In This Update: Investment Spotlight | Stock Market Review | Economic Review & Outlook

Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

The Spending Genie is Roaming Freely Outside of the Bottle

Consumers were willing to pay up in a big way to be entertained over the summer, with record-breaking concert tour revenues, a billion-dollar blockbuster movie, restaurant dining and air travel fueled by credit card spending sprees. The wall of plastic debt has surpassed an eye-popping epoch of one trillion dollars and is unlikely to subside anytime soon without a reconsideration of post-pandemic spending habits. Personal savings have fallen significantly, credit delinquencies are at the highest level in a decade, and there has been an unfortunate uptick in the amount of consumers borrowing from retirement plans or otherwise leveraging their futures.

Another factor contributing to a near-term change in buying power that consumers can no longer ignore is the return of student loan payments. Repaying student debt is now back to the front of the budget line after a three-year period of forbearance. However, it seems consumers have elected to spend (or perhaps save, although the data does not support much of that having happened) funds previously allocated to paying back education loans.

MARKET INDEX RETURNS | July 2023 | YTD 2023 |

S&P 500 Index | 3.2% | 20.6% |

Russell 2000 Index | 6.1% | 14.7% |

MSCI EAFE Index | 3.2% | 15.3% |

Bloomberg US Agg. Bond Index | -0.1% | 2.0% |

FTSE 3 Mo. T-Bill Index | 0.5% | 2.9% |

After three years of spending at will, consumers will need to refocus on budget discipline. That may very well prove to be a genie that is difficult to get back into the bottle.

STOCK MARKET REVIEW & OUTLOOK

Even Giddy Pumpkin Spice Enthusiasts Felt Some September Blues in Financial Markets

September has historically been a challenging month for equities and this year was no exception. It is the only month with a negative average return over the past 50 years. The S&P 500 Index finished the month lower by nearly 5%. After a scorching recovery in the stock market through the first seven months of the year, we are more than half of the way to a good old-fashioned, and perfectly normal, market correction (a decline of 10% or more from a recent high) over the past two months. The road to capturing risk premium in equities over time is regularly bumpy, and this period is no exception. In a reversal of narrow leadership by the “Magnificent Seven” (Apple, Amazon, Microsoft, Nvidia, Tesla, Google and Meta) earlier in the year, old economy energy stocks were the only sector to eek out a positive return for a second straight month.

Returns for fixed income investors were equally disappointing as yields rose, driving prices (and total returns) down. Following a Fed meeting during the month in which interest rates remained unchanged, as was widely anticipated, the Committee’s message of a “higher for longer” view was factored into markets. The Federal Open Market Committee (FOMC) dot plot of forward projections was modified to reign in expectations on rate cuts in 2024, a cooler for the bond market. The bellwether 10-Year U.S. Treasury yield closed the month at 4.57% and kept its upward momentum into territory not seen since before the 2008 financial crisis. The 2-Year Treasury closed at 5.04% after being as high as 5.18% earlier in the month. Risk-free rates at these levels continue to vie for attention from investors realizing that there are other potentially attractive alternatives to equity investing.

S&P 500 SECTOR RETURNS | July 2023 | YTD 2023 |

Communication Services | 6.9% | 45.7% |

Consumer Discretionary | 2.4% | 36.2% |

Consumer Staples | 2.1% | 3.5% |

Energy | 7.4% | 1.4% |

Financials | 4.8% | 4.3% |

Healthcare | 1.0% | -0.5% |

Industrials | 2.9% | 13.4% |

Information Technology | 2.7% | 46.6% |

Materials | 3.4% | 11.4% |

Utilities | 2.5% | -3.4% |

ECONOMIC REVIEW & OUTLOOK

Job Creation in September Surprised to the Upside

Nonfarm payrolls reported for the month of September jumped well beyond expectations, with 334k new jobs added, nearly double the consensus estimate and the highest level since the start of the year. The lion’s share of the increases came from the services (rather than goods-producing) industries including leisure and hospitality, education and healthcare. Including some upward revisions to the prior two months, this brings the monthly average for the third quarter to 226k new jobs, ahead of the 201k average in the second quarter and moving in the wrong direction in the eyes of the Federal Reserve trying to cool economic conditions. The Unemployment Rate held steady at 3.8% with wage growth at 4.2% over the past year.

CHART OF THE MONTH

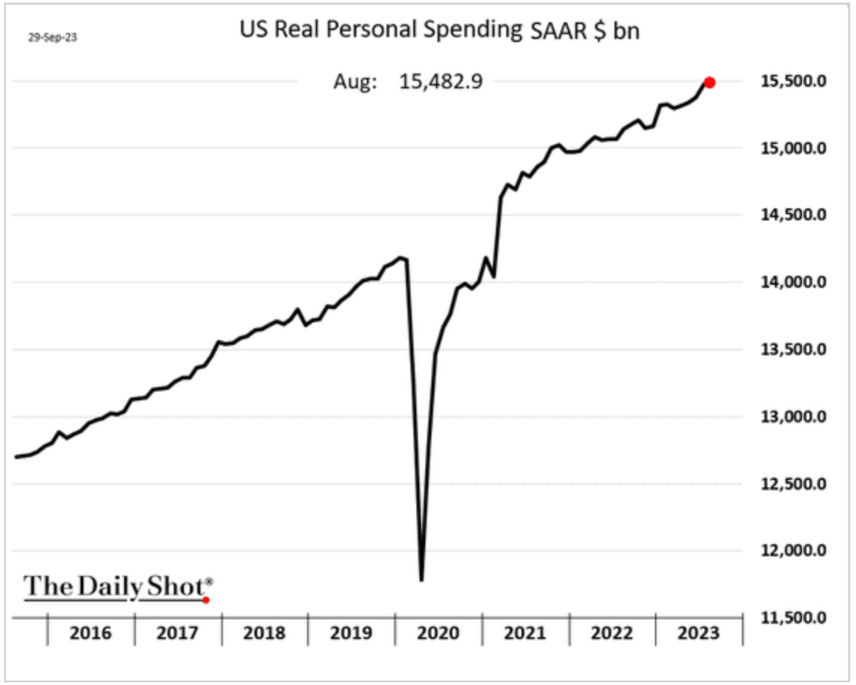

Seasonally Adjusted Annual Rate (SAAR) of Real (Inflation Adjusted) Spending Continues to Rise

Source: The Daily Shot

Consumers did what was asked of them and spent pandemic stimulus checks to revive the lagging economy. As shown above, the habit has been hard to break once the relief payments ended.

CLOSING STATEMENT

Looking Ahead

A return to “a chicken in every pot and car in every garage” (or “car in every backyard, to boot” as originally written) mindset popularized in the late 1920s presidential race seems to be back in vogue with the American consumer. As the Federal Reserve struggles to reign in inflation, some degree of fiscal restraint (by those controlling the purse strings in Washington as well as those pulling at them) is a necessary part of the equation.

(As a side note… the quote above is, at times, incorrectly attributed to President Herbert Hoover, although he never actually made the statement, which was, in fact, taken from an ad placed by a political committee without his input in 1928.)

Fed action will be tied to economic outcome now more than ever as we approach what appears to be the final innings of the monetary tightening cycle started just over a year and a half ago. The FOMC is doing their best to navigate the “long and variable lags” of the blunt force interest rate lever they have cranked at the fastest pace in modern history. If they can avoid pushing too hard, there is a possibility they may just stick the (soft) landing, something (arguably) achieved only once in the past 60 years, in 1994 under Alan Greenspan’s tenure as Chairman. If a recession were to occur in 2024, as many predict, we remain in the consensus camp that it will be shallow and relatively short-lived.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com