In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

High Tech Recovery Met Low Tech Espionage

Companies that suffered significant declines in calendar year 2022 (particularly technology-related) were big advancers in January, while some of the strongest areas from last year were the weakest in the new year. A cooler inflationary environment (with food and energy costs moderating) and smaller-sized moves in interest rates were likely contributors to the sentiment shift.

Markets were also strong outside of the U.S., particularly in China (up 12% for the month) where economic reopening was a positive catalyst. A weakening of the previously high-flying U.S. dollar was an added benefit to the region. The rapid turnaround in market strength in the second largest economy in the world flies in the face of the discovery of a low tech, low flying (60,000 feet, not all that much higher than commercial aircraft flights) surveillance balloon over the United States, confirmed to have come from China.

MARKET INDEX RETURNS | JANUARY 2023 | YTD 2023 |

S&P 500 Index | 6.3% | 6.3% |

Russell 2000 Index | 9.7% | 9.7% |

MSCI EAFE Index | 8.1% | 8.1% |

Barclays US Agg. Bond Index | 3.1% | 3.1% |

FTSE 3 Mo. T-Bill Index | 0.4% | 0.4% |

Swiftie: noun (slang) a super fan of American singer-songwriter, pop star, Taylor Swift

Surveillance balloons were used well before satellites existed as a means of gathering intelligence from the air. Their use reportedly dates back to the 1700s during the French Revolution and were utilized by the Union and Confederate armies during the U.S. Civil War.

STOCK MARKET REVIEW & OUTLOOK

Risk-on Flags Were Flown Around the World to Kick Off a New Trading Year

The S&P 500 came out of the gates like a rodeo bull in the new year, posting a greater than 6% return. Renewed interest in technology stocks boosted the battered NASDAQ Composite by a whopping 11%. This was the strongest January return for the index since 2001. Higher growth segments of the market such as Communication Services, Consumer Discretionary and Information Technology were key drivers of the rally. Travel-related and auto stocks were particularly strong. The most defensive sectors of the S&P 500 (Utilities, Healthcare and Consumer Staples) were all negative for the month. The data points included below point to particularly strong “risk-on” sentiment thus far in 2023. Small cap, international and emerging markets stocks, typically viewed as higher risk, all outperformed during the first trading month of the year.

Having already taken away the punch bowl, music and decorations, the Federal Reserve’s latest interest rate hike in January did not weigh on the market’s celebration. The Federal Open Market Committee raised the Fed Funds Rate for an eighth time in the current tightening cycle by (a smaller than previous) 0.25% to a target rate of 4.50-4.75%. The bellwether 10-Year U.S. Treasury yield ended the month at 3.51%, 37 basis points lower than where it started. A hike in short-term rates in the final week of the month expanded the gap between 2-Year and 10-Year yields, further inverting the yield curve and cooling economic conditions.

S&P 500 SECTOR RETURNS | JANUARY 2023 | YTD 2023 |

Communication Services | 14.5% | 14.5% |

Consumer Discretionary | 15.0% | 15.0% |

Consumer Staples | -0.9% | -0.9% |

Energy | 2.8% | 2.8% |

Financials | 6.9% | 6.9% |

Healthcare | -1.9% | -1.9% |

Industrials | 3.7% | 3.7% |

Information Technology | 9.3% | 9.3% |

Materials | 9.0% | 9.0% |

Utilities | -2.0% | -2.0% |

ECONOMIC REVIEW & OUTLOOK

U.S. Economic Growth Was Positive, While Not Particularly Exuberant

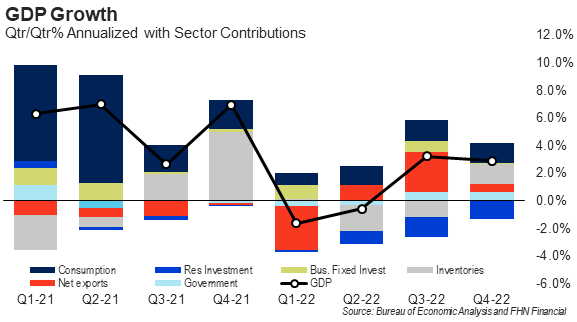

The first estimate of Q4, 2022 Gross Domestic Product (GDP) year-over-year growth was 2.9%, modestly lower than 3.2% in the third quarter, but ahead of economists’ expectations. Consumer spending was less robust than the typical holiday shopping season, but a slow pace of growth is certainly preferable to economic contraction as was experienced in the first two quarters of 2022. A look through to the constituents of growth show that the positive results were driven primarily by a rebuilding of inventories that had contracted meaningfully in the previous two quarters. Residential investment continued to be a headwind as was the case throughout 2022.

CHART OF THE MONTH

S&P 500 Annual Returns and Intra-year Declines

Source: Bureau of Economic Analysis and FHN Financial

As described in the Economic Review above, Q4 GDP was positive, but driven by a rebound in inventory levels, rather than more permanent components relating to actual consumption. Inventory rebuilds led to nearly half of the positive growth shown in the period.

CLOSING STATEMENT

Looking Ahead

As the prevailing winds of tight monetary policy start to lose some of their hold on financial markets and the skies over the U.S. are foreign spy balloon free at the time of this writing (as far as we know), positive investor sentiment is a prevailing force. One would expect that with a waning focus on macro-economic overhangs, investors will be paying closer attention to corporate earnings, which have begun to slow. With lower earnings guidance, an increase in valuations has come from price-to-earnings (P/E) multiple expansion. Stated more simply, optimistic investors simply appear willing to pay more for a dollar of expected company earnings.

A number of large companies, particularly within the technology sector, that bolstered their employee ranks during the pandemic, have announced sizable layoffs. These actions are occurring while the key measure of unemployment in the U.S. (U3) dropped to a 53 year low of 3.4% in the latest payrolls report. Investors appear to be rewarding this type of corporate belt tightening, followed by similar headcount reduction plans being announced by other companies with weaker than anticipated forward revenue and earnings guidance. Perhaps a continued shift in this workforce dynamic will lead to an absorption of some of the 11 million open positions reported in the latest JOLTS (Job Openings and Labor Turnover Survey) report. These are just some of the factors our team will be focused on in the coming months.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or if we can assist you in any other way.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com