In This Update: Investment Spotlight | Stock Market Review | Financial Markets

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Stay Calm and Invest On

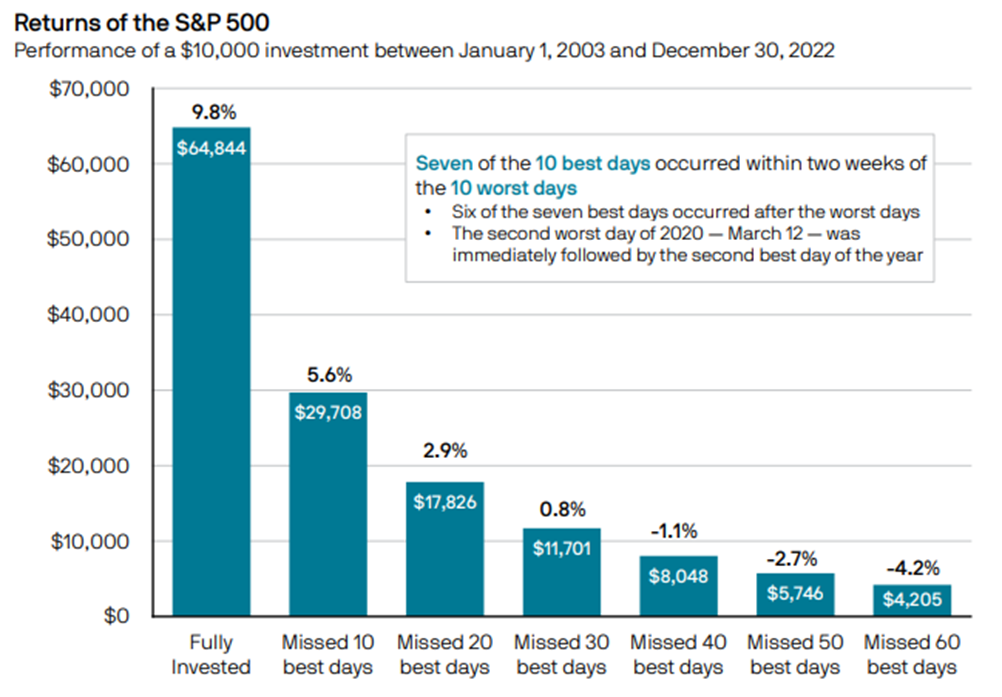

At the end of the 2022 calendar year, an investment of $10,000 in the S&P 500 made 20 years prior would have been worth $64,844. The (nearly 6.5 times larger) investment would have earned an impressive compounded annual return of 9.8% during the period. The key to this stellar result however is for the astute investor to have done exactly… nothing; nothing other than buy and hold. Had the holder become overly nervous and attempted to jump in and out of the market during periods of uncertainty, the results would have been much less satisfying. In fact, the data shows that by missing only the 10 best days (during the entire 20-year period), the holding would have been worth a dramatically lower $29,708 during the same period, with a compounded return of 5.6%. The story gets even worse if more of the top days are missed. Sitting out the best 30 days evaporates the majority of return to 0.8%, and 40 of the wrong days on the sidelines moves the position into negative return territory at -1.1%. The real kicker is that 7 of those 10 best days (so critically important to the impressive return) all happened within two weeks of the 10 worst days during that time period.

Now that is a lot of numbers to digest, but the message should be straightforward. When markets pull back in periods of sharp decline, raising investors’ uneasiness (and perhaps blood pressure), that has proven to be the worst possible time to try to make market timing decisions to be out of equity markets “while things settle down”.

MARKET INDEX RETURNS | MARCH 2023 | YTD 2023 |

S&P 500 Index | 3.7% | 7.5% |

Russell 2000 Index | -4.8% | 2.7% |

MSCI EAFE Index | 2.5% | 8.5% |

Bloomberg US Agg. Bond Index | 2.5% | 3.0% |

FTSE 3 Mo. T-Bill Index | 0.4% | 1.1% |

Long-term investors are well served to focus on time in the market versus trying to time the market.

STOCK MARKET REVIEW & OUTLOOK

Equity Markets Got Some Spring in Their Step to End a Stormy Month

The month of March will be remembered for being far more of a lion than a lamb, but in the end, equity markets not only recovered from concerns about a strained banking system but found their way to provide a positive return to investors. The second largest bank failure in the U.S. (Silicon Valley Bank) along with two other closures (Silvergate and Signature Bank), sent shockwaves through the financial system during the month. Regulators quickly stepped in to backstop depositors and kept the situation from exacerbating, but not before a centuries-old bank received a large capital infusion from the Swiss government, only to be subsequently acquired (Credit Suisse by UBS). Several regional banks also saw their market caps diminish significantly in concern about uninsured deposits hitting the exits in the fast-paced world of online banking.

In a month when the S&P 500 rose by 3.7%, the Information Technology and Communication Services sectors stood out with double-digit returns. Investors that shunned technology shares last year in a rapidly rising interest rate environment focused on the companies in those industries with the strongest cash flows and balance sheets, trading at more attractive valuations after their sell-off last year. The technology-focused NASDAQ Composite was a standout beneficiary of the shift in sentiment, higher by 6.8% in March and 17% in the first quarter alone. As expected, given the recurring negative headline blitz throughout the month, Financials were the weakest sector, lower by nearly 10%. Small-cap stocks also pulled back in a month when investors shied away from regional banks that hold a sizable weighting in the Russell 2000 Index.

Bonds provided positive total returns in March, with yields lower and prices higher. The yield on the 10-Year U.S. Treasury declined by 45 basis points, ending the final trading session at 3.47%. The spread between the 2-Year and 10-Year Treasuries narrowed from -0.90% to -0.66%, reducing some degree of the persistent yield curve inversion.

S&P 500 SECTOR RETURNS | MARCH 2023 | YTD 2023 |

Communication Services | 10.4% | 20.5% |

Consumer Discretionary | 3.1% | 16.0% |

Consumer Staples | 4.2% | 0.8% |

Energy | -0.2% | -4.7% |

Financials | -9.6% | -5.6% |

Healthcare | 2.2% | -4.3% |

Industrials | 0.7% | 3.5% |

Information Technology | 10.9% | 21.8% |

Materials | -1.0% | 4.3% |

Utilities | 4.9% | -3.2% |

FINANCIAL MARKETS

Some Historical Perspective

Patient investors were rewarded last month, much like those who kept a cool head during what turned out to be a remarkably short-lived bear market in the first quarter (pandemic lockdowns) of 2020. There were similar rewards for those who stayed the course during other stock market sell-offs like those in 2015 and 2011. The same can be said of other more dramatic market crashes like the financial crisis in 2008-2009, TMT (technology, media, telecommunications) bubble in 2000, and the list could go on back through the annals of financial market history.

One of the keys to long-term investing in equity markets is to anticipate and expect that periods of heightened volatility will be the norm, not the exception. Our team at Plimoth constructs portfolios on behalf of our clients with this mindset, continually striving to optimize exposures for the most attractive return outcome for a given level of risk.

CHART OF THE MONTH

20-Year Return History of the S&P 500

Source: J.P. Morgan

As the chart above depicts, attempting to make short-term jumps in and out of the stock market can have a dramatic impact on portfolio returns over time.

CLOSING STATEMENT

Looking Ahead

At the time of this writing, it appears that cooler heads have prevailed in the banking industry and depositors have decided to heed the recommendation to… keep calm and bank on. As we have seen through decades of investing through various market cycles, the size of the “wall of worry” on investors’ minds may change, but as one concern abates, there is sure to be another to follow. Calmly managing through prevailing risks is key to optimizing portfolio returns over time.

We continually seek ways to enhance ongoing dialogue between our clients and account officers and would be delighted to connect with you at any time. Sometimes the seemingly simplest question or sharing of a shift in risk tolerance can spark incredibly useful dialogue. The index return example above makes a compelling case for holding equities for the long haul, through various market cycles, and not jumping all in or all out. There are ample ways to modify asset allocation, portfolio positioning, and holdings to adjust risk while maintaining exposure to equities as a long-term source of capital return.

Please contact one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com