In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Do Not Let a Sensible Retirement Plan be Derailed if You Can Help it

Retirement plans are often the highest balance accounts of our personal assets, so it is understandable to think of them when costs increase, and budgets get tight. The first thing to perhaps keep in mind is that those particular assets were set aside for a reason, with a specific future goal in mind. If that goal has not changed, then it is in all of our best interests to remain steadfast with the plan of growing our nest egg for the golden years of retirement.

So, what is the harm in tapping retirement accounts prematurely as a source of funds? If considering a withdrawal from a plan such as a 401(k), the full amount will be considered taxable income, with a hefty 10% penalty on top if done prior to age 59 1/2. How about taking a loan from the plan then? While not taxable at the time of receipt, there are unpalatable tax consequences to consider when borrowing from a 401(k). When repaying the loan back into your account (with interest) you do so with after tax dollars, setting yourself up to enjoy paying taxes on those same dollars again when later withdrawn from the plan in retirement. Another important consideration is the potential of disrupting your careful retirement planning as assets withdrawn are no longer able to compound and grow as originally intended. While assets are being paid back over a number of years, a strikingly large number of participants with 401(k) loans leave their jobs prior to fully repaying (roughly 85% according to the Bureau of Economic Research.) Those participants are left in the untenable situation of being forced to pay back their loans in a much shorter time frame than anticipated or suffer the tax consequences and potential penalties associated with taking a premature distribution.

Determining the consequences of covering large expenses from different sources of funding will likely have a host of considerations. The scenarios can vary based upon the direction of financial markets during the borrowing period, costs of alternative funding or the speed at which repayment can be made. While the pitfalls of borrowing from retirement noted above are only a part of the equation, they are certainly important factors to keep in mind. If you have come to a point in which borrowing from your future retirement funds seems to be the best option, perhaps it is time to take a step back and reach out to a financial professional who can fully explain the implications of such a decision and suggest alternatives that may be less detrimental to your long-term financial plan.

MARKET INDEX RETURNS | July 2023 | YTD 2023 |

S&P 500 Index | 3.2% | 20.6% |

Russell 2000 Index | 6.1% | 14.7% |

MSCI EAFE Index | 3.2% | 15.3% |

Bloomberg US Agg. Bond Index | -0.1% | 2.0% |

FTSE 3 Mo. T-Bill Index | 0.5% | 2.9% |

If you are facing decisions associated with funding any type of large expense, we would be delighted to connect with you to discuss your unique circumstances and consider appropriate options.

STOCK MARKET REVIEW & OUTLOOK

Stocks Took a Time Out from the Strong Rally Enjoyed Thus Far in 2023

Investors were reminded in August that financial markets are inherently volatile and, while historically positive over long periods of time, do not advance in a straight line. Returns for equity investors were negative for the month for the first time since February. The S&P 500 Index was off by a marginal 1.6% while smaller company stocks and international equities performed worse. Utilities stocks, which typically don’t fare as well during rising rate environments, were hit the hardest, but with our view that the Fed is nearing peak rates in this monetary cycle, select companies within the sector may now be attractively undervalued. Energy stocks were the only sector of the S&P to finish above water during the period.

Fitch rating agency decided to downgrade U.S. government debt (AAA to AA+) in August, citing “steady deterioration in standards of governance” with respect to the ample amounts of debt raised over the past two decades. Yields on the 10-Year U.S. Treasury continued to push higher during the month reaching a 16-year high of 4.35% before settling back at 4.09%, with the 2-Year closing at 4.85% after reaching over 5.00%. The inversion between the 2 and 10-Year Treasuries has remarkably now been a menacing factor for economists to consider for over 13 months.

S&P 500 SECTOR RETURNS | July 2023 | YTD 2023 |

Communication Services | 6.9% | 45.7% |

Consumer Discretionary | 2.4% | 36.2% |

Consumer Staples | 2.1% | 3.5% |

Energy | 7.4% | 1.4% |

Financials | 4.8% | 4.3% |

Healthcare | 1.0% | -0.5% |

Industrials | 2.9% | 13.4% |

Information Technology | 2.7% | 46.6% |

Materials | 3.4% | 11.4% |

Utilities | 2.5% | -3.4% |

ECONOMIC REVIEW & OUTLOOK

Consumers Seem to be Treating Every Day Like “Prime Day”

Personal Spending continues to outpace Personal Income with the former increasing by 0.8% (in the latest reading from July) and later by only 0.2%. Consumers continue to pay up for services, such as dining out and home improvements, but the latest data also show steady purchases of durable goods (e.g. autos, appliances) as well as nondurable goods (e.g. food, clothing, gasoline.) Consumer Spending reached an all-time high in the second quarter of 2023. With fiscal stimulus now spent, and then some, consumers are leveraging up their personal balance sheets at a level we believe requires some pause. Credit card debt has grown by 30% over the past two years and has reached $1 Trillion for the first time in history, while delinquency rates have hit an 11-year high.

CHART OF THE MONTH

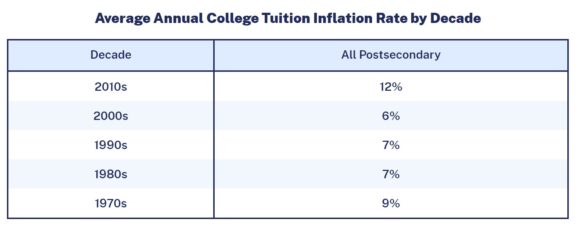

The Rapid Change in College Education Costs Over the Past Decade

Source: Education Data Initiative “College Tuition Inflation Rate”

Even the most fastidious savers and planners likely underestimated the rapid rise in postsecondary education costs over the past decade (12% annually) relative to the previous decade (6% annually), when those plans were originally being made.

CLOSING STATEMENT

Looking Ahead

The dog days of summer are now behind us and (like many others) we are focusing on the Fed, with an upcoming September meeting that seems likely to conclude with no change in short-term rates. We believe that Chairman Powell perhaps has one additional hike up his sleeve which we may see in the November 1st meeting.

We wholeheartedly embrace any and all feedback from our readers on topics raised in this newsletter. Whether you would like to provide a comment, perhaps debate whether double taxation of 401(k) loans is a “myth” (or mischaracterization, as some financial pundits have espoused) when compared to alternative costs of borrowing, or simply pose any question that comes to mind, we would be delighted to hear from you. You are welcomed and encouraged to reach out to one of your Account Officers or any member of our Executive Leadership Team at any time.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com