spent the majority of the month below the long-term average of 20, unlike the startling spike into the 80s during the height of pandemic lockdowns.

MARKET INDEX RETURNS | July 2023 | YTD 2023 |

S&P 500 Index | 3.2% | 20.6% |

Russell 2000 Index | 6.1% | 14.7% |

MSCI EAFE Index | 3.2% | 15.3% |

Bloomberg US Agg. Bond Index | -0.1% | 2.0% |

FTSE 3 Mo. T-Bill Index | 0.5% | 2.9% |

A stock market correction is defined as a decline of 10% or more of an equity index (such as the widely followed S&P 500 Index) from a recent high.

STOCK MARKET REVIEW & OUTLOOK

Please Pass the Gravy and How About that Change in the Shape of the Yield Curve?

The pullback in the S&P 500 Index was broad-based in October. The oversold Utilities sector eked out a small gain and Information Technology stocks were flat. Otherwise, traders did not seem to differentiate when paring back bets in the large cap segments of the U.S. market. The more rate sensitive small cap companies (requiring more debt financing to fund growth than large companies) pulled back the most and international diversification again added no benefit to equity portfolios.

The yield on the 10-Year U.S. Treasury skyrocketed in October, closing at 4.88%. The rise in 2-Year rates was far more subdued during the period, ending the final trading session close to where it started the month at 5.07%. The more rapid increase in the intermediate part of the curve, known as a “bear steepener” (a term all are welcomed to keep in their pocket to be pulled out over Thanksgiving if a topic change around the family dinner table is needed) went a long way to further reign in the inversion of the yield curve to the lowest levels in 15 months.

S&P 500 SECTOR RETURNS | July 2023 | YTD 2023 |

Communication Services | 6.9% | 45.7% |

Consumer Discretionary | 2.4% | 36.2% |

Consumer Staples | 2.1% | 3.5% |

Energy | 7.4% | 1.4% |

Financials | 4.8% | 4.3% |

Healthcare | 1.0% | -0.5% |

Industrials | 2.9% | 13.4% |

Information Technology | 2.7% | 46.6% |

Materials | 3.4% | 11.4% |

Utilities | 2.5% | -3.4% |

ECONOMIC REVIEW & OUTLOOK

The Components of Third Quarter Gross Domestic Product Came Out Like a Perfectly Prepared Turkey Dinner

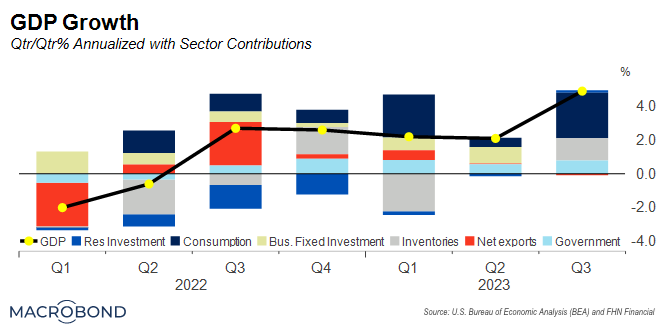

The total amount of goods and services produced in the United States grew by an impressive 4.9% on an annualized basis through the end of the third quarter. The strong result was driven by continued vigorous personal consumption, higher by 4.0% during the period. Purchases of durable goods, particularly autos, were a key driver, advancing by 7.6%. Spending on non-durable goods and services continued to be solid as well. Government spending rose by 4.9%, driven by an 8.0% increase in defense spending.

CHART OF THE MONTH

GDP Growth

Source: U.S. Bureau of Economic Analysis (BEA) and FHN Financial

As shown in the chart above, the U.S. economy has been firing on all cylinders thus far in 2023, a far cry from the prevailing outlook of recession by market pundits a year ago. With the exception of a higher than anticipated level of imports (mostly offset by strong exports), all segments of goods and services growth were positive contributors to the results.

CLOSING STATEMENT

Looking Ahead

With a close eye on fixed income futures trading and digesting the overload of comments made by Fed officials, we are continuing to contemplate signs that the Federal Reserve is likely to stay the course with their current state of “pause” on rate hikes. Now more than three quarters of the way through the current earnings season, the S&P 500 seems poised to buck the trend of negative corporate earnings growth prevalent over the last two quarters. Amidst all the other information flow, assessing the ability for companies to generate sustained future profits continues to be key to our process for identifying attractive investment opportunities for the capital you have entrusted to our management.

We would like to wish a safe, healthy, Happy Thanksgiving to you and your families. With the devastating strife prevalent around the world, it is truly a time to count our blessings. Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com