In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Running of the Bulls

Fans of the prolific author Ernest Hemingway may have a fanciful vision of the running of the bulls in Pamplona, Spain. For dyed-in-the-wool stock jockeys, a bull run is all about green on the screen…with some added nuance.

The widely followed S&P 500 Index has remained in a bear market since June of this year. On a technical basis, the Dow Jones Industrial Average (a concentrated index of 30 large cap blue-chip companies) put the bear to bed for the winter and found its way into bull market territory on the final trading day of November. After a stellar 14% return in October (the largest monthly gain since 1976) the oldest U.S. equity index rose further in November to surpass a 20% increase from its recent September low. That is sufficient for technical analysts to claim a regime change into a bull market, while traditionalists (a label most Dow followers comfortably embrace) would say that a breach of the peak reached in January 2022 is required to officially confirm a new bull market cycle.

MARKET INDEX RETURNS | NOVEMBER 2022 | YTD 2022 |

S&P 500 Index | 5.6% | -13.1% |

Russell 2000 Index | 2.3% | -14.9% |

MSCI EAFE Index | 11.3% | -14.5% |

Barclays US Agg. Bond Index | 3.7% | -12.6% |

FTSE 3 Mo. T-Bill Index | 0.3% | 1.2% |

“Bull market” is a term often used loosely by investors to indicate an optimistic view when financial assets are rising and expected to continue to do so. The most commonly accepted technical definition is a rise of 20% in a major market index following a recent low. The origin of the term stems from the manner in which a bull attacks, by thrusting its horns up into the air, as opposed to a bear which forcefully swipes its paws downward at its prey.

STOCK MARKET REVIEW & OUTLOOK

U.S. Stocks Continued to Rise Amid Modest Corporate Earnings Growth

U.S. equities continued their autumn rebound during November. Gains were spread widely across risk assets despite a fairly lackluster earnings season dampened by difficult comparisons companies faced from robust earnings growth enjoyed a year ago. International equities added value to diversified portfolios with the MSCI EAFE Index (11%) returning double the S&P 500 in the latest month. The Emerging Markets Index finished higher by an eye popping 15%. How China handles the loosening of strict COVID lockdown rules will continue to play a part in investor sentiment towards markets outside the U.S. A policy enacted to speed up the pace of vaccine injections to the elderly in Beijing was a catalyst for the strongest monthly gain in the Heng Seng Index (26%) in 24 years.

Cyclically oriented segments of the S&P 500 were the strongest in November with Materials and Industrials returning 12% and 8% respectively. The strong recovery during the period moved additional sector returns (beyond the lone Energy space) out of the red on a year-to-date basis. Consumer Staples and Utilities shifted onto the positive side of the ledger; Healthcare returned back to even and Energy stocks added modestly to their formidable lead, now higher by 70% thus far in 2022.

Fixed income prices were higher at month’s end as rates declined in anticipation of a Fed pulling back on tight monetary policy. The bellwether 10-Year U.S. Treasury yield dropped to 3.68% from a peak of 4.25% in October. Credit spreads (the yield premium afforded to corporate bond investors over equivalent government debt) tightened modestly as well, another tailwind to bond price appreciation.

S&P 500 SECTOR RETURNS | NOVEMBER 2022 | YTD 2022 |

Communication Services | 6.9% | -34.8% |

Consumer Discretionary | 1.0% | -29.0% |

Consumer Staples | 6.4% | 2.3% |

Energy | 1.3% | 70.2% |

Financials | 7.0% | -5.6% |

Healthcare | 4.8% | 0.0% |

Industrials | 7.9% | -2.6% |

Information Technology | 6.0% | -21.6% |

Materials | 11.8% | -7.1% |

Utilities | 7.0% | 2.1% |

ECONOMIC REVIEW & OUTLOOK

Inflation Was Cool Enough for a Sweater, not a Winter Coat Yet

Key measures of inflation in the U.S. showed some modest cooling in the latest data released through the end of October. The Consumer Price Index (CPI) was reported lower than anticipated at 0.4% for the month and 7.7% on a year-on-year basis (the lowest since January). While the annualized figure remains well ahead of historical norms, it is down from the red-hot readings that have worried Fed watchers over the past several months. Apparel, household furnishings, health insurance, used cars and airfares all declined in price. Food costs rose 0.6%, the lowest monthly increase of the year, just in time to shop for family holiday dinners without humbug pandemic restrictions.

Producer Prices (PPI) followed suit with a modest 0.2% rise in the month and the core reading (stripping out volatile food and energy costs) was flat. The Federal Reserve’s preferred gauge of inflation, Personal Consumption Expenditures (PCE), decelerated from the prior month and came in below consensus estimates as well. While too soon to consider a changing tide, the difficult to navigate pricing seas have shown signs of calming.

CHART OF THE MONTH

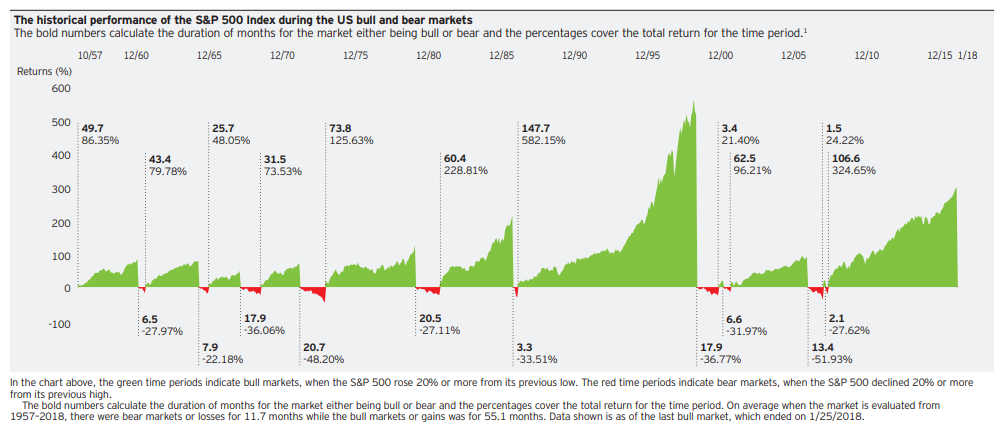

Historical Performance of Bull Versus Bear Markets

Source: Bloomberg, Invesco

While the particularly detailed chart above may require more time to digest than an overcooked holiday roast, the key takeaway is that bull markets (shown in green) have historically been greater in magnitude of return and longer in duration than bear markets (shown in a similar scale in red).

CLOSING STATEMENT

Looking Ahead

Regardless of the labels placed on equity markets (typically made official well after the fact) to identify the general state of investor optimism, (bull and bear) market cycles are an inevitability. A typical refrain in our office is that bears often sound smart (in the moment) while bulls are more likely to enjoy a positive return on investments over time. This sentiment is well represented in the graphic shown above. Navigating financial markets requires being neither a nimble matador nor expert bear trapper. It is a matter of employing disciplined strategy with a focus on the long-term big picture. Interpreting opposing viewpoints in the moment is relevant, healthy, and can be additive to tactical thought processes. We do so, while keeping in mind that from a strategic perspective, utilizing risk assets (particularly equities) in a diversified portfolio is a sound approach towards optimizing investment portfolio construction, with a long-term timeframe.

We would like to wish you and your families a healthy and happy holiday season and all the best for the new year. There will be much to watch and interpret as critical economic data releases in 2023 are factored into Fed policies and market participants’ actions.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com