In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Powell’s Speech Blew a Hole in Market Rally

Fed Chairman Jerome Powell spoke at the Federal Reserve’s annual summit in Jackson Hole, Wyoming. One quote from his speech stuck with investors and traders; “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.” This statement caused an unwinding of what had previously been a strong August for stocks. Wall Street traders see a third consecutive 0.75% Fed Funds rate hike as the most likely course of action at the Fed’s next meeting, which takes place on September 20th and 21st. One sign that the Fed Funds rate is set to go higher is that Federal Reserve bankers who were previously wary of interest rate hikes (Minneapolis Fed President, Neel Kashkari, and St. Louis Fed President, James Bullard) are now advocating for massive hikes to lower inflation. The Fed seems to accept a higher unemployment rate and lower stock prices as necessary side effects of getting inflation close to their 2% target.

MARKET INDEX RETURNS | AUGUST 2022 | YTD 2022 |

S&P 500 Index | -4.1% | -16.2% |

Russell 2000 Index | -2.1% | -17.2% |

MSCI EAFE Index | -4.8% | -19.6% |

Barclays US Agg. Bond Index | -2.8% | -10.8% |

FTSE 3 Mo. T-Bill Index | 0.2% | 0.4% |

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.” This statement caused an unwinding of what had previously been a strong August for stocks.

STOCK MARKET REVIEW & OUTLOOK

Energy Remains Lone Bright Spot in Harsh Year for Equity Investors

Once the most hated sector on Wall Street, shares of oil companies have easily outpaced those of other groups thus far in 2022. High oil prices have allowed these companies to increase capital returns to shareholders using buybacks and high dividend payouts. The Energy sector is up 48.5%, while Utilities are the only other sector that is positive this year, gaining 5.5%. Technology stocks were hurt badly last month as investors worried about future growth prospects. Semiconductor stocks are falling out of favor, as lower sales of video games and personal computers means less demand for the microchips that power them. The SOXX ETF, which tracks shares of semiconductor firms, fell over 9% in August.

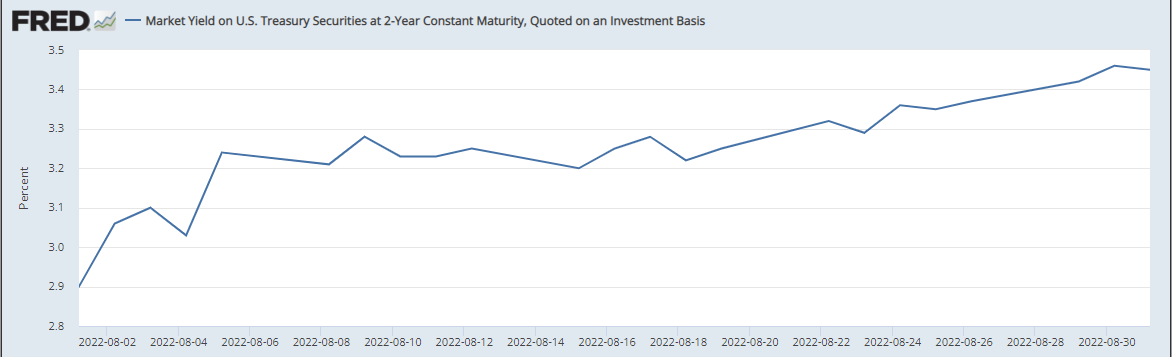

The yield on the bellwether 10-Year U.S. Treasury soared by 54 basis points this month to 3.19%. The 2-Year, which more closely tracks the actions of the Federal Reserve’s interest rate hikes, rose 57 basis points to 3.45%. The inversion of these two interest rates is generally a precursor to recessions, and two straight quarters of negative GDP growth signal that this indicator is retaining its predictive power.

S&P 500 SECTOR RETURNS | AUGUST 2022 | YTD 2022 |

Communication Services | -4.2% | -30.6% |

Consumer Discretionary | -4.6% | -23.8% |

Consumer Staples | -1.8% | -4.2% |

Energy | 2.8% | 48.5% |

Financials | -2.0% | -14.6% |

Healthcare | -5.8% | -10.8% |

Industrials | -2.8% | -11.4% |

Information Technology | -6.1% | -22.1% |

Materials | -3.5% | -15.9% |

Utilities | 0.5% | 5.5% |

ECONOMIC REVIEW & OUTLOOK

Consumer Remained Resilient Despite Recession Fears

The second estimate of Gross Domestic Product for the 2nd Quarter came in at -0.6%, an improvement from the 0.9% decline we saw with the first estimate. Inventories and lower business investment were among the factors that kept GDP in the red. This positive revision was powered by a change in consumption growth from 1% to 1.5%. Consumers continued to spend despite significant pressure from inflation. The monthly Consumer Price Index (CPI) gauge was flat in its most recent reading, reflecting the recent drop in gasoline prices. However, rent and medical cost pressures remain worrying, and despite the better month, inflation is still running at a red-hot 8.5% on an annual basis. The Personal Consumption Expenditures index is the Fed’s preferred measure of inflation, and it contains a larger portion of health care costs than the CPI reading. This index declined 0.1% in the last month, and increased 6.3% annually, or 4.6% when stripping out the volatile prices of food and energy.

CHART OF THE MONTH

Bond Yields Reflect Fed Hike Fears

Source: Bureau of Economic Analysis, FHN Financial

The chart above depicts the steady climb in the yield on the 2-Year U.S. Treasury during August. As the Federal Open Market Committee raises the Fed Funds Rate, short-term interest rates like that of the 2-Year Treasury are driven up. Due to the historically high level of inflation, Fed policymakers have spoken about the need for aggressive interest rate hikes. The aim of the higher rates is to make loans more expensive, which will serve to cool off economic activity as borrowing money becomes more expensive for businesses and households.

CLOSING STATEMENT

Looking Ahead

As summer comes to a close, all eyes turn to the Federal Reserve’s next meeting in late September. At the beginning of the month, we will receive crucial data points on inflation and the labor market that will help guide the Fed’s decision. Markets could be volatile, but as usual, our team will look to identify investment opportunities that may weather the storm. Geopolitical events continue to command attention, such as the tensions between Taiwan and China, however these situations often provide opportunities to buy quality businesses that grow earnings over the long-term at reduced prices. Regardless, our team will stay on top of domestic and foreign economic events in order to most accurately assess the investing landscape.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com