In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

Did the Tail Wag the Dog on the Latest Fed Rate Hike?

The Federal Open Market Committee (FOMC) raised the Fed Funds Rate in June as was widely anticipated. After one of the more clear and concise communications on its intent to raise rates by 50 basis points, FOMC changed course with a more aggressive 75 basis point increase, the largest hike since 1994. Reports of lower than anticipated consumer sentiment and higher inflation within days of the FOMC meeting sent market expectations for higher rates soaring. The Fed has stated repeatedly that rate decisions will be data-dependent. However this change, in a matter of days, was one of the most notable in modern monetary policy history.

The Fed is more than happy to allow the market to do some of its heavy lifting, using transparent communication to allow expectations to price in tighter conditions with minimal action thus far on their part. A Wall Street Journal article printed days before the FOMC meeting, during what is known as the “quiet period,” called into question just how quiet Fed officials actually were. Shortly after the article was released, major Wall Street banks and economists began to follow suit, raising long-standing rate hike expectations from 50 to 75 basis points. What had been a mere 3% probability of such a move just days before, spiked to 90% in the closely followed futures market – and just like that, an unlikely outcome became industry consensus. Chairman Powell dodged and weaved on questions inferring that a change of course was leaked to the press in advance of the meeting. If so, was it actually the Fed, or the market, calling the shots in this situation? If possible, perhaps both the dog and tail were wagging to some extent, each playing a part in the major change in the latest rate policy decision.

MARKET INDEX RETURNS | June 2022 | YTD 2022 |

S&P 500 Index | -8.3% | -20.0% |

Russell 2000 Index | -8.2% | -23.4% |

MSCI EAFE Index | -9.3% | -19.6% |

Barclays US Agg. Bond Index | -1.6% | -10.3% |

FTSE 3 Mo. T-Bill Index | 0.1% | 0.2% |

The S&P 500 officially closed in bear market territory on June 13th, defined as a decline of greater than 20% from a recent peak.

STOCK MARKET REVIEW & OUTLOOK

“Risk-Off” Remained the Pervasive Theme of the Month

Global markets continued to slide in June, putting the first half of the year in the books as one of the worst on record. The S&P 500 had its worst first half of a calendar year since 1970, at a time the economy was squarely in the throes of a recession and real sustained inflation in the U.S. The Dow Jones Industrial Average is off to its worst start since 1962 – a time when gasoline sold for $0.30 per gallon.

In a sharp reversal from prior months, energy stocks moved from first to worst in June, underperforming all other sectors. Even the “strongest” sectors during the period (Consumer Staples and Healthcare) were in the red. The technology-focused NASDAQ Composite is lower by 29% for the first half of the year.

With stocks and bonds selling off in unison, investment-grade bonds have had the worst start to a year in recorded history. Investors in risk assets have had nowhere to hide during the selloff other than securities tied to higher commodity prices or the rapidly rising U.S. dollar.

S&P 500 SECTOR RETURNS | JUNE 2022 | YTD 2022 |

Communication Services | -7.7% | -30.2% |

Consumer Discretionary | -10.8% | -32.8% |

Consumer Staples | -2.5% | -5.6% |

Energy | -16.9% | 31.6% |

Financials | -10.9% | -18.7% |

Healthcare | -2.7% | -8.3% |

Industrials | -7.4% | -16.8% |

Information Technology | -9.3% | -26.9% |

Materials | -13.8% | -17.9% |

Utilities | -5.0% | -0.6% |

ECONOMIC REVIEW & OUTLOOK

Voldemort – Recession… Those “Who Must Not be Named”

Recession. There, it’s been said (written), and we can all take a deep breath and put the current environment into context.

Raising interest rates aggressively, while the appropriate medicine to mitigate high levels of inflation, may slow the economy into contraction. Remarkably, within minutes of the latest FOMC rate move, the closely followed Atlanta Fed cut their Q2 GDP forecast to 0% and have now lowered it into negative territory. With a revised negative GDP print in Q1 of -1.6%, even the smallest of negative numbers in Q2 would mean the U.S. entered into (the textbook definition of) a recession in 2022.

If such an occurrence takes place (about as off the radar and below the hard deck as Maverick in the Top Gun sequel, just weeks ago) it would perhaps go down in history as one of the most epic fails of any Federal Reserve Board. Causing a recession, with three policy moves over the course of four months, is about as far from the “soft landing” plan as it gets. With nearly every economist calling for a recession predicting it would hold off until next year, such an outcome would leave many on Wall Street questioning what went wrong.

CHART OF THE MONTH

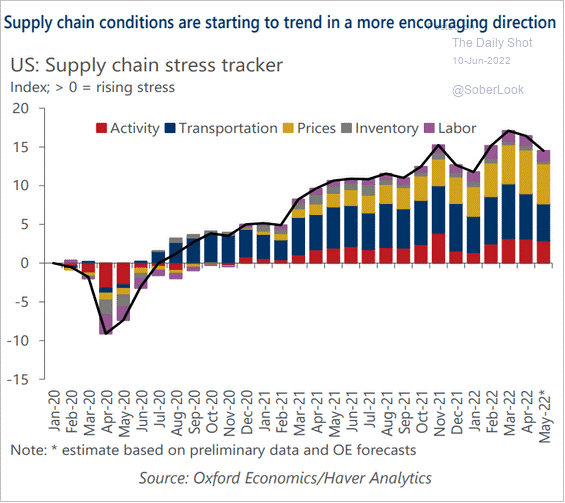

Supply Chain Bottlenecks are Showing Signs of Easing

Source: Oxford Economics / Haver Analytics

Some good news in the recent tumult of data releases has been signs of improvement in supply chain disruptions, a key contributor to inflationary pressures. A number of recent regional Fed reports showed improvements in delivery times and order backlogs. The combination of the Fed tapping the brakes on demand, with improvements in the flow of supply, should start to chip away at stubborn price inflation. This is something we have seen starting to take hold in the Fed’s preferred inflation measure, Core Personal Consumption Expenditures (PCE), over the last three months.

CLOSING STATEMENT

Looking Ahead

The deep and wide selloff of risk assets has created ample attractive opportunities for long-term disciplined investors. The S&P 500 price-to-earnings multiple is well below long-term averages. Higher bond yields are now offering attractive alternatives for income-oriented investors. To put the term “higher” into context, apropos of a collective deep breath, in 1986, when the original Top Gun movie was released, the 10-Year U.S. Treasury yield had a high of 9.5%, down from double digits the previous seven years. At the time of the sequel this year (now the highest grossing film in Tom Cruise’s career) the yield on the bellwether Treasury has peaked (thus far) at 3.5%.

I recently heard an economist predicting that the next recession is likely to be somewhere between the severity of the Great Recession, which followed the 2008 financial crisis, and the “COVID Recession” of 2020. Since the former was one of the deepest and worst in history (with memories for those who lived and worked through it day-to-day still capable of sending shivers down one’s spine) and the latter easily the most short-lived on record, I am using the word “predicting” quite loosely. As we like to remind investors, all business cycles eventually come to an end. When the next one does (if it hasn’t already) our expectation leans much more toward a milder economic downturn within that particular “broad side of a barn” prediction.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or any other way we can assist you.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com