In This Update: Investment Spotlight | Stock Market Review | Economic Review Chart of the Month | Closing Statements

INVESTMENT SPOTLIGHT

April Showers Brought Floods of Volatility

The volatility measure of the S&P 500 (VIX Index) ended the month near the mid-30s, well above average. Fixed income volatility (MOVE Index) took a similar path, well above its historical norms. Spiking bond yields (the 10-Year U.S. Treasury yield rose the most in a month since December 2009) have made the promise of future profits from high tech growth stocks less appealing. The largest market cap technology stocks (Meta, Apple, Amazon, Netflix and Alphabet), touted as a safe haven for compounding sustainable earnings only months ago, lost more than $1 trillion in combined market value in April. Investors’ attention has shifted to more cyclically oriented and defensive sectors of the stock market.

Sky high commodity prices were exacerbated by the ongoing war in Ukraine. Prices for corn and soybeans approached new record territory, putting further upward pressure on food costs. Despite some signs of easing supply constraints in shipping receipt data, Russia’s move to cut off natural gas to Poland and Bulgaria may be the start of the next leg of disruption. Investors’ concerns about an economic slowdown in the U.S. heightened, with worry of the Fed potentially creating a damaging hard landing. Fed supporters’ conviction eroded last month as it became much harder to defend against the argument that the spicket of overly accommodative quantitative easing policies was left on for too long.

MARKET INDEX RETURNS | APRIL 2022 | YTD 2022 |

S&P 500 Index | -8.7% | -12.9% |

Russell 2000 Index | -9.9% | -16.7% |

MSCI EAFE Index | -6.5% | -12.0% |

Barclays US Agg. Bond Index | -3.8% | -9.5% |

FTSE 3 Mo. T-Bill Index | 0.0% | 0.1% |

Despite an exorbitant amount of forewarning before the start of the Fed Funds Rate hiking cycle, fixed income markets were sent reeling with a spike in volatility and rise in rates not seen in decades.

STOCK MARKET REVIEW & OUTLOOK

A Month to Forget, With Lessons to Remember

The S&P 500 declined by -8.7% in April, unable to secure a positive weekly return during the period. The technology-focused NASDAQ Composite suffered the worst monthly drawdown since 2008, lower by -13.2%. Both indices have had a very difficult start to the calendar year. The S&P 500 return of -12.9% is the worst return for the first four months of the year since 1939 and the NASDAQ (at -21%) is off to the worst start in its recorded history.

The defensive nature of the Consumer Staples sector provided a modestly positive return during the month, while all other index sectors were in the red. Communication Services, Consumer Discretionary and Information Technology stocks were particularly hard hit. Fixed income has not provided protection to diversified portfolios thus far in the year as rapidly rising interest rates have pummeled bond prices.

S&P 500 SECTOR RETURNS | APRIL 2022 | YTD 2022 |

Communication Services | -15.6% | -25.7% |

Consumer Discretionary | -13.0% | -20.9% |

Consumer Staples | 2.6% | 1.5% |

Energy | -1.5% | 36.8% |

Financials | -9.9% | -11.2% |

Healthcare | -4.7% | -7.2% |

Industrials | -7.5% | -9.7% |

Information Technology | -11.3% | -18.7% |

Materials | -3.5% | -5.8% |

Utilities | -4.2% | 0.3% |

ECONOMIC REVIEW & OUTLOOK

First Quarter GDP was Weaker than Anticipated

The first estimate of Gross Domestic Product for Q1 2022 contracted by -1.49%, below consensus estimates for modestly positive growth. A meaningful pullback in net exports and inventories were contributing factors to the decline in the total goods and services produced in the United States. Personal consumption was positive but slowed toward the end of the quarter amid rapid price increases in food and gasoline and waning government stimulus.

CHART OF THE MONTH

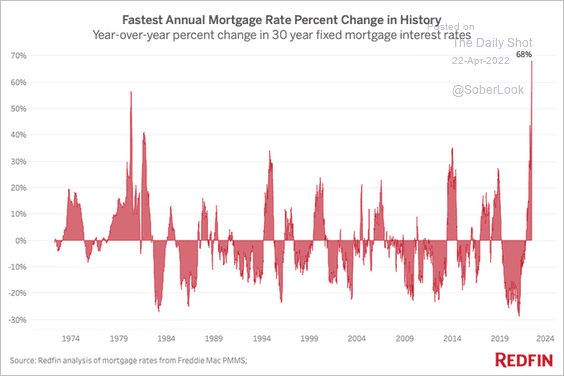

Mortgage Rates Spiked at the Fastest Pace in History

Source: Redfin

If you are old enough to remember the game of Operation, then you likely also remember waiting in long gas lines in the 1970s on odd and even days based on your license plate number, and perhaps recall the high teens annual interest rates earned on passbook savings accounts in the 1980s. Remarkably, the percentage change in 30-year fixed mortgage rates over the past year spiked faster than both those periods of high inflation and sky-high rates, by an eye popping 68%, as shown in the chart above.

CLOSING STATEMENT

Looking Ahead

All eyes will remain squarely focused on the Fed with a highly anticipated 50 basis point hike made at the time of this writing. The magnitude and pace of additional hikes expected to come this year is front and center on all market participants’ minds. Anticipation of higher rates has sent the U.S. dollar soaring relative to other currencies. The greenback had its largest monthly jump in a decade in April. A rapidly rising dollar creates headwinds for U.S. exporters. Given the negative impact the latest balance of trade report had on GDP, this is a factor we will be paying close attention to in coming quarters.

The current volatile state of financial markets is a firm reminder of the rationale for the premium that exists for risk assets. While unpleasant, a periodic reminder that there is no free lunch in investing is necessary to create opportunities for future gains. The cycle of fear and greed gyrations, while at times stressful, is a necessary dynamic in a “zero sum” market in which each trade inherently involves a winner and loser.

Please reach out to one of your Account Officers or any member of our Executive Leadership Team to discuss topics raised in this letter or anything else we can be helpful with.

Meet The Plimoth Investment Advisors Executive Leadership Team

Steven A. Russo, CFA

President & Chief Executive Officer

508‑591‑6202

srusso@pliadv.com

Louis E. Sousa, CFA

Senior Vice President & Chief Investment Officer

508‑675‑4313

lsousa@pliadv.com

Edward J. Misiolek

Senior Vice President & Operations Officer

508‑675‑4316

emisiolek@pliadv.com

Teresa A. Prue, CFP®

Senior Vice President & Head of Fiduciary Services and Administration

508‑591‑6221

tprue@pliadv.com