In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Debt Ceiling Political Theater Act Wraps, For Now

A prolonged game of high-stakes financial chicken with the balance sheet of the United States was in full swing at month’s end. Fortunately, at the time of this writing, debt ceiling talks have reached a conclusion, albeit temporarily. The political theater associated with debt ceiling negotiations has again transitioned to a game of “Kick the Can.” A deal to suspend the debt ceiling out to January 2025 was agreed to in principle and subsequently approved by both the U.S. House and Senate. The move punts the issue to after the next U.S. Presidential election and off the front pages of financial publications and minds of investors for the time being.

MARKET INDEX RETURNS | May 2023 | YTD 2023 |

S&P 500 Index | 0.4% | 9.6% |

Russell 2000 Index | -0.9% | -0.1% |

MSCI EAFE Index | -4.2% | 6.8% |

Bloomberg US Agg. Bond Index | -1.1% | 2.5% |

FTSE 3 Mo. T-Bill Index | 0.4% | 2.0% |

With the debt ceiling issues falling from the headlines, investors have shifted focus primarily back to Fed policy and inflation.

STOCK MARKET REVIEW & OUTLOOK

Stocks Landed in the Green in May, But Just Barely

The S&P 500 eked out a modest gain of 0.4% during May, with investors on their heels over the prospects of a potential U.S. government shutdown and debt default. The index exhibited particularly narrow leadership, driven by double-digit returns of a handful of the largest companies in the Information Technology, Communication Services, and Consumer Discretionary sectors. Any mention of the latest buzzwords, “artificial intelligence” (AI), caught investor attention. The more cyclically oriented and defensive sectors of the market were all in the red. The median stock in the closely followed large-cap benchmark declined by mid-single digits for the month. Diversifying exposures to international and small-cap stocks detracted value during the period.

The Federal Open Market Committee raised short-term rates by 25 basis points at their meeting last month, as was widely anticipated. The hike was the tenth in the current monetary tightening cycle. U.S. Treasury yields continued to rise during the month, particularly on the short end of the curve, leading to a greater degree of inversion (short rates higher than intermediate to long). The spread between the 2-Year and 10-Year U.S. Treasuries went from -0.58% to -0.76% during the month.

S&P 500 SECTOR RETURNS | May 2023 | YTD 2023 |

Communication Services | 6.2% | 32.8% |

Consumer Discretionary | 3.2% | 18.6% |

Consumer Staples | -6.1% | -1.9% |

Energy | -10.0% | -11.4% |

Financials | -4.3% | -6.8% |

Healthcare | -4.3% | -5.6% |

Industrials | -3.2% | -1.0% |

Information Technology | 9.5% | 34.0% |

Materials | -6.8% | -3.0% |

Utilities | -5.9% | -7.2% |

ECONOMIC REVIEW & OUTLOOK

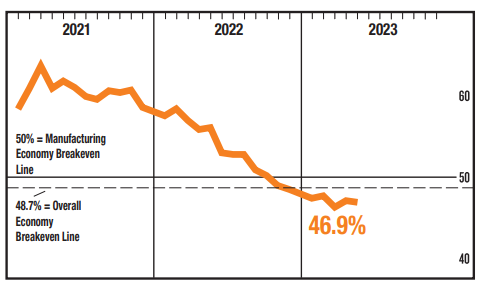

U.S. Manufacturing Has Continued to Contract

The Institute for Supply Management (ISM) Manufacturing report in May showed a seventh consecutive month of contraction for U.S. manufacturing activity. New orders pulled back at a faster pace, and order backlogs were reported at a 14-year low. The index has been trending to levels not seen since the pandemic. The latest monthly reading showed that only three of the ten sub-indices expanded during the month, and only five of the eleven industries reported growth during the month. Consumers have continued a shift from spending on goods to directing more discretionary income toward services.

CHART OF THE MONTH

The U.S. Manufacturing Sector Continues to Trend Lower

Subtitle for This Bloc

Title for This Block

Text for This Block

Source: Institute for Supply Management

The Manufacturing Purchasing Managers’ Index (PMI) shown in the chart above has trended into contractionary territory (below 50) and remained there throughout 2023. The average monthly reading over the past year now stands in a contractionary territory as well.

CLOSING STATEMENT

Looking Ahead

The second quarter company earnings season is now behind us. Companies reported better-than-expected earnings, while still negative at -2.1% versus original consensus expectations going into the quarter of -6.7%. Forward guidance was mixed by sector, with technology companies reporting the most optimism (sneaking in mention of AI whenever possible). In a shift from the first quarter, the word “recession” took a backseat in earnings calls for most companies outside of the financials space. It seems company leadership and economists alike have decided that is a can to be kicked a bit further down the road.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com