In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The Federal Open Market Committee Stayed on the Expected Course

The Federal Open Market Committee (FOMC) held short-term rates steady during their January meeting, hitting the pause button on recent reductions to its benchmark target rate. There were two dissents among the 12 voting members from Governors (Waller and Miran) preferring an additional 0.25% cut. Fed Chairman, Jerome Powell, whose term is set to conclude in May, stated that downside risk to employment and upside risk to inflation have diminished. His discussion of an economy that has “once again surprised us with its strength” led Fed watchers to reign in expectations for additional cuts in the near-term. At the time of this writing, there is a greater than 90% probability (priced in by the Fed Funds futures market) that the Fed will stand pat on rates at their upcoming meeting in March as well.

MARKET INDEX RETURNS | January 2026 | YTD 2026 |

S&P 500 Index | 1.4% | 1.4% |

Russell 2000 Index | 5.4% | 5.4% |

MSCI EAFE Index | 5.2% | 5.2% |

Bloomberg US Agg. Bond Index | 0.1% | 0.1% |

FTSE 3 Mo. T-Bill Index | 0.3% | 0.3% |

Overall consensus is for one to two additional quarter-point rate cuts by the Fed this year.

STOCK MARKET REVIEW & OUTLOOK

U.S. Energy Stocks Staged a Sprint and International Equities Added to a Year Long Marathon

The S&P 500 maintained positive momentum in 2026, closing with a modestly positive return that looked nothing like the prior year. One of the coldest sectors of the prior year, Energy, was the dominant leader during the first trading month of the new year. After declining for five consecutive months, crude oil prices rose by over 13% in January, serving as a tailwind to the leading sector. In contrast, the previously high-flying returns from the Information Technology and Financials sectors were the only negative index subcomponents in the period. International stocks maintained their dominance, standing atop the second highest peak of the market podium, edged out for the top spot by small cap stocks.

During the month, equal-weighted index returns outpaced cap-weighted returns, reflecting improved market breadth. The data is indicative of investors looking to add ballast to portfolios with stocks providing durable (though often more modest) earnings, particularly from cyclical stocks. At the same time, there appears to be some trimming of exposure to companies driven largely by multiple expansion, such as high growth stocks that have garnered a growing premium for a dollar of future earnings.

The yield on the 10-Year U.S. Treasury closed the month at 4.23%, modestly higher from where it started. The 2-Year closing at 3.54% left a healthy spread and normally shaped yield curve, except for the shortest end between the one month and one-year maturities.

S&P 500 SECTOR RETURNS | January 2026 | YTD 2026 |

Communication Services | 5.8% | 5.8% |

Consumer Discretionary | 1.7% | 1.7% |

Consumer Staples | 7.7% | 7.7% |

Energy | 14.4% | 14.4% |

Financials | -2.5% | -2.5% |

Healthcare | 0.0% | 0.0% |

Industrials | 6.7% | 6.7% |

Information Technology | -1.7% | -1.7% |

Materials | 8.7% | 8.7% |

Utilities | 1.4% | 1.4% |

Real Estate | 2.9% | 2.9% |

ECONOMIC REVIEW & OUTLOOK

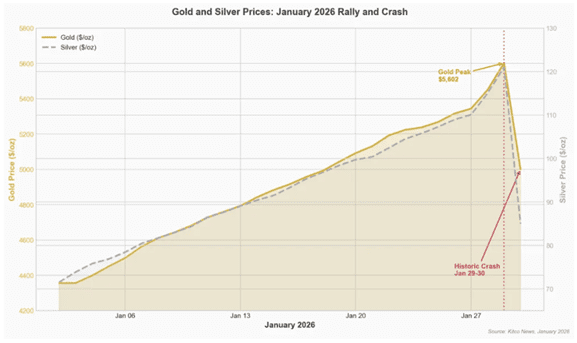

Precious Metals Price Volatility Spiked Like a Volleyball at Match Point

After remarkable gains of 64% and 140% for gold and silver in 2025, the two precious metals pulled back sharply in January. By month’s end, gold and silver were down approximately 10% and 27%, respectively from peaks reached just two trading days earlier. This level of volatility vaulted historical norms for assets normally considered a “safe haven” for uncertain times.

The price collapse coincided with the announcement of President Trump’s nomination of Kevin Warsh as the next Chair of the Federal Open Market Committee. Warsh has long been viewed as an interest rate “hawk,” with a history of emphasizing inflation control and advocating for quantitative tightening through a smaller, less market‑accommodative, Federal Reserve balance sheet. Although his views of late have echoed the President’s, calling for the Fed to act more quickly with rate reductions. This divergence from his historical stance is making his influence a bit more challenging for pundits to predict.

When technical and liquidity factors are added to the mix, alongside an already overextended asset class, even a modest increase in uncertainty can have an outsized impact on prices. Algorithmic trading platforms, executing transactions faster than the speed of an Olympic ice luge, acted as a key catalyst in the rapid sell off. The short‑term plunge in gold and silver serves as a reminder of how quickly momentum driven trades can unwind when a stampeding herd of speculators heads for the exits.

CHART OF THE MONTH

Gold and Silver Prices Charted Like a Treacherous Downhill Ski Slope in the Final Trading Days of January

Source: Kitco News, Bullion Trading LLC

CLOSING STATEMENT

Looking Ahead

Are technology stocks taking a long-term sideline breather or merely adjusting to a good amount of valuation expansion? The evidence points more toward the latter. The long‑term case for technology remains intact, particularly as businesses across a wide range of industries continue to benefit from the transformative power of artificial intelligence. With S&P 500 companies on track to post a fifth consecutive quarter of double‑digit earnings growth, we expect technology to remain a key contributor to overall market performance.

Although there won’t be any batons being passed (or any other track and field events) in the 2026 Winter Olympics taking place throughout February, there will be plenty of excitement around the games. American favorite, Lindsey Vonn (retired from competition since 2019) will be returning to downhill skiing competition at the age of 41, remarkably pushing through a completely ruptured ACL knee injury suffered during her training at the end of January. It seems that competing at this level on the slopes can be as volatile as the prices of the precious metals used to create the coveted Olympic medals the athletes will be competing for.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way. Remember to join the conversation on our social media sites – Facebook and LinkedIn.

And good luck to our Team USA athletes after (for the first time in history) the Olympic flame is lit simultaneously in two cites, Milan and Cortina, Italy.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com