In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The Fed Sees its Way Through to an Additional Rate Cut

The government shutdown (now the longest in history at the time of this writing) has led to halted operations at critical economic statistical agencies such as the Bureau of Labor Statistics, Census Bureau, and Bureau of Economic Analysis. Consequently, Fed Governors have been left to operate without key data points on employment, inflation and economic growth for over a month. Despite the limitations, the Federal Open Market Committee announced another 0.25% cut to the Fed Funds Rate following their October 29 meeting as was widely anticipated. Market participants were pleased with the move, as well as the announcement on the winding down of balance sheet contraction by replacing maturing Treasury and mortgage-backed securities with U.S. Treasuries, rather than allowing them to roll off at the previously prescribed pace.

Chairman Jerome Powell, however, was keen to ensure Wall Street (and perhaps Washington) know he “won’t be pushed around.” This is reminiscent of the poker table talk by Teddy KGB (played by John Malkovich), the venerable character in the 1998 cult classic movie Rounders, starring Matt Damon and Edward Norton. Powell was quick to pull away the punchbowl in his post announcement press conference by dismissing the idea that an additional rate cut in December was a foregone conclusion. “Far from it” he pointedly added. He sullied investor optimism by stating that “there were strongly differing views about how to proceed in December” during committee discussions. The statements all but ensured that Federal Reserve Chair would not be among the top Halloween costumes in 2025.

MARKET INDEX RETURNS | October 2025 | YTD 2025 |

S&P 500 Index | 2.3% | 17.5% |

Russell 2000 Index | 1.8% | 12.4% |

MSCI EAFE Index | 1.2% | 26.6% |

Bloomberg US Agg. Bond Index | 0.6% | 6.8% |

FTSE 3 Mo. T-Bill Index | 0.4% | 3.7% |

According to Google, characters from Netflix’s biggest ever hit, KPop Demon Hunters (an animated musical), were the most popular Halloween costumes of 2025.

STOCK MARKET REVIEW & OUTLOOK

Another Trillion Dollar Milestone Driven by AI Optimism

U.S. stocks led investor gains in October, driven by stellar returns in Information Technology and other AI-related growth stocks. Despite lofty expectations, rock solid earnings reports from market favorites like Alphabet and Amazon were key catalysts to investor optimism. Anticipation of further robust AI spending drove shares of Nvidia (first ever company to pass $5 trillion in market capitalization) higher in advance of their earnings report in the coming weeks. Outperformance by these index heavyweights has driven the concentration of the top 10 stocks in the S&P 500 to a new all-time high, representing 41% of the cap weighted index.

Materials, Consumer Staples and Real Estate sectors were distinct laggards in October, but all major industry segments of the U.S. large cap index remained in the green on a year-to-date basis. Investors in international equities added to exceptional year-to-date gains and small cap U.S. stocks finished the month higher as well. The yield on the bellwether 10-Year U.S. Treasury was lower by 7 basis points during the month to close at 4.08%.

S&P 500 SECTOR RETURNS | October 2025 | YTD 2025 |

Communication Services | 1.9% | 26.8% |

Consumer Discretionary | 2.4% | 7.8% |

Consumer Staples | -2.3% | 1.5% |

Energy | -1.1% | 5.8% |

Financials | -2.8% | 9.5% |

Healthcare | 3.6% | 6.3% |

Industrials | 0.5% | 18.8% |

Information Technology | 6.2% | 29.9% |

Materials | -5.0% | 3.8% |

Utilities | 2.1% | 20.2% |

Real Estate | -2.6% | 3.4% |

ECONOMIC REVIEW & OUTLOOK

A Skeleton Crew Cobbled Together an Inflation Report Just in Time for Halloween

Despite the government shutdown, the Bureau of Labor Statistics (BLS) recalled some staffers to report delayed Consumer Price Index (CPI) data collected in September, which is relied upon by the Social Security Administration for cost-of-living benefit adjustments. This may be the last inflation report we see for a while as collection of October data has not resumed. If that monthly print fails to be published, it will be the first time in U.S. history.

Headline year-on-year CPI came in modestly above the prior month reading at 3.0%, while moderately below survey results (a trick and a treat.) Core CPI (excluding volatile food and energy costs) came in at the same level, modestly below consensus and the prior month’s reading. The results were met with a shrug by investors, much like dropping a “fun” size candy bar in a costumed child’s plastic pumpkin on a street known for full sized bounty.

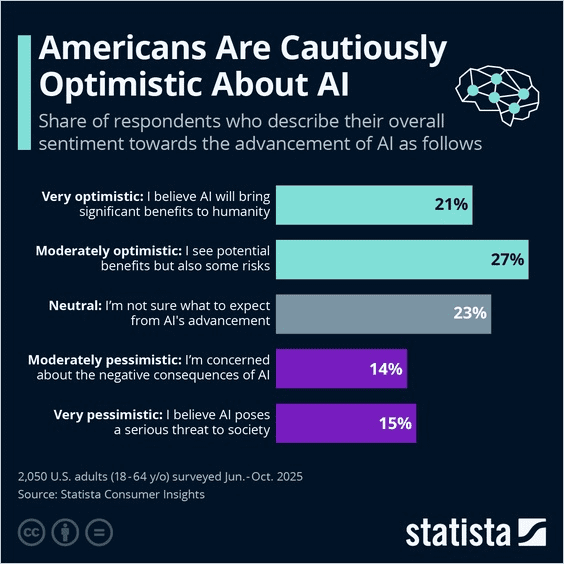

CHART OF THE MONTH

Wall Street Appears Ready to Move All-in on AI Innovation While Main Street is Slowly Coming Around to the Idea

Source: Statista

A recent study by Statista shows that Americans appear to be favorable but cautious on the prospects for AI as a significant game changer, but investor optimism appears to only be getting stronger.

CLOSING STATEMENT

Looking Ahead

We will continue to look through the ample sensational headlines and noise and focus on the most critical element of security valuation, underlying quality of earnings. If third quarter corporate earnings continue to come in as strongly as they started, we could see a fourth consecutive quarter of remarkable, double digit, year-on-year earnings growth. That will go a long way toward steadying risk asset investors’ nerves, even with the Federal Reserve making turbulent comments.

The continuation of the longest government shut down in U.S. history will stay atop the ever-present wall of worry. Fortunately, unpaid air traffic controllers continue to report to work for the time being during the stoppage as “flying blind” is not something anyone wants to start talking about in the airline industry.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way. As always, we invite you to join the conversation on our social media pages, Facebook and LinkedIn.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com