In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

6-7 It’s All Relative

Our (cutting-edge) data scouring colleagues at Bloomberg Intelligence put these valuations into perspective in a recent communication, stating “The Magnificent Seven – Alphabet (Google), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla – trade at a trailing price over earnings multiple of 36.8 times. That’s less than half of the average 80+ multiple that the “four horsemen” of tech (Cisco, Microsoft, Dell and Intel) peaked out at during the dot-com bubble.” (Insight sourced from a recent communication from our equally astute data enthusiasts at MFS.)

At the end of the day, “it’s all relative,” “maybe this, maybe that,” or “6-7” as our exuberant youth have taken a liking to saying (as one of the most overused slang references of 2025) much to the confusion of adults and frustration of educators. The consecutive mention of these two, once innocuous, numbers now leads to a scale balancing-type two-hand gesture and giggling by our younger generation that many hope will soon run its course, until the next “if you know, you know” viral meme reference comes along.

MARKET INDEX RETURNS | November 2025 | YTD 2025 |

S&P 500 Index | 0.2% | 17.8% |

Russell 2000 Index | 1.0% | 13.5% |

MSCI EAFE Index | 0.6% | 27.4% |

Bloomberg US Agg. Bond Index | 0.6% | 7.5% |

FTSE 3 Mo. T-Bill Index | 0.4% | 4.1% |

Dictionary.com recently announced that slang viral phenomenon “6-7” is the 2025 “word” of the year.

STOCK MARKET REVIEW & OUTLOOK

A Healthy Rotation Took Place in Stock Sectors in November

U.S. stocks experienced a mid-month slump in November, wiped away by a strong rally in the final trading week that pushed the S&P 500 a step over the line back into the green. The bellwether large cap index was higher by 0.2% for the month and back within striking distance of the all-time high reached in October. The technology-focused Nasdaq Composite finished in the red after seven consecutive months of gains as investors grew concerned about potential overvaluation in artificial intelligence-related stocks.

It was the best month for the Healthcare sector vs. the S&P 500 in 25 years. The sector is typically viewed as a defensive haven for investors during times of market angst given the steady demand for personal care and pharmaceuticals, regardless of the economic environment. Strong earnings and announcements of major acquisitions in the space were key catalysts to renewed investor interest. The “growthiest” segments of the market took a back seat during the month with Information Technology and Consumer Discretionary posting negative returns along with the more cyclically oriented Industrial sector. International stocks added to their 2025 lead, outperforming U.S. stocks once again.

The yield on the 10-Year U.S. Treasury was lower by 0.06% during the month, closing the final trading session at 4.01%. Shorter-term rates pulled back modestly more in anticipation of a Fed poised to make an additional cut to the Fed Funds Rate in December.

S&P 500 SECTOR RETURNS | November 2025 | YTD 2025 |

Communication Services | 6.4% | 34.9% |

Consumer Discretionary | -2.4% | 5.2% |

Consumer Staples | 4.0% | 5.6% |

Energy | 2.5% | 8.5% |

Financials | 1.9% | 11.5% |

Healthcare | 9.3% | 16.2% |

Industrials | -0.9%% | 17.8% |

Information Technology | -4.3% | 24.4% |

Materials | 4.2% | 8.1% |

Utilities | 1.8% | 22.3% |

Real Estate | 2.0% | 5.5% |

ECONOMIC REVIEW & OUTLOOK

Labor Markets Still Treading Water Based on Limited Data

The September employment report showed non-farm payrolls increased by 119k, relatively unchanged since April, with the exception of a 4k loss of jobs in August. The Bureau of Labor Statistics (BLS) has been forced to delay the next release (of November data) until December 16th due to the impact of having shut down operations. This is the first time a monthly jobs report has been delayed in 12 years. The BLS has announced that October data will not be released at all, a first in U.S. history.

The unemployment rate through September ticked up to 4.4%, the highest since 2021, mainly due to an increase in available workers actively seeking employment as opposed to job losses. The explanation for this uptick seems to be supported by initial jobless claims reported through November (including the typically volatile Thanksgiving holiday period) that were below economists’ expectations at 191k, the lowest weekly level since September 2022. Factor in mixed reports from ADP and layoff data from Challenger, Gray Christmas (another 2022 level high) and the water workers are treading in appears a bit cloudy. We will be keeping a watchful eye on the JOLTS jobless claims report (also delayed due to government shutdown) when next available in early December to help add additional context to the situation.

CHART OF THE MONTH

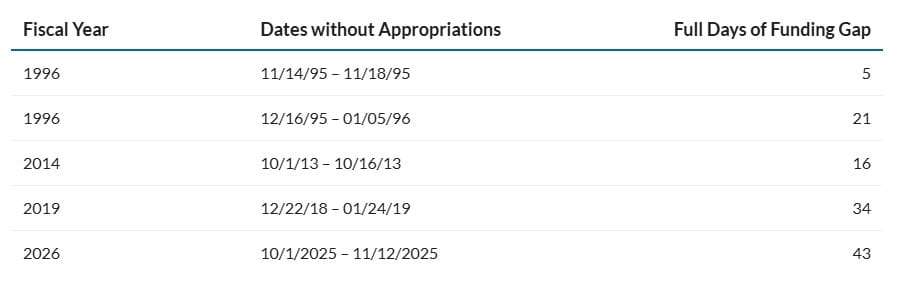

Five Major U.S. Government Shutdowns Since 1980

Source: Congressional Research Service

CLOSING STATEMENT

Looking Ahead

The longest government shutdown in U.S. history (shown in the exhibit above) is now in the rearview mirror. Data agencies are starting to get back on track, moving on after a hole in October data collection, putting a bit more meat on the bone for upcoming economic assessments.

The Federal Open Market Committee (FOMC) is highly anticipated to cut rates by a quarter point at their next meeting on December 10th. The meeting will include an update to the closely followed Summary of Economic Projections for investors to contemplate until the next FOMC meeting six-seven weeks later.

By including a reference in this newsletter to one of the more (adult vexing) viral sensations in some time, we are hopeful to have done our part toward making it entirely uncool and helping put it out to pasture, until the next confusing fad comes along.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way. As always, we invite you to join the conversation on our social media pages – LinkedIn and Facebook.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

Chairman of the Board

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

President & Chief Executive Officer

508‑675‑4313

lsousa@pliadv.com

Mark J. Gendreau, CFP ®

Senior Vice President & Chief Investment Officer

508-591-6211

mgendreau@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President &

Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com